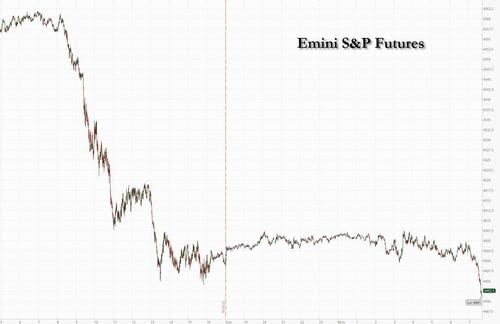

US equity futures were flat for much of the session before taking leg lower into the red with Treasury yields ticking higher, the USD flat, oil near $95, highlighting inflationary pressures just as policymakers prepare for interest-rate meetings, and bitcoin is surging as traders start pricing in the coming easing tidal wave. As of 7:45am, S&P and Nasdaq 100 futures were down -0.2%. In commodities, WTI and ags are the best performers with base metals and natgas the biggest laggards. Stocks in Europe and Asia dropped sharply, mirroring the decline that took the S&P 500 down more than 1% last Friday.

This week is a filled with multiple central bank decisions, including the Fed. JPM's market intel desk writes that with BBG reporting options markets are betting on faster than expected rate cuts in 2024; "let’s see the update from the DOTS" says JPM's Andrew Tyler. This week, the UAW strike may dominate headlines with about 10% of the 150k person union on strike, and the Biden admin may get involved. Meanwhile, the US government shutdown looms after Sep 30, currently a bi-partisan deal in the House has yet to materialize.

In premarket trading, mega cap Tech names are mostly in the green. Apple shares rise as much as 0.5% with analysts positive on the tech company’s pre-orders for the latest iPhone 15, saying data so far is surpassing expectations and could bode well for the shares if momentum is sustained. Societe Generale plunged as much as 11% after cutting profitability targets. Here are some other notable premarket movers:

A three-week rally in oil prices has pushed benchmark Brent higher by 11%, and back to the average price at which Joe Biden drained almost 200 million barrels from the SPR, complicating the task of central bankers around the world in their fight against inflation. The Federal Reserve’s policy announcement on Wednesday will be followed by those from the Bank of England on Thursday and the Bank of Japan a day later.

“This week will be bumpy,” said Francois Rimeu, a fund manager at La Francaise Asset Management in Paris. “Pretty tough messages are expected from central bankers.”

Monday’s subdued mood in stock markets matched the relentless bearish tone of a note from Morgan Stanley's Mike Wilson, who said investors have turned more cautious (which is amusing since he has been talling them to short the S&P since 3900 last December). “The majority of investors we’ve spoken with are in the ‘pushed out’ camp and are of the view that 2024 is now looking like a more challenging year for risk assets relative to 2023,” Wilson wrote in a note.

Other disagree: according to economists surveyed by Bloomberg News, a resilient US economy will prompt the Fed to pencil in one more interest-rate hike this year and stay at the peak level next year for longer than previously expected,

“A number of Fed speakers have taken a slightly more cautious tone recently, mentioning that risks have become more two-sided and talking of the ability to ‘proceed carefully,’” said Credit Agricole strategists led by Jean-François Paren. “That said, it is far too early to declare victory, and the Fed will want to keep the possibility of further tightening on the table.”

European stocks slumped; the Stoxx 600 is down 0.6%, led by declines in the construction and consumer product sectors. Major European markets are all lower with France the biggest laggard. UK rents increases 12% YoY in Aug, the largest increase on record. In EMEA, 3M Momentum is leading, Cyclicals are lagging; Value over Growth. UKX -0.2%, SX5E -0.7%, SXXP -0.5%, DAX -0.5%. Here are the most notable movers:

Earlier in the session, Asian stocks fell, with the tech sector leading the declines in a busy week for central bank decisions. A lack of positive developments from China also kept sentiment in check. The MSCI Asia Pacific ex-Japan Index dropped as much as 0.9%, dragged lower by information tech and financials. Among individual stocks, TSMC and Samsung Electronics contributed the most to the benchmark’s loss. Japanese markets were closed for a holiday, while the central bank there is due to meet later this week. Optimism spurred by nascent signs of stabilization in China’s economy has been offset by lingering concerns over the property crisis, with some distressed developers facing more debt payment deadlines.

In FX, the Bloomberg Dollar Spot was is down 0.1%. The Norwegian krone is the worst performer among the G-10’s, falling 0.6% versus the greenback. Spot gold rises 0.1%.

