Authored by Simon White, Bloomberg macro strategist,

A US recession is looking increasingly imminent, but the usual playbook of a deep equity selloff and Treasuries acting as a hedge may not apply to the same extent.

The US looks as if it will be in a recession very soon, if it isn’t already in one.

The chart below shows the average evolution of the main assets around a downturn.

The chart shows that gold typically fares best of the selected assets shown after a recession, followed by USTs and corporate debt. Equities and commodities (Bloomberg Commodity index) come off worst in the six months after the recession begins.

But this recession will come with an unwelcome helping of elevated inflation, which means the usual rules cannot be relied upon.

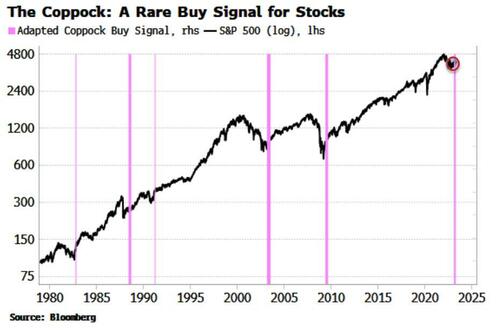

Some rare and reliable signals, such as the Coppock shown in the chart below, suggest the S&P could be much better supported than would normally be expected.

Gold (and silver) are intriguing as they have already been rallying, intimating they are already sniffing out that this will not be a garden-variety recession, one through which inflation potentially rises and for which Treasuries are an inadequate hedge.

Commodities might also be expected to perform better than their recession average as real assets are best-placed to weather inflation likely to prove more persistent than the consensus expects.

An atypical recession requires an atypical response, and there are several more adjustments that would make portfolios better prepared for such an outcome.