The US housing market may be staging a powerful recovery - if one only goes by homebuilders record prices and certainly not the highest mortgage rates in 40 years - but it's not because affordability is getting any better. On the contrary: according to Redfin, the typical homebuyer’s monthly mortgage payment was $2,605 during the four weeks ending July 30, up 19% from a year earlier and down just $32 from early July’s all-time high (with the 10Y blowing out, it's just a matter of time before we hit a fresh record).

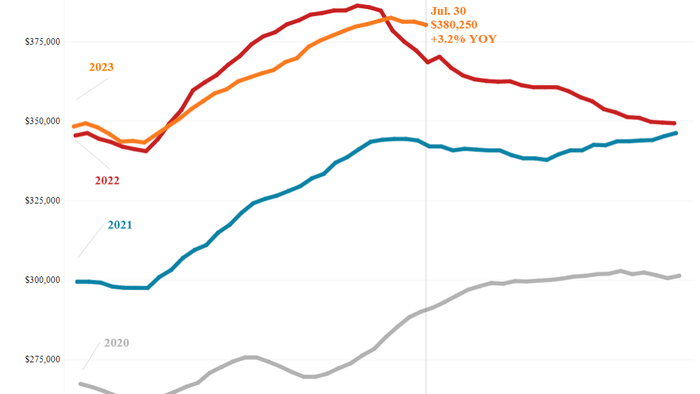

This means that housing payments remain historically high because mortgage rates remain elevated, with weekly average rates clocking in at 6.9% this week, and yet home prices continue to rise. Paradoxically, the median home-sale price is up 3.2% year over year, the biggest increase since November.

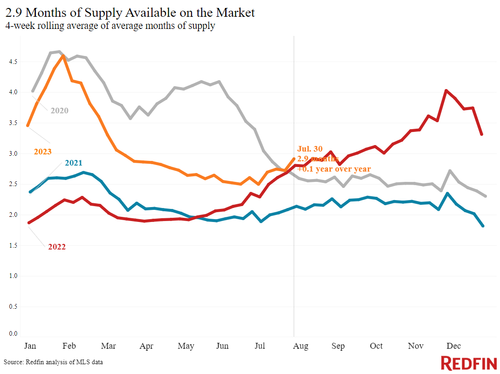

Needless to say, the renewed rise in prices are not due to the increase in mortgage rates but largely due to the persistent lack of supply...

... with inventory posting its biggest drop in 18 months as homeowners grasp onto low rates. Here's Redfin:

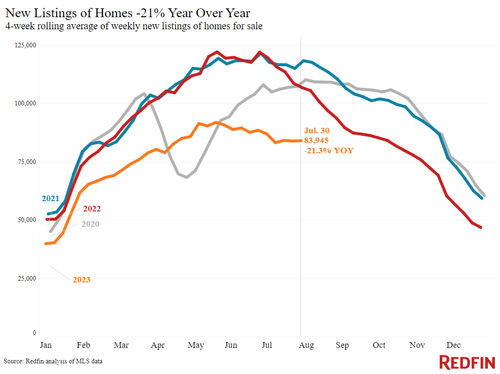

Home prices are increasing because of the mismatch between supply and demand. High mortgage rates have pushed many would-be sellers out of the market, with homeowners hanging onto their relatively low rates. The total number of homes for sale is down 19%, the biggest drop in a year and a half, and new listings are down 21%.

Yes, high rates are also sidelining prospective buyers, but ironically not as much as they’re deterring would-be sellers, who are holding on to rates achieved during the last refi - most in the 4% or lower bracket - and are loath to take out a new mortgage with a 6 or 7 handle. Redfin’s Homebuyer Demand Index, which measures early-stage demand through requests for tours and other buying services from Redfin agents, is down just 4% from a year ago.

Some more leading indicators of homebuying activity from Redfin:

And a summary of the data based on homes listed and/or sold during the period:

Source: Redfin