The Trump administration is exploring using US Chips Act money to take an equity stake in Intel Corp., according to people familiar with the matter — an unusual move aimed at rescuing the struggling chipmaker and bolstering domestic semiconductor production, according to Bloomberg.

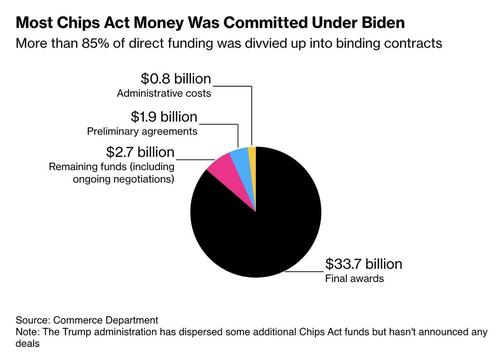

Talks center on using Chips Act funding to partially finance the purchase, though options are still in early discussion, the people said. It’s unclear whether the stake would come from converting existing Intel grants, allocating new funding, or combining Chips Act money with other sources.

Bloomberg first reported the deliberations, which helped spark a 15% rally in Intel shares over the past two days. The company declined to comment, but said in a statement it is “deeply committed to supporting President Trump’s efforts to strengthen US technology and manufacturing leadership.”

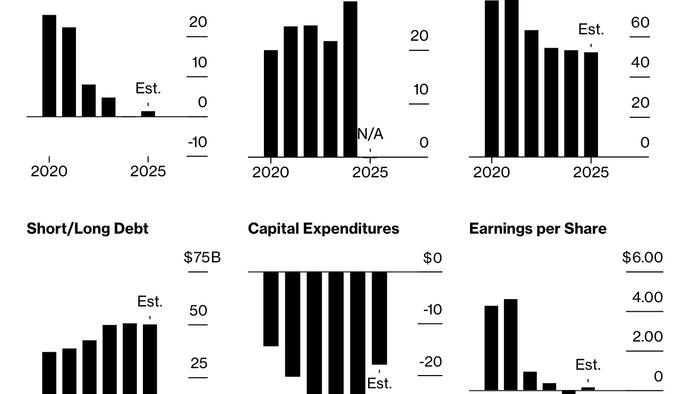

Bloomberg writes that Intel has already been awarded $7.9 billion in Chips Act grants for commercial production, up to $3 billion for the Pentagon’s Secure Enclave program, and access to $11 billion in loans. Any new agreement would strengthen the company’s finances as it slashes spending and jobs.

The talks come days after Trump met with Intel CEO Lip-Bu Tan, whom he had previously called “highly conflicted” over ties to China. The two appeared to patch things up; Trump later said Tan has an “amazing story.”

The approach mirrors other Trump-era interventions, including a “golden share” in US Steel Corp. and a $400 million Pentagon stake in MP Materials Corp. “In the past few months, we’ve seen the government take a much more active role in engaging the economy,” said Geoffrey Gertz of the Center for a New American Security. “That appears to be the current direction for US industrial policy in these critical sectors.”

Intel’s Ohio chip hub — once touted as part of a comeback — has faced repeated delays and will require tens of billions more to launch next-generation manufacturing. “Just a few billion dollars to fund the Ohio plant doesn’t cut it for Intel,” said Jay Goldberg of Seaport Research Partners.