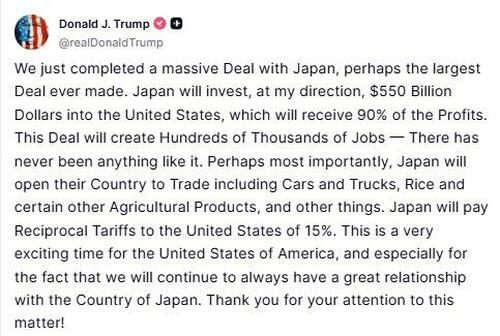

President Donald Trump announced on Truth Social that he reached a "massive" trade deal with Japan that will set tariffs on Japanese imports at 15% and see the key American trading counterpart and ally invest $550 billion into the US (with about the same likelihood of doing so as Stargate is to invest $500 billion in US AI technology) .

“I just signed the largest trade deal in history, I think maybe the largest deal in history — with Japan,” Trump said at an event at the White House on Tuesday after announcing the deal on social media. “And that was done with Japan. They had their top people here and we worked on it long and hard and it’s a great deal for everybody.”

On Truth Social, Trump explained that the pact calls for Japan to “open their Country” to US automobile imports, as well as additional agricultural imports including rice - a remarkable achievement with a country which has historically been extremely protectionist of the food staple - without specifying further. Trump has repeatedly zeroed in on auto trade as he criticizes trade imbalances with the country. Around 80% of Japan’s trade surplus with the US is in cars and auto parts.

Additional details of the preliminary agreement with Japan - including, critically, if Japanese automobiles and parts would receive a carve-out from separate 25% tariffs - were not immediately available. Trump originally threatened to place a 24% tariff on Japanese imports earlier this year, a proposal viewed as “extremely disappointing” by Ishiba. He later amended that threat to 25% in a letter earlier this month.

The issue of automobiles has been a particular sticking point in trade negotiations between the two countries. US trade negotiators have pushed Japan and other countries to accept cars built to US federal motor vehicle safety standards, rather than subjecting them to differing requirements. Meanwhile, negotiators from Japan and other countries have pushed for exemptions to Trump’s existing 25% levies on autos and auto parts.

It was not immediately clear Tuesday if any such carveout would be established for Japan, like a planned tariff-rate quota for steel imported from the UK. Japanese public broadcaster NHK said Washington would set the rate on the auto sector at 15%, citing an unidentified government official. Shares in Japanese carmakers jumped in Tokyo trading with Toyota rising more than 10%.

Japanese-based car companies have made significant plans to invest in the US, including Isuzu Motors Ltd.’s $280 million investment in a new facility in South Carolina, and Toyota Motor Corp.’s $88 million commitment to boost production of hybrid vehicles. The US has also offered tariff relief for auto companies that assemble cars in American facilities, part of a broader effort to bring offshore manufacturing to the US.

“Japan and the US have been conducting close negotiations with our national interests on the line,” Japanese Prime Minister (and lame duck) Shigeru Ishiba said in Tokyo, just two days after suffering a huge loss for his LDP party. “The two nations will continue to work together to create jobs and good products.”

According to local media reports, the Japanese premier was linking his shaky political future to developments in the talks following the huge election setback this weekend, although when asked about the trade deal he just signed, it's almost as if he knew nothing about it, instead telling reporters he needs to look closely at the details of agreements with the US, and that he’ll be getting further updates from his chief trade negotiator, Ryosei Akazawa

This was reminiscent of the US president's approach: Trump has previously announced trade frameworks without many specifics only for the White House to provide details days and weeks later, as terms are hammered out.

Trump indicated at the event with Republican lawmakers at the White House that he also expects to sign a deal on a joint venture with Japan to export LNG from Alaska.

The deal with Japan came just hours after Trump announced he had reached an agreement with the Philippines, setting a 19% tariff on the country’s exports (down a whopping percent from the previous 20%). The flurry of activity comes days before the Aug. 1 deadline for imposing so-called “reciprocal” tariffs that will hit dozens of trading partners.

Trump first announced the plan for sweeping tariffs on nearly every US trading partner in April, only to quickly put them on hold for 90 days amid market backlash in order to work out agreements. But that stretch saw the US finalize only a handful of deals and Trump instead moved to unilaterally impose rates on countries and blocs before the looming deadline.

While talks continue with major economies including the European Union and India, Trump said some 150 smaller countries will be hit with a blanket rate of between 10 and 15%.

The yen fluctuated in early Tokyo trading, before strengthening again after the NHK report on the auto tariffs. Japanese stocks on the Topix benchmark index rose as much as 2.5% and US equity futures edged higher.

The talks came after eight rounds of negotiations, and a week after Bessent visited Japan to lead the US delegation to the World Expo in Osaka. Japan had its upper house elections on Sunday, and while losses there significantly weakened Ishiba’s domestic position, the prime minister has cited the trade talks as one of the reasons why he needs to stay on.

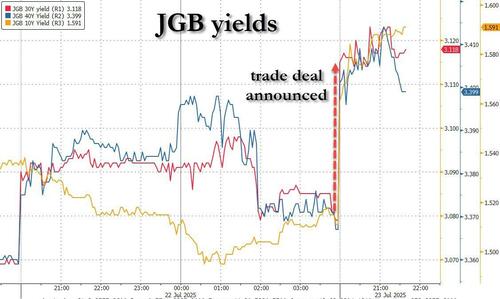

In kneejerk response, this is how most asset classes reacted to the news:

UBS said that its desk flows have a strong sell bias (1:10), impacted by the US-Japan trade deal. Wednesday’s focus is the 40y bond auction – the first since PM Ishiba’s election loss. The current selloff looks a bit overdone, and maybe a decent auction could calm some nerves. Auction results are out at 12:35 Tokyo, as futures resume trading post the lunch break.