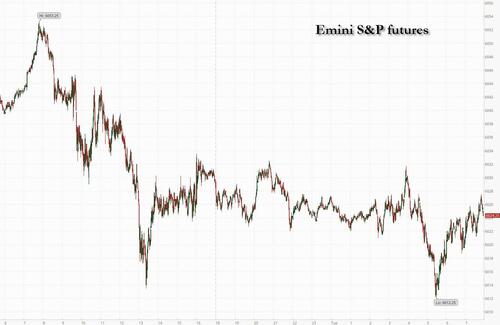

The torrid five-day rally that pushed the S&P 500 to its 51st record close above 6,000 on Monday has finally reversed amid unease over nosebleed equity valuations and the composition of Trump’s incoming cabinet. As of 8:00am, contracts on the S&P 500 and Nasdaq 100 indexes slipped about 0.2% with Mag7 and semiconductors under pressure, while Tesla also dropped in after a post-election surge that lifted its valuation past $1 trillion; healthcare names among the notable gainers. Europe’s Stoxx 600 gauge lost 1% as the rout in Asia continued and the MSCI Asia Pacific Index dropped as much as 1.3%, with chipmakers TSMC and Samsung among the biggest drags. Bond yields are 3-6bps higher as the curve twists flatter; yields are pulling the dollar higher. Commodities are weaker with Energy outperforming. Other Trump trades remained in play, however, with Treasuries falling, the dollar hitting a one-year high and Bitcoin hovering just below $90,000. Today’s macro data focus is on SLOOS, 1-year inflation expectations, and Small Business Optimism, as well as five Fed speakers.

In premarket trading, cryptocurrency-exposed stocks erase earlier premarket gains as Bitcoin retreated after its record-breaking rally took the digital asset beyond $89,000. The digital currency has rallied as traders bet on a crypto boom under Trump. Here are some other notable premarket movers:

According to Citi, the election outcome has taken investors’ US equity exposure to the highest in three years, suggesting the rally could run out of steam. Traders are also pondering the potential for Trump’s economic policies, including trade tariffs and immigration crackdowns, to spur inflation and affect the path for Federal Reserve monetary policy.

“If we have those tariffs kicking in, if we have those so-called deportations, those would have an outright inflationary impact, and so would result in higher bond yields,” said Kevin Thozet, a member of the investment committee at Carmignac. “Higher bond yields across the curve may start to bite at some point,” especially at a time of lofty stock-market valuations, he said. Ten-year Treasury yields rose as much as six basis points as the market reopened after Monday’s holiday.

Traders are now focusing on the make-up of the incoming Trump adminstration. Fears for the future of China’s relationship with the US played out in Hong Kong’s Hang Seng Index, which shed more than 3%. US-listed Chinese stocks, such as Alibaba Group Holding Ltd. and PDD Holdings Inc. also fell.

Overnight, we got reports that Senator Marco Rubio — known for his aggressive stance on China — is expected to be named secretary of state. Representative Mike Waltz, who views China as a “greater threat” to the US than any other nation, is in line to be national security advisor. Tom Homan, named as “border czar,” was criticized for harsh immigration policies implemented during Trump’s first term.

“Up until Trump’s inauguration in January, we will be in a period where there will be some form of uncertainty regarding the implementation of his policy measures,” Thozet said. Meanwhile, US inflation data due Wednesday, could determine whether the Fed cuts interest rates again next month. The core consumer price index, which excludes food and energy, is expected to have risen at the same pace on both a monthly and annual basis compared with September’s readings.

European stocks dropped in early trading in the wake of similar declines in Asia as worries over the policies of US President-elect Donald Trump may fuel inflation. The Stoxx 600 fell 1.1% to 506.61 with basic resources, chemicals and consumer products leading declines. German chemical giant Bayer shares plunged as much as 14% to the lowest level in 20 years after the German company reported weaker-than-expected results for the third quarter and cut its guidance for the year. Here are the biggest movers Tuesday:

Earlier, Asian equities fell, weighed by declines in China and major technology companies amid rising geopolitical uncertainties. The MSCI Asia Pacific Index dropped as much as 1.3%, with chipmakers TSMC and Samsung among the biggest drags. Chinese internet firms Tencent and Alibaba also slumped ahead of their earnings reports later this week.

