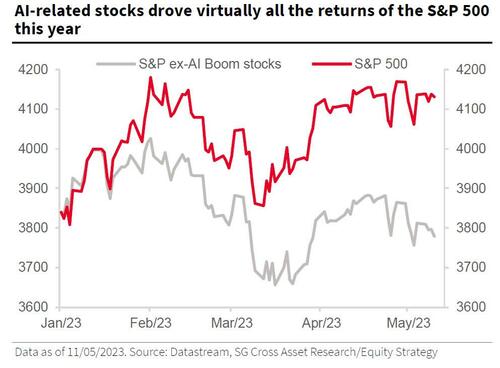

While it is not exactly news that market breadth has collapsed to record low levels, even we were surprised to learn last week that according to SocGen calculations, if one excludes the impact of the market's latest mania - AI stocks - the S&P would be down 2% instead of up 8%.

But it's not like these stocks are rising in a vaccum: someone is buying them (aggressively at that). Well, courtesy of the latest 13F filings that hit overnight, we know what that someone is.

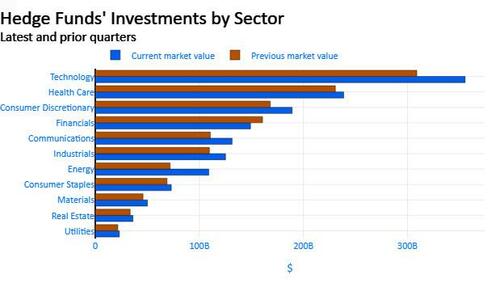

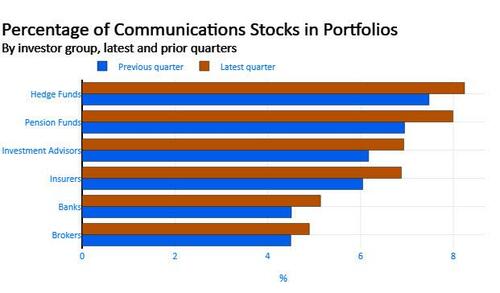

According to 13F data compiled by Bloomberg, hedge funds and other institutional investors bought into the sizzling tech rally - with an emