By Peter Tchir of Academy Securities

It is unusual to say that I don’t really care that much about the FOMC meeting, but I don’t. Everything seems incredibly well telegraphed coming into this meeting.

The Fed tends not to deviate that much from market expectations, and the next two meetings appear pretty cut and dry right now, without some unforeseen large data (or geopolitical) surprises.

The hawkish sentiment expected is appropriate:

Even the Neutral Rate seems to have settled into around 3.75% towards the end of 2025, which is hard to argue with (I think it should be 4%, but that would be quibbling since we had the move from 2.875% over the past few months). Nothing the Fed says at this presser is likely to move the needle on the neutral rate, since I think they had every intention of getting the market to price it higher, and they have been successful.

Drones, especially the ones that have been over New Jersey for weeks (but are apparently being seen elsewhere), have become fascinating. Even President-elect Trump tweeted about them (though I’d be shocked if he hasn’t been briefed, or at least had the opportunity to be briefed).

It is fascinating and makes me think a lot about Twilight Zone episodes (just in time for hopefully some Twilight Zone marathons during the holidays).

Academy’s Geopolitical Intelligence Group has been discussing them, but so far, nothing conclusive is emerging, which again adds to the “Twilight Zone nature” of this drone phenomenon.

As we get info that can be shared (and we have a high degree of faith in its accuracy), I’m sure we will send out a SITREP, but in the meantime, everyone is left speculating. However, while the rough consensus is that these are almost certainly ours, we aren’t really sure why the details aren’t being released (especially when there is so much curiosity).

Two things struck me as very interesting in the past week. I would say “out of character,” but they aren’t really out of character once you think about them.

Inviting Xi to the inauguration. Given all the rhetoric about China, unfair practices, tariffs, etc., it was easy to be surprised by this invitation. But that’s only because “we” forgot to account for how much Trump believes he can influence people in personal meetings. It is very interesting, though in the back of my mind, this time seems “different.” According to a few of our GIG members, he feels strongly that Xi failed to live up to promises on the purchases of certain agricultural products.

Getting rid of Daylight-Saving Time. I don’t think it was a campaign promise, but who doesn’t agree with the idea of keeping it lighter later in the day? Let’s remember not to forget that Trump wants people to like him, so why wouldn’t he embrace something that very few people would seem to disagree with (and I really can’t think of the reasons to disagree with this).

In the meantime, while President Biden is still the president and making headlines of his own, it is pretty clear that wherever possible, people have moved on to positioning themselves for the new Trump administration. Hence our use of the term – “Trump 1.5.”

I still expect some “chaos” as Trump thrives (or believes he thrives) in chaotic environments and things seem to be a little too complacent right now.

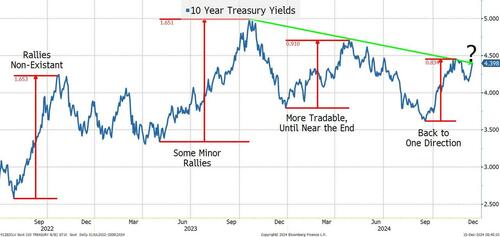

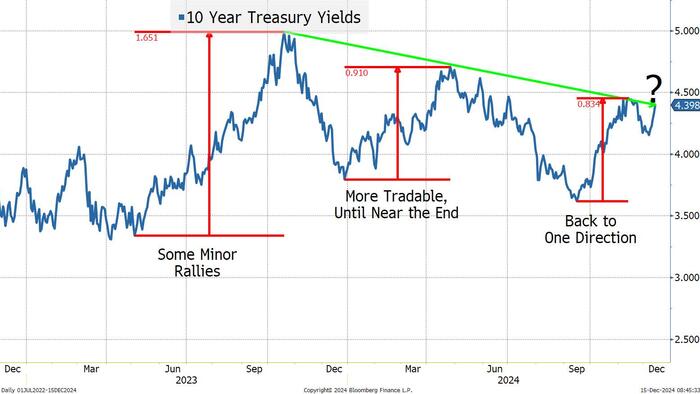

While I don’t care that much about this week’s FOMC, I do care a lot about where longer dated yields are headed.

Bearish the longer end of the yield curve (10s through 30s), though we will see how the market responds here to what seems like resistance.

While guest hosting on Bloomberg TV Tuesday morning (link), I was able to ask Ellen Wald (an energy expert) about not just “drill baby drill,” but also about refining (starts at the 36:25 mark).

Her response fit perfectly into a couple of our themes:

I think that betting on infrastructure and anything critical that we are required to extract from the earth (and process), especially in areas of importance to the nation’s ability to be independent of foreign suppliers, will do very well in the coming year. Yes, the stock market is all about a handful of stocks again, but we think that this thesis will be our biggest recommendation to start the new year.

We spent time on this in last weekend’s The Genius of Mariah Carey, but I think I have underestimated how much higher this can all go.

Not sure I can make myself buy up here. Virtually every historical use case has failed, except that now the “limited supply” theme seems to be helping it rise. I have to admit, the “digital gold” rebranding is also interesting as advocates beg big governments to adopt it as a reserve asset.

Maybe I can convince myself to add some ETH to the portfolio? Logically I struggle with the value proposition, but this market has always been about flow and adoption, and it seems to be on their side right now.

The FOMC will be boring, but that won’t stop 10-year yields from rising further.

Stocks have had almost no breadth, we’ve seen some valuations hit extreme levels, and we just had the Nasdaq 100 rebalancing announced, etc., but it is difficult to fight especially when a major player in the chip industry can still surprise the market to the point that it had a record setting rise (for them) which was big enough to drag that entire sector of the market higher. As a contrarian, it is difficult to judge sentiment and positioning when so many people seem checked out, so keep looking for some trading ranges, and wait for a real “consensus” type of trade as we near the new year. I think (officially) the Santa rally starts this week.

I will “refine” the “refine baby refine” viewpoint as I do think that could be the best risk/reward theme out there, if we can identify it properly.

Credit, boring. I cannot say that I like it here and now, but spreads still seem unlikely to do much. I will stick to my argument that I do NOT like credit on an all-in yield basis, and investors should still be reducing their yield exposure, while corporations should take advantage of the ongoing window to issue more!

Crypto, feels like another pump and dump, but this pump seems like it could have a lot more legs to it.

Have a great week, and we can only hope that we find out what all these drones are up to sooner rather than later as, to quote Rod Serling: “So, if you’re ever feeling like you’ve entered a strange new world, just remember, you might have crossed into….the Twilight Zone.”