In rates, treasuries drop, with US 10-year yields rising 1bps to 4.34%. Bunds and gilts are also lower; regional yields are higher in this heavy central bank week, which sees decisions from the Fed (pause), BOJ (no change but may hint at tightening) and BoE, which is expected to hike 25bps to 5.5%, ending the hiking cycle; The ECB warns on additional hikes, but market expects the CB to have already completed.

In commodities, oil prices gained with US crude futures rising 0.6% to trade near $91.30. On the outlook for oil, traders will be monitoring clues on prospects for global supply when Saudi Energy Minister Prince Abdulaziz bin Salman addresses an industry conference later Monday. Hedge funds last week boosted their bullish wagers on Brent and US crude to a 15-month high. Brent has gained 11% in three weeks.

Looking at today's calendar, it's a slow start to the week, with the New York Fed Services Business index due, followed by the NAHB Housing Market Index, and the latest TIC data after the close.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower following last Friday’s declines on Wall St and with the region cautious in a holiday-thinned start to a busy week of central bank policy announcements. ASX 200 was pressured with underperformance in tech and telecoms and with the handover of leadership at the RBA met with little fanfare. Nikkei 225 remained closed as Japanese participants observed the Respect for the Aged Day holiday. Hang Seng and Shanghai Comp retreated at the open with the declines in Hong Kong led by tech and property stocks including Evergrande shares which slumped by more than 20% in early trade after some of its wealth management employees were detained by Chinese authorities. Conversely, the losses in the mainland were later reversed in the aftermath of the PBoC’s firm liquidity efforts and the previously unannounced meeting between Chinese Foreign Minister Wang Yi and US National Security Adviser Sullivan.

Top Asian News

European bourses are in the red, Euro Stoxx 50 -0.8%, with participants cautious ahead of a Central Bank frenzy. Sectors have Health Care at the bottom weighed on by Lonza while pressure on LVMH's Champagne brands has put Consumer Products & Services on the backfoot. Stateside, futures are essentially unchanged on the session after Friday's pressure, ES +0.1%, with the US docket light until Wednesday's FOMC. JP Morgan on EZ Equity Strategy: stays cautious on the region and expects defensive sectors to trade better into year-end.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

The FOMC on Wednesday will highlight a busy week for markets with central banks at the fore. Outside of the Fed, the BoE (Thursday), and the BoJ (Friday) are the other main events on this front. Central banks in Norway, Sweden, Switzerland and Turkiye (all Thursday) all have policy meetings too.

The CPI inflation data for both the UK (Wednesday) and Japan (Friday) will also be out this week. The global flash PMIs due Friday will be another big focus. The latest manufacturing PMI for Germany printed at 39.1 (43.5 in the Eurozone), much lower than the still soft 47.9 in the US and 49.6 in Japan. Momentum in the services gauge, especially in the US (50.5) where it’s only just above 50, will also be in focus after stronger comparable prints in other US surveys.

Also in the US we have the monthly housing week data dump even if it will be tough to learn something new. US housing affordability is around the worst on record for buyers, and activity is at around 30 year low, but for the vast majority of existing homeowners there is no stress. We have today's NAHB homebuilder index (DB forecast 50 vs. 50 previously), Tuesday's housing starts (1.478mn vs 1.452mn) and building permits (1.460mn vs. 1.443mn) and Thursday's existing home sales (4.25mn vs. 4.07mn). Elsewhere in the US, Thursday's Philadelphia Fed survey (-5.0 vs. +12.0) will be of some interest. Elsewhere the UAW autoworkers strike that started on Friday will gain more macro attention the longer it lasts. Some may say this is an idiosyncratic risk to the economy but with inflation having been high and corporate profits coming back, this sort of thing is a genuine consequence of the macro environment.

Anyway, let's dive into a brief FOMC preview. A fuller one from our economists can be found here. You'd be hard pressed to find someone who thinks they'll hike this week but our expectation is that they keep the door open for another hike later this year which the dot plot will continue to reflect. Our economists believe other parts of the SEP are likely to undergo meaningful revisions, particularly for 2023. Stronger growth (2023 could double to 2%, 2024 could increase around 25bps to 1.3%) and lower unemployment should counterbalance softer inflation (2023 revised down but core forecasts for 2024 likely to be unchanged). So the meeting is likely to see a confident pause but one where further tightening is seen as the risk.

After the Fed, the focus will shift to the BoE on Thursday. Our UK economist previews the meeting here and expects another +25bps hike that would take the Bank Rate to 5.5% and sees another, potentially final, hike in November. The market were pricing in around a 70% chance of a hike at the close on Friday. Perhaps a swing factor on the outlook could be the UK CPI the day before where headline is expected to rise from 6.8% to 7.2% due to energy costs but core is expected to dip 0.1pp to 6.8%. A big fall in October's headline release should occur alongside a big fall in energy bills as bad YoY comps drop out. Retail sales on Friday completes a busy week for the UK. Retail sales will also be due on Thursday in France. Highlights in Germany include the PPI out on Wednesday.

