U.S. non-residential construction is expected to soften through the second half of 2025, but UBS analysts project a meaningful reacceleration beginning in 2026. Structural tailwinds—including investment in data infrastructure, energy, life sciences, and public-sector projects—are expected to drive the next phase of growth, even as commercial construction remains pressured by high interest rates and broader macro uncertainty. The anticipated rebound in activity has Goldman analysts forecasting upward pressure on machinery pricing later this year.

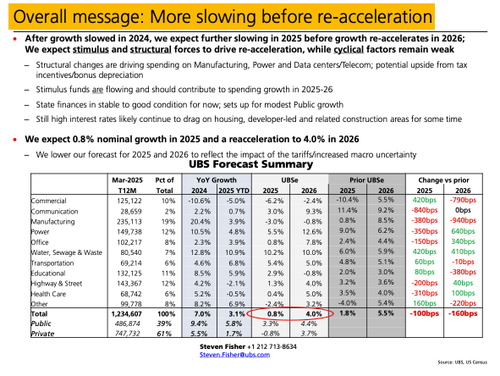

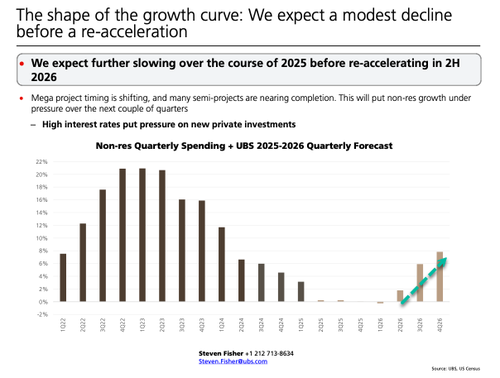

According to UBS analysts Steven Fisher, Amit Mehrotra, and others, the latest industry outlook for construction spending is expected to remain soft through 2025, with nominal growth projected at just .8%, while real growth is anticipated to decline by 3%. The weakness is primarily attributable to a slowdown in manufacturing project starts over the past year, as well as continued headwinds facing commercial projects across retail, office, and warehousing.

"More slowing before reacceleration in 2026," Fisher wrote in a note, adding, "We expect stimulus and structural forces to drive the rebound, while cyclical factors remain weak."

Analysts forecast construction growth to reaccelerate to 4% in 2026. They noted some of those growth drivers:

The reacceleration in construction spending is expected to begin in the second half of 2026.

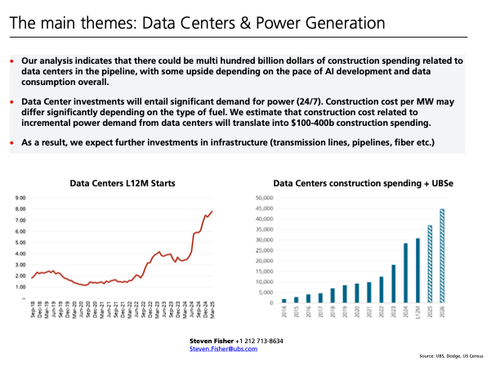

What will drive the reacceleration? It's very easy: Power, Data Centers, Infra, Semis...

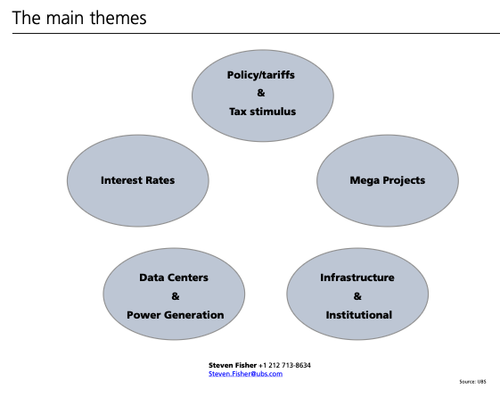

We've laid out multiple themes for readers to capitalize on this:

And a new theme:

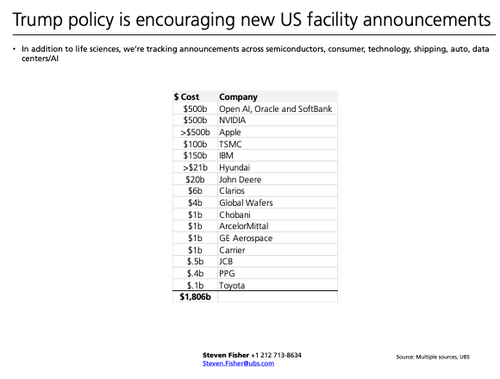

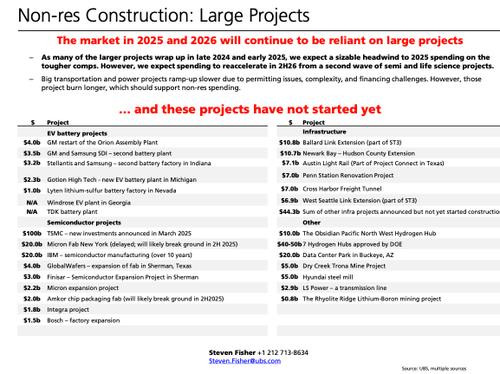

Trump has secured commitments for $1.8 trillion in investments from major corporations, with projects either shovel-ready or nearing that stage. This pipeline of development is expected to generate significant construction tailwinds next year.

Top themes in the construction world for next year:

One senior executive at an asset management firm backing a major data center project in Texas described the anticipated pace of construction during Trump's second term as a "sprint."

"The market in 2025 and 2026 will continue to be reliant on large projects," the analysts noted.

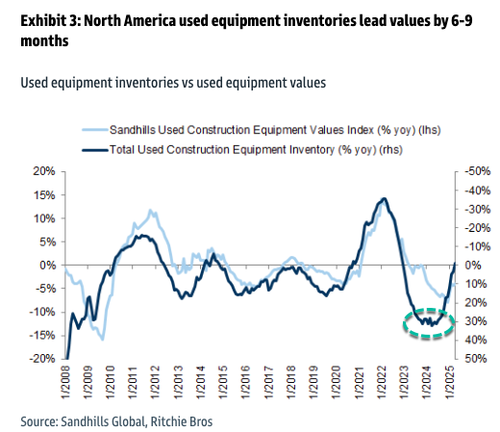

Separately, Goldman analysts have issued a note describing how the tightening of used equipment inventories will send prices higher over the next 6 to 9 months. This aligns with UBS's view that a surge in construction activity is expected to begin next year.

Great news for the Trump administration: construction tailwinds are expected to build momentum in the economy next year. However, a lag is anticipated before the full impact materializes.