Authored by Mike Shedlock via MishTalk.com,

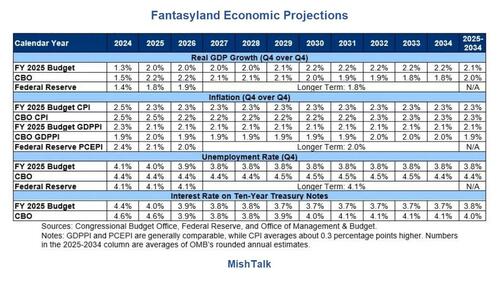

What’s the key item that’s wrong in the following table of GDP, inflation, unemployment, and interest rate projections?

Has the Fed, the nonpartisan Congressional Budget Office (CBO), or the White House Office of Management & Budget (OMB) ever forecast a recession?

The answers are no, no, and no.

Yet, for the next ten years, real GDP and the unemployment rate reflect the no recession idea without any discussion of recession by any of the above parties.

Since the Fed has a mandate on price stability, and the Fed ridiculously defines stability as 2.0 percent, the Fed predicts 2.0 percent.

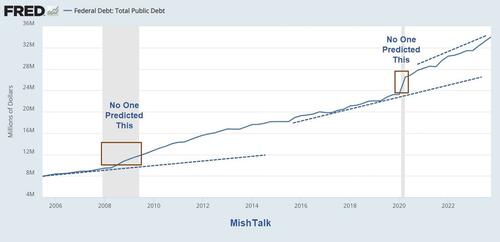

Without exception, budget deficits soar in recessions.

The Fed never predicts deficits but miraculously and arrogantly thinks no matter what they are, it can achieve a steady unemployment rate of 4.1 percent and inflation of 2.0 percent for a decade.

Please consider CBO Projections at a Glance

Every one of those projections counts on there being no recession.

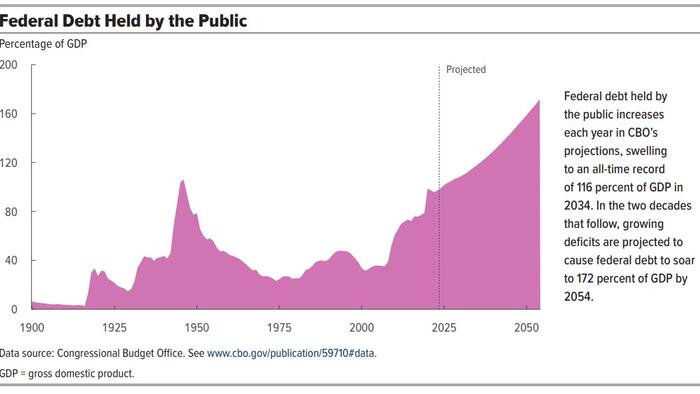

The only way to explain the above chart is the OMB projects no recession all the way to 2050.

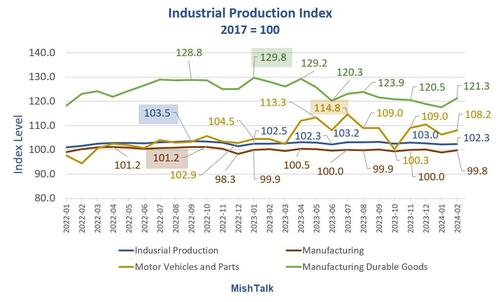

Industrial production rose in February from huge negative revisions in January.

Industrial Production data from the Fed, chart by Mish.

For discussion of the above chart, please see Industrial Production Takes a Huge Revised Dive, the Fed Blames the Weather

Has Industrial Production peaked this cycle? Many charts suggest the answer is yes.

The answer to the question appears to be yes, starting October of 2023.

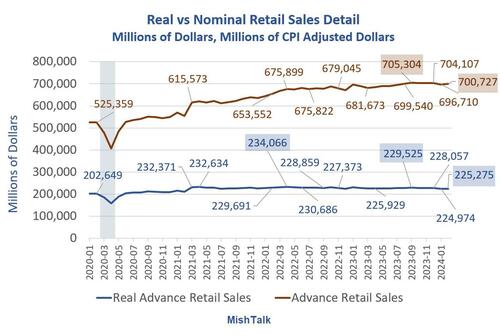

For discussion, please see Has the US Consumer Finally Waved the White Flag on Spending?

Six pictures of real vs nominal advance retail sales tell the story.

OK, I get it that it’s impossible to pencil in a recession date. But there has to be a better approach that forecast no recession until 2050.

Someone asked “What about GDP beating expectations like 2023?”

OK what about it? What did that do for deficits or debt, or interest on the debt?

With every recession, fiscal prudence goes further and further out the window.

The Fed will update its dot plot of expected economic conditions on Wednesday.

I can hardly wait.