By Peter Tchir of Academy Securities

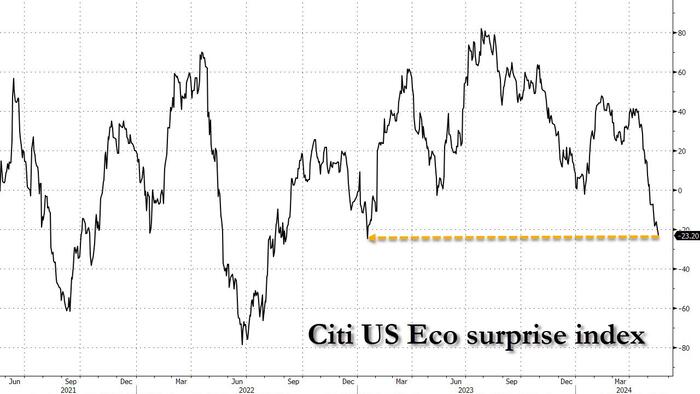

The Citi Economic Surprise Index continues to deteriorate (worst levels in a year).

Bond yields have declined (the 10-year Treasury got to 4.31% on Thursday, basically the bottom of our 4.3% to 4.5% range, and crept higher the rest of the week). Bonds in part moved on economic data (weak), inflation (high, but “explainable”), and Powell (who couldn’t resist being dovish) effectively dismissing the higher than anticipated PPI (explainable as it was). I’d argue that bond yields went lower partly due to economic data and partly due to Powell.

Stocks did well again this week (1% to 2% depending on the index), but the narrative seemed narrowly focused on Powell, cherry picking economic data, and the ongoing importance of corporate buybacks in an otherwise slow and boring tape.

As we start this week, Nvidia’s earnings on May 22nd seem to be the biggest catalyst as there is virtually no data on Monday or Tuesday. While we will likely hear from more Fed speakers, will anyone pay attention after Powell’s tone last week?

My concern, I guess, is that we are spending too much time focused on the Fed and inflation, while ignoring (or not treating as importantly) other data.

The market, to some degree, has seemed to:

I completely understand the arguments for why the inflation prints were not as bad as they seemed on the surface. The explanations ranged from:

But, I’m not here to argue about where inflation has been, I’m here to point out that I think the market has been too narrowly fixated on past inflation, and what the Fed might do about that, while not thinking enough about some bigger picture issues.

My simple case for inflation is this:

I do believe that with PPI and CPI behind us, markets will start delving deeper into the overall slew of economic data and are unlikely to like what they see.

We asked the question, Will Tariffs Outweigh CPI? They didn’t. The media and most economists were quite sanguine about this round of tariffs (as opposed to the ones imposed in 2018, which remain in place). Maybe they were so “concentrated” that they are unlikely to impact the shape of the global economy? Maybe China won’t respond? Or maybe we are missing a big risk?

In Friday’s Geopolitical Risks – Perception versus Reality, we examine CYBER, Commodities, the Middle East, Russia, Trade War, and “wildcard” risk. For now, our assessment is that the biggest gap between perception and reality is around the Trade War (with commodities not too far behind). Please see that report, as nothing about the recent announcement that China and Russia are cooperating more makes me any less concerned that the Trade War is about to ratchet higher.

Also, if you missed it, I recommend listening to this month’s Around The World Podcast.

Hopefully we do get an expanded narrative and spend less time and energy worrying about an inflation print here or there and how the Fed will act, and focus instead on the bigger discourse on the state of the global economy and the likely direction of travel (which I continue to think will not be favorable for our markets).

On the other hand, I could be the one being too narrowly focused (on China and geopolitics), but I’m encouraged by recent announcements that my fixation is valid (not encouraged for the state of global affairs, just in the narrow definition that I don’t think I’m wasting time or energy thinking about trade war escalation).