Authored by Peter Tchir via Academy Securities,

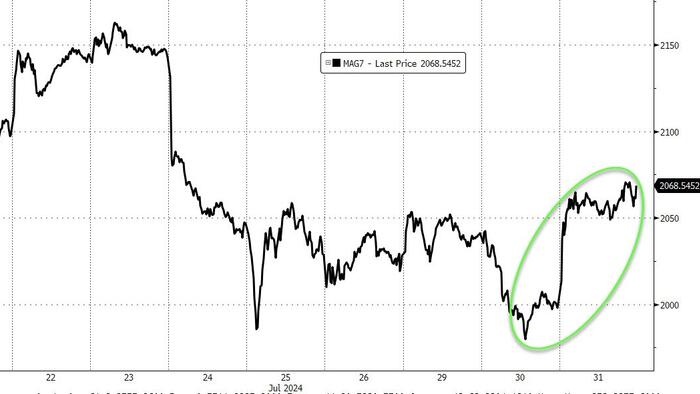

It is difficult to tell how much of today’s rally was:

Both stocks and bonds seem a little too complacent about the Fed, earnings and other factors.

I still expect that stocks will be lower in August than they were yesterday, but it won’t be a one way street and today likely helped to reset some “for a trade” longs, and squeeze out shorts, smoothing the path to more downside on any disappointment.

I am somewhat surprised the rate rally is continuing, but there has been less corporate new issuance and the “month end index extension” trade is well known and likely helping support rates here (which in turn are helping stocks). I don’t see that continuing.

Energy related stocks remain my favorite position, as they will act as a hedge in the event of geopolitical escalation.