By Peter Tchir of Academy Securities

That seems like such a strange question. If all you did was read the headlines, you would think that things were great (if not spectacular) in markets. If you say you are bearish, people will look at you with sympathy, wondering if you are going to be able to feed your family with such a disastrous call.

Yet, the reality of the situation is quite different from what the headlines seem to be trying to spoon feed us on a daily basis.

The Nasdaq 100, which was down on the week, is down 1% since February 9th. Yes, it had its closing high on March 1st, and its intraday high of 18,417 on March 8th. But 5 weeks, with a lot of hype and cheerleading, has amounted to a loss of 1%. Since the highs, we are down 3%, which is one of many things that have me wondering how quickly we’ve fallen from “all-time highs” to bear market? While 20% is a tad more bearish than I am, it sounded better than using a “correction” of 10% in the title.

The S&P 500 has performed more steadily than the Nasdaq 100, but at the other end of the spectrum, despite begging people to Stop Using the Magnificent 7 Moniker, we still hear that term quite frequently. Yes, some people have started talking about the Fab 4 or some other catchy phrase, but that makes sense when at least a couple of the so-called Mag 7 are back to levels from October, before the big bull market started (a time when we were quite bullish, possibly fighting consensus back then too).

We’ve been bearish, but with an emphasis that we felt the risk of a 5% to 10% rapid move to the downside was far more likely than a sharp rally. We’ve discussed aspects of this in:

While those have helped articulate and explain our bearish view, they are all relatively recent (the oldest was published on February 27th). We should go back to one more article to express why the view has changed from a DEFCON 3 or 4 sort of bearishness, to a more dangerous and urgent DEFCON 2 level of bearishness.

Back on February 9th we published A Market Only a Mother or AI Could Love. That chart showed the “crazy” trading pattern of the week. So many wild swings. Gyrations, some of which could be attributed to news, but some of which seemed inexplicable.

This week seemed like that, on steroids! I think I actually physically poked my screen once to make sure it was working. I swear, the market was up almost 1%, I glanced away, it was down 1%, and then a few minutes later it was back to flat. I’m not sure what tapping my screen would do, but I could remember doing that when a thermometer didn’t seem to be working, so it seemed appropriate.

But no, my screen was working just fine – it was the markets that weren’t functioning “normally” in my opinion.

It seemed that every “big” order just caused the market to gap higher or lower while the order was being filled. It did work in both directions, but I’m increasingly convinced the risk is that the market will need to find some serious bidside liquidity, when it may be non-existent.

All of this is forcing me to think about some things we’ve discussed in the past, which are rapidly rising to the forefront of my thoughts again.

While aging myself, yet again, I cannot help but think about the Tacoma Narrows Bridge. A fun “movie” many of us got to watch in school. This was back when someone had to bring in a projector and seeing a video in class was a “cool” thing (though not as cool as getting the whole school to watch the Canada Cup in the gym). But anyways, that video shows a bridge oscillating. That oscillation increases until, ultimately, it collapses! The movie was all about resonance frequency, but all I remember is seeing a structure, so seemingly sturdy, start to bend and twist before collapsing. The first time that hit me was back in 2007 and it is the main image I have in my mind right now.

It also made me think about pendulums. In Dredging Up Pendulums, we focused primarily on the complexity of a simple pendulum versus a double pendulum, and how important even tiny changes in starting conditions could be.

We also discussed Machine Learning Triple Pendulums. This YouTube video shows how a computer is able to manipulate a “cart” to get a triple pendulum to stand upright for a period of time. For about a decade, I’ve been using that when discussing market mechanics. It is difficult to tell what exactly happens day by day, or even minute by minute, when so much of the trading is driven by algorithms. The algorithms link not just “vehicles” (like stocks, ETFs, and futures), but also asset classes as correlations are traded rapidly. The reason thinking about market structure in terms of a machine learning triple pendulum cart is so important (if it is a correct interpretation) is that “functioning” or holding it upright is very unstable and takes more computing power and skill than a human possesses. Yet, it can be accomplished. The problem is that when it fails, it tends to result in an “epic” failure where the “natural” position of the pendulums (all pulled by gravity) is to be facing down rather than standing upright. Sure, maybe a bit alarmist, but we’ve seen it in the past. A VIX related ETF Went Poof.

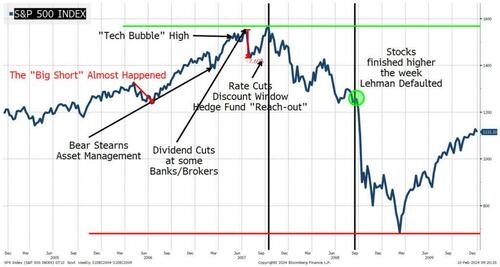

One thing that changed is the “randomness” of trading seemed to accelerate, forcing me to think about bridges and pendulums. I also cannot stop thinking about some of the charts we included in A Retrospective of All-Time Highs. While many of the bears (and doomers) want to talk about “tech bubbles,” I’m more fixated on 2007. To me, the 2007 “all-time high” was one of the strangest ones.

All the problems were known. None had been fixed, but we hit an all-time high, based largely on the Fed. We bounced hard again after JPM bought Bear, only to sink to new lows a week or so after Lehman. Those “lows” seemed tame compared to where the market finally bottomed in 2009, but it was the almost “hubris” of all-time highs in the autumn of 2007 that I think about more than the tech bubble, as I don’t think that is the right metric. Though as a bear, who is increasingly worried about a 10% pullback, I shouldn’t look a gift horse in the mouth.

But here are things that have made me increasingly nervous:

While I don’t see “stagflation as a risk,” I think we are entering a period where we could see:

While I don’t want to get into detail today, I think people staring at the VIX are looking in the wrong direction. This is a world of daily and weekly option flows that don’t show up in the VIX calculation. Unlike other strategies that have been difficult to understand (meme stocks for example), the 0DTE options market seems perfectly capable of trading from the call side of the market to the put side of the market. Many other strategies, like blindly selling vol, have tended to work in one direction and could really only be traded consistently from that direction. The 0DTE can work both ways and that could be the “shock” we need that disrupts this market.

For credit, look for CDX IG to go back above 60, maybe to 65. Not because of any serious problems in credit, but because spreads will be forced wider if I’m right on stocks.

So, instead of thinking about a 5% to 10% pullback in stocks, I’m much more concerned about a 10% or higher pullback along with 10-year yields breaking through 4.5%.

We didn’t answer the question posed at the start of the title, but I’m increasingly worried that we might be forced to find out what the competition is if markets start rolling over and lose the support of bonds, the Fed, and the few sectors that have done the heavy lifting.

On that note, I do promise to write “Up in Smoke” as a title of a T-Report (I couldn’t end this report without at least trying to get you to smile!)

Finally, Happy St. Patrick’s Day to those who celebrate!