At exactly 12.01am ET this morning, the long-awaited 25% US tariffs on Canada and Mexico as well as an additional 10% levy on China went live. The 25% tariffs taking effect apply to all imports from Canada and Mexico, except for Canadian energy which will be tariffed at a 10% rate.

Canadian and Mexican tariffs were supposed to be the low odds given their potential for blow back onto US growth; according to JPMorgan today’s implementation should therefore raise odds that the plethora of other tariffs that are currently in the works – the 25% EU tariffs, sectoral tariffs on copper, lumber etc., as well as the broader suite of reciprocal tariffs – will be enacted and are more than just negotiating tactics.

Swift retaliation followed from both Canada and China. Canada imposed 25% tariffs of its own on $155bn of US exports including orange juice and bourbon in two stages – immediate tariffs on $30bn of goods and the remaining $125bn in 21 days.

China raised tariffs by 10% on soybeans, pork, beef, and fruits starting March 10th, and 15% tariffs on chicken, wheat, corn and cotton in line with yesterday’s press reports of agricultural goods being Chinese tariff targets. 10 American companies involved in defense work have also been put on the entity list.

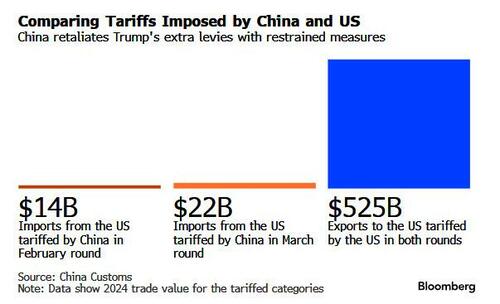

The Bloomberg chart below compares tariffs imposed by China and US - according to JPM, the tempered and targeting China reaction is keeping sentiment stable with China equities bouncing on today’s China announcement.

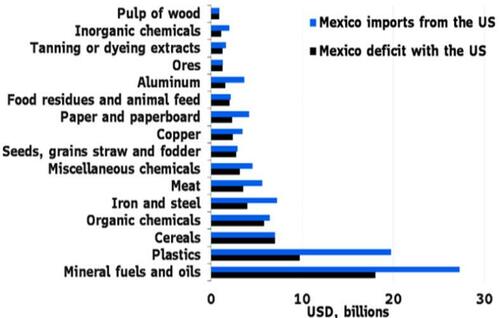

Mexico hasn’t made a formal retaliation announcement at the time of writing, but around the Feb 1 deadline Sheinbaum said they would impose “tariff and non-tariff measures in defense of Mexico’s interests” (with ‘sources’ suggesting 5%-20% tariffs on pork, cheese, fresh produce, steel, aluminium). The Blomberg chart below of Mex-US trade items where Mex is a net exporter to the US and could target these goods for tariffs (BBG):

According to JPM, the muted nature of the price action in markets in the wake of the news is somewhat surprising, given the gravity of the economic impact on Canada/Mexico in particular. One could argue that the stoic USD/CNH reaction is not entirely surprising given that any FX retaliation decisions will likely have to wait till the end of the NPC. For CAD, the lack of an immediate reaction could owe to the pre-existing risk premium in the likes of CAD, but defies ex-ante expectations of USD/CAD spiking above 1.50 in the event of actual implementation. According to JPMorgan there are three possible reasons to rationalize this price action:

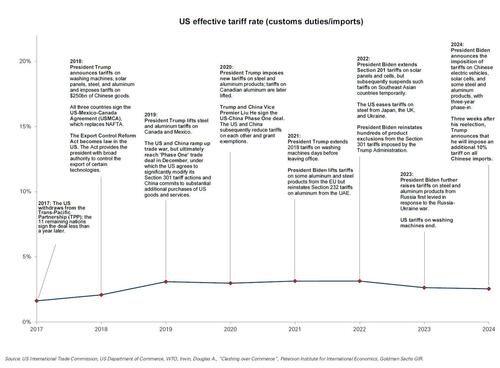

According to Goldman (full note here for pro subscribers), the 10% hike in the China-focused tariffs will raise the US effective tariff rate by 1.2%, and increase core prices by around 0.1%.

FX Flows

A few quick thoughts across Goldman's Sales, trading, Rsrch

There remains a meaningful amount of doubt about whether the Canada & Mexico tariffs will truly be in effect for any meaningful amount of time.

China’s restrained response and FX stability are a big inhibitor to a broader DXY reaction. That’s unlikely to change through the Two Sessions (ongoing now); and there’s an argument—to which Sun Lu (GS Strats) subscribes—that China is still trying to keep its response moderate and prioritise the domestic rebound. The RMB vs. the CFETS basket has weakened YTD, and RMB REER is near multi-year lows given inflation differentials (i.e. little ‘pressure’ to weaken RMB).

Trump’s comments in last night’s press conf. about countries gaining an unfair advantage by weakening their currencies, specifically referencing China & Japan as examples (BBG/White House).

Non-US end asset owners (Pension, Insurance etc.) have been increasing hedge ratios in recent weeks on their US assets (partic. the case for Cadandian & Swedish Real Money), making some large USD selling flows.

US assets are taking a hit from US data implying a real sentiment and activity impact from tariffs on the US economy. Yesterday’s ISM Manufacturing included 20 mentions of tariffs in the press release (vs. 4 in January release). The USD’s beta to SPX and SPX’s beta to tariff headlines have gone up.

Tariffs are no longer the #1 theme – focus is now on European fiscal, the end of US exceptionalism, broadening of the ‘AI trade’ to China and China policymakers softening their tone on business etc.., which all cut against the USD.

Digging into some of the individual crosses, Goldman's Kristian Brauten-Smith notes:

The market is struggling to richen the USD when it is simultaneously marking-down US nominal growth. Our US economist’s view is that we’ve gotten excessively negative on the US data misses recently, but, it seems the market needs more confidence in that part of the equation before we can see any reversion to Tariffs Up--USD Up price-action.

Delta 1 take (From Goldman Delta One head Rich Privorotsky)

Few ppl think Canadian and Mexican tariffs (especially at 25%) will be a lasting feature. Think the real angle is getting allies to impose 20%+ tariffs on China (https://www.cnbc.com/2025/03/01/treasury-chief-urges-canada-mexico-to-m…) and so we’ll be on watch out for later in the week to see if this leg of the policy abruptly reverses (the China tariffs are here to stay imo).

Yesterday I was inundated with calls from US clients asking if they had missed the European rally (in absolute terms maybe yes). The double digit leap in defense stocks and the broader move higher in the geography is quite simply a reflection of the increase in fiscal space. The decision overnight of the US to cut financing to Ukraine will only accelerate that debate (expect another higher start in defense). Think we’ve gotten a bit ahead of ourselves in terms of size and scope. Many broad based spending initiatives or new funds will need unanimous support across all European nations (a high bar especially given Hungary and Slovakia ). That said, the case for European outperformance remains as long as the US continues to be a relatively poor destination for forward returns (Mag 7 capex machine instead of buyback machine...NVDA broke DeepSeek lows and crypto can't hold a rally).

Atlanta Fed GDPnow has hit an extreme low of -2.8%. Surely exaggerated in terms of degree, but directionality likely correct. US equity sentiment feels low/extreme but I'm not sure positioning reflects that. Bracing myself for an adversarial Trump at the State of the Union tonight…think any hope on tariff reversal won’t come until Wednesday. Watching Target and Best Buy on consumer.

Side-note: Polymarket summarizes the mood out there (https://polymarket.com/event/us-recession-in-2025)”

Developing