Chinese stocks fell as fears of worsening Sino-US ties further undermined investor confidence after underwhelming fiscal stimulus and weak economic data affected sentiment. Reports that President-elect Donald Trump is poised to pick two men with track records of harshly criticizing China for key positions in his new administration added to investor worries.

In FX, the dollar added to its post-election gain, with the Bloomberg Dollar Spot Index advancing 0.4% to the highest since Nov. 1, 2023. Investor expectations for Trump’s policy agenda have lifted the greenback in recent sessions. “The fundamental dollar uptrend remains intact,” Win Thin, global head of markets strategy at Brown Brothers Harriman & Co., wrote in a note. “The Fed made it clear it is in no hurry to cut rates, growth remains solid in Q4”

In rates, treasuries slumped as the incoming Trump administration has investors fretting over the prospect of a resurgence in inflation. US 10-year yields climb 5 bps to 4.36% while the yield on the two-year Treasury rose as much as 8 basis points to 4.33%, its highest since July 31. Bunds rose to session highs after German ZEW data fell short of estimates. German lawmakers have also agreed to hold an early election in February, according to government officials familiar with the talks. Gilts underperform their German peers after mixed UK jobs data. Oil prices advance, with WTI rising 0.8% to $68.60 a barrel. Spot gold falls $26 to $2,592/oz.

Bitcoin is lower having flirted with the $90,000 level earlier on.

The US economic data calendar includes October New York Fed 1-year inflation expectations at 11am and the Senior Loan Officers Survey at 2pm; the Fed speaker slate includes Waller (10am), Barkin (10:15am, 5:30pm), Kashkari (2pm) and Harker (5pm). Senior Loan Officer opinion survey is released at 2pm.

Market Snapshot

S&P 500 futures little changed at 6,026.75

Brent Futures up 0.5% to $72.17/bbl

Gold spot down 1.0% to $2,593.31

US Dollar Index up 0.28% to 105.84

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed and failed to sustain the momentum from Wall St where the major indices climbed to fresh record highs in a continuation of the Trump Trade and in quiet conditions due to Veterans Day. ASX 200 was restrained by weakness in mining and resources after underlying commodity prices were hit by dollar strength. Nikkei 225 gave up its early gains and more despite initial tailwinds from JPY weakness and chip-related support. Hang Seng and Shanghai Comp weakened with notable underperformance in the Hong Kong benchmark amid weakness in tech and auto names owing to the current tariff-related concerns, while the mainland was also pressured after recent new loans and financing data underwhelmed but with the downside cushioned after the PBoC recently pledged measures and with China reportedly planning to cut homebuying taxes to boost the property sector. Softbank Group (9984 JT) 6-month (JPY): Revenue 3.47tln (exp. 3.42tln). Net +1.01tln (prev. -1.41tln). Co. reaffirms guidance.

Top Asian News

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

The post-election rally edged higher yesterday, as the S&P 500 (+0.10%) closed above the 6,000 mark for the first time, posting a fourth consecutive record high following the election and its 51st of 2024 so far. In fact, the index is currently experiencing its strongest YTD performance since 1995, having risen by +25.82% since the start of the year, and it’s the first time since 1997-98 that it’s on course to post back-to-back annual gains above +20% and only the third time in 100 years. So it was another strong performance, with the Dow Jones (+0.69%) closing above 44,000 for the first time as well, just as the small-cap Russell 2000 (+1.47%) closed just 0.3% from its all-time high back in November 2021.

This rally has led to a significant easing of financial conditions, but yesterday also saw investors dial back their expectations for rate cuts yet again. For instance, the rate priced in by the December 2025 meeting was up to 3.82% yesterday, meaning that investors are only pricing in three more 25bp rate cuts by the end of 2025. Bear in mind that’s risen by almost 100bps in just over six weeks, thanks to positive US data and the election result. So this is a significant reassessment of the Fed’s outlook, and with investors pricing in fewer rate cuts, the dollar index strengthened another +0.52%, reaching its highest level since early July.