The BoJ will wrap up the busy week on Friday and a preview from our Chief Japan economist is available here. He expects the central bank to stick to its current policy stance but revise the MPM statement to point to policy normalisation. Further out, our economist sees the YCC and negative interest rate policy ending at the October and January meetings, respectively. Japan's latest nationwide CPI will also be out that day. Our Chief Japan economist sees the headline gauge at 2.9% YoY (+3.3% in July), core inflation excluding fresh food at 2.9% (+3.1%), and core-core inflation excluding fresh food and energy (+4.3%).

Asian equity markets are generally tracking down to Friday's DM losses, especially in the tech sector but S&P 500 (+0.18%) and NASDAQ 100 (+0.12%) futures have rebounded a little. The Hang Seng (-1.03%) is the biggest underperformer followed by the KOSPI (-0.87%) and the S&P/ASX 200 (-0.60%). Elsewhere, mainland Chinese stocks are trading up with the CSI (+0.39%) slightly higher while the Shanghai Composite (+0.03%) is just above the flatline. Meanwhile, markets in Japan are closed for a holiday with cash treasuries closed.

In energy markets, oil prices are extending gains with Brent crude (+0.42%) inching towards $95/bbl amid Russian and Saudi Arabian production cuts.

Now, looking back on last week. On Friday, we had the preliminary results of the University of Michigan’s September survey of consumer sentiment. The headline missed expectations, falling to 67.7 (vs 69.0 expected). On the other hand, the inflation expectations section of the survey saw one-year inflation expectations hit their lowest level since 2021 after falling from 3.5% to 3.1% (vs 3.5% expected). Inflation expectations at the long-run horizon, 5 to 10 years, also surprised to the downside, falling from 3.0% to 2.7% (vs 3.0% expected). So more encouragement that disinflation is being felt by US consumers which is surprising for the last month given the notably higher gas prices of late. The first release is often revised so we will see. At face value though this will be very good news for the Fed.

With a week of former US data though, markets moved to price in a higher for longer Fed funds rate. The rate priced for December 2024 rose +10.8bps last week, and +4.2bps on Friday. Off the back of this, US 10yr Treasury yields gained +4.5bps on Friday, and +6.7bps in weekly terms. Similarly, 2yr yields rose +4.2bps week-on-week (and +2.1bps on Friday).

In Europe, on Friday, the day after the ECB’s 25bps hike to 4.00%, comments by the ECB’s Muller that higher inflation in the Eurozone could “yet warrant another hike” saw 10yr bund yields rise +8.2bps to 2.67%. So the hawks leaving the door open to another hike. This was followed by comments from President Lagarde that interest rate cuts were not yet on the table for policymakers. The move on Friday erased the fall in 10yr yields that had occurred earlier in the week, as yields rose +6.5bps to 2.67%, their highest weekly close since the first week of March. Of note, German 30yr yields gained +9.0bps on Friday (and +8.2bps week-on-week) to 2.81%, their highest level since 2011.

Turning back to the US, equities pared back their weekly advance as tech giants like Amazon and Nvidia fell on Friday. The S&P 500 slipped -1.22%, erasing its earlier weekly gains (-0.16%). The decline was led by technology stocks, with the tech-heavy NASDAQ falling -1.56% on Friday (-0.39% on the week). Within the technology sector, semiconductors had a more than lacklustre day, down -3.01% after a report that the largest chip manufacturer, TSMC, had requested its major supplier to delay shipments of high-end equipment. Nvidia fell -3.69% on Friday (-3.67% week-on-week), while Amazon declined -2.99% on Friday (though still up +1.56% in weekly terms). Things were sunnier in European equities. The STOXX 600 gained +0.23% on Friday, wrapping the week up with gains of +1.60%, its best weekly performance since mid-July. The FTSE 100 also outperformed, up +3.12% over the week (and +0.50% on Friday) in its strongest weekly run since January.

Finally, in commodities, oil had a formidable run last week, hitting a new 10-month high. This came as supply continues to tighten following production cuts by Saudi Arabia and Russia alongside OPEC’s warning last week that the oil market would likely be in large deficit by the end of 2023. WTI crude futures were up +3.73% week-on-week (and +0.68% on Friday), breaking through the $90/bbl to level to finish at $90.77/bbl, ticking off a third consecutive week of gains. Brent similarly gained on the week, up +3.62% (and +0.25% on Friday) to $93.93/bbl.