By Peter Tchir of Academy Securities

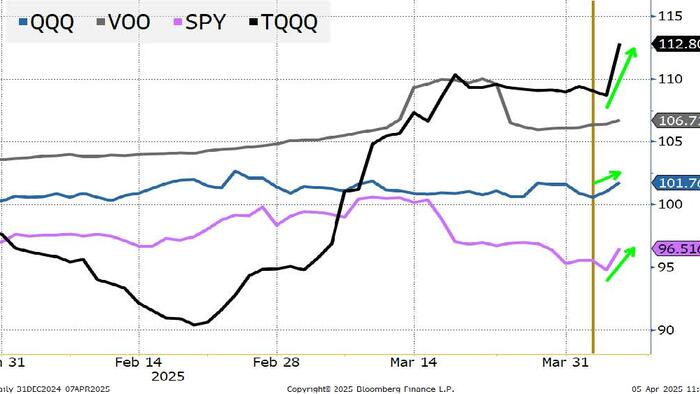

After a tumultuous week in stocks (Nasdaq 100 down 10%, the S&P 500 down 9%, and the Russell 2000 down somewhere in between), it seems like a good time to get back to basics.

Though it hasn’t just been a bad week – the Nasdaq 100 is down almost 15% in the past month and 17% year-to-date.

Credit spreads were also starting to show signs of wear and tear – the Bloomberg Corporate bond OAS went from 93 to 109 and CDX IG went from 61 to 72. Not alarming, but worth watching. The high yield market, which has been so resilient, also experienced some weakness, with CDX HY rising 100 bps, to 439 since March 25th.

Treasuries performed very well, with the 10-year dropping 25 bps to close out the week at under 4%! Though Treasuries did fade off of the best levels of the day when Powell made it clear that he is watching inflationary impacts from tariffs, as well as watching the jobs data (which was surprisingly solid).

Bitcoin was the standout, as it defied recent correlations on Friday and acted as a “safe haven.” My best guess on this, or at least what I’m thinking, is that the tariff policy demonstrated that this administration will stick to their guns, and one of their guns has been to buy crypto to pay off the debt.

But let’s move on to the basics – the Mission Statement and Tariff Basics.

We have been discussing what we see as this administration’s “mission” for months. Whether you want to call it a mission statement, desired legacy, or what they were elected to do, I think this sums it up quite well:

I think that accurately reflects the main mission of this administration and two major elements of what they will work towards to achieve it.

Fully on board with this mission but let’s for a moment assume the global economy is a zero-sum game.

In game theory, it is usually safe to assume that a “zero-sum game” should be “win-win” (not impossible to achieve) and “lose-lose” should largely be avoided.

So, in a zero-sum game, if the American Middle Class is to grow and get richer, it benefits the existing middle class and should reach down and help lower income families the most. I don’t think anyone can argue with that.

Well, where will the income/wealth distribution come from?

I think it is perfectly rational to believe in the mission, and to believe that the policies will be successful, and at the same time still be nervous about corporate earnings and valuations.

We won’t delve into all the policies enacted (and likely to be enacted) to achieve this mission, as it would be too long, and be total guesswork, relative to what we know now about tariffs.

We went into a lot of detail on what we considered The New Trump Tariffs in early February. In our Bottom Line in that report, we published “At the moment, I’m not that worried” and went on to discuss our lack of concern about tariffs, as we understood them back then.

Our view changed on that back in the middle of February as we evaluated the policies as implemented. Leading up to this week, we were already nervous about the combination of geopolitical policies alongside tariffs but were still, quite frankly, shocked by the tariff policy launched in the Rose Garden this week.

As of Friday afternoon, we backed off being negative on U.S. stocks for a trade (see NFP, Powell and Tariffs).

What does the administration expect tariffs to deliver?