Given the Veterans Day holiday, cash trading in US Treasuries was closed yesterday. But futures markets showed them losing ground across the curve, with 2yr, 5yr and 10yr futures all pointing towards higher yields. This morning in Asia they've crystallised this with 2 and 10yr yields up +3.8bps and +2.1bps, respectively. That also comes ahead of the CPI release tomorrow, where there’s been some concern about another robust print, particularly after monthly core CPI was at a 6-month high in September. We’ll have to see what that brings, but inflation expectations have risen quite a bit over the last couple of months, with the 2yr inflation swap up from just 1.99% on September 10 to 2.62% yesterday, so another upside surprise would only accelerate that trend. That said, our US economists expect core CPI to tick down in October to +0.26%.

In the meantime, there was a lot of focus on several “Trump trades”, which continued to outperform yesterday. Bitcoin was one of the most notable, rising by more than 10% yesterday and up another +0.96% this morning to trade above $88,000. Its YTD gain now stands above 100%. It’s been supported by the fact that Trump and the new Congress appear more friendly to crypto, and Marion Laboure on my team has just released a note looking at the immediate impact of the election on crypto along with the outlook ahead.

Among equities themselves, the Trump trade was also clear, and Tesla (+8.96%) advanced for a 5th consecutive session, bringing its gains over the last week to +44.1%. That single-handedly dragged the Magnificent 7 group to a +1.02% gain and another record high, even as five of them actually lost ground on the day. Nvidia (-1.61%) was the weakest of the Mag-7, echoing a -2.54% decline for the Philadelphia Semiconductor index after Reuters reported over the weekend that the US had told TSMC to stop shipping its advance AI chips to China. Meanwhile, banks continued to post strong gains, with the KBW Bank index rising +2.35%.

In terms of US politics, we got a few more reports on potential appointees to the new Trump administration yesterday. That included a report from Bloomberg, which said Trump would narrow the shortlist for Treasury Secretary this week. It also said he was leaning towards someone with Wall Street experience to the job. Otherwise, CNN reported that Trump would name Stephen Miller, his immigration adviser, as Deputy Chief of Staff for Policy. Overnight the FT and others suggest he will appoint Mike Waltz as national security advisor and Marco Rubio as Secretary of State. They are China hawks.

Lastly, we still don’t officially know who’s going to end up in control of the House of Representatives, but the current AP tally now stands at 214-205 to the Republicans, with 218 required for a majority. Polymarket is now putting the likelihood of a Republican sweep at 99%, and as it stands, the Republicans are currently ahead in more-than-enough districts to put them over the 218 majority line.

Over in Europe, risk assets followed a broadly similar pattern, and the STOXX 600 (+1.13%) posted its strongest performance in six weeks. But for sovereign bonds, there was a clear rally across the continent as investors priced in a growing likelihood of ECB rate cuts over the months ahead. In fact, yields on 10yr bunds (-4.0bps), OATs (-4.1bps) and BTPs (-6.3bps) all moved lower, which was in contrast to the way that US Treasury futures were pointing.

When it comes to German politics, there was still no clarity on when an election might take place, but there’s been plenty of pressure to bring forward the timetable of a confidence motion before the new year. AFP reported yesterday that German President Frank-Walter Steinmeier was moderating discussions between the parties, and Chancellor Scholz said on Sunday that an earlier vote could happen this year “if all sides agree”. Nevertheless, Scholz’s spokesman said yesterday that a vote of confidence wouldn’t happen this Wednesday, and Vice Chancellor Habeck of the Greens said yesterday that the decision was down to Scholz.

Asian equity markets are mostly lower this morning with non-US risk still struggling to weigh up all the post-election implications. Leading the losses is the Hang Seng (-2.73%), followed by the KOSPI (-1.73%), the Nikkei (-0.97%), and the Shanghai Composite (-0.85%). S&P 500 (-0.11%) and Nasdaq (-0.08%) futures are slightly lower.

A Bloomberg report overnight indicates that China is planning to cut taxes on home purchases. The proposal would allow major cities to reduce the deed tax for buyers to as low as 1%, down from the current rate of up to 3% in an effort to revive the struggling housing market.

To the day ahead now, and one of the main highlights will be the Fed’s Senior Loan Officer Opinion Survey on Bank Lending Practices. Otherwise, central bank speakers include the Fed’s Waller, Barkin, Kashkari and Harker, the ECB’s Rehn, Holzmann, Centeno and Cipollone, and the BoE’s Pill. Data releases include the UK unemployment rate for September, the German ZEW survey for November, and in the US there’s the NFIB’s small business optimism index for October.