Since it will take time to build up manufacturing capacity in the U.S. (there is some excess capacity, but nothing on the scale that is envisioned by the administration), presumably the initial benefit will be the income from tariffs, and over time that income will dissipate as manufacturing shifts here (the two goals are somewhat mutually exclusive – either import and get the tariff revenue but not the jobs, or build here and get the jobs, but not the tariff revenue). But in an ideal world, the tariffs pay for a lot up front as the U.S. builds the manufacturing base, creating jobs during the buildout and even more jobs down the road, which will replenish any revenue gap from no longer receiving the tariffs.

But only if it was that simple. It seems, logically, if it was that simple, someone would have tried it already, successfully. That terms like “comparative advantage” would have dropped out of our language due to lack of use. So, let’s examine some of the risks.

Country A produces a widget that they sell for the equivalent of $100 to a U.S. importer. The U.S. now imposes a 30% tariff on that country/product combination.

That is about as basic as it gets.

As described in more detail in the February report on tariffs, 4 things can happen and in all likelihood, some combination of the 4 occurs.

The importer can reduce margin or pass on higher costs. Whatever the net cost rises by it either hits earnings (the importer eats it) or it is inflationary, as prices increase. Yes, in theory it is a “one-time price increase” but at already high price levels for many things, that might hit hard.

This is already complex enough, but there is one more big question that we are getting mixed signals on – how long will the tariffs stay in place?

If tariffs are viewed primarily as a negotiating ploy two things are likely to happen:

If tariffs are going to bring back jobs, they need to be long-lasting.

Basically, if this is just negotiating, the stated goals don’t really work (unless you believe that tariffs really are hitting sales of U.S. made goods globally really hard). In which case, the markets need to start pricing in long-lasting tariffs. The end game could work, but it will not be an easy path, and the world is likely trying to figure out alternatives (so far China isn’t coming to the table, so much as upping the ante).

Everyone is free to see how these scenarios play out, but for now I’m stuck in the camp:

I cannot get bullish stocks, beyond just for a trade, while I see tariffs playing out this way (as my base/maybe even good case).

Since we focused on mission/legacy goals and some thoughts on how tariffs might work (I think I laid out a more optimistic case than I expect, and I don’t think it is great for risk assets globally), I wanted to include one chart in this section.

The “soft” data all points to extreme fear. CNN Fear and Greed Index. AAII Investor Sentiment. You name it, but I look at these 4 incredibly important ETFs and some had almost record inflows into the selling after April 2nd. It is great to be a contrarian, but is the contrarian trade really that it is oversold? That everyone is bearish?

The “hard” data/fund flows don’t seem to support that. If you get bored and have a Bloomberg terminal, find any ETF you want (the more speculative, the better) and append SO (shares outstanding) at the end of the ticker and hit <index> <go>. Massive inflows into risky funds and big outflows out of inverse funds.

Whatever we might think, there is still a lot of belief that stocks are cheap and that the plans will all work out. Down 20% from the highs, it is difficult to argue with that, and I’m long for a trade, but I think we have another 10% downside and when I look at the massive dip buying still occurring, I’m sadly more comfortable with that outlook in the next week or two.

Credit has “joined” the fray as we thought last weekend. That could turn, but as so many other factors (not discussed today, but that we’ve touched on repeatedly) point us towards recession, maybe even stagflation, I don’t think we’ve seen the wides yet.

At some point I will be bullish again on risk. Either I find the scenarios (as I probability weight them) point to better conditions for stocks, or we finally get so oversold that it is truly the contrarian trade to buy.

In the meantime, I expect more downside.

Rates are tricky, as they should be lower, but inflation pressures could be real if the tariffs go ahead as planned (and are semi-permanent). But my bigger concern, which applies both to stocks and bonds, is that the wave of capital repatriation has only just started.

It will be curious to see if (or when) retirees (or those getting close) decide that maybe it is prudent to reduce stock exposure for safety? I don’t think that has happened yet (though, it probably has occurred with Democrats already as the gap between the parties on so many fronts has never been wider at any time that I can think of).

Good luck, I hope I’m right about the bounce to start the week, and I hope I’m wrong that we won’t see enough of a policy shift, or signs of “winning,” to make me bullish beyond a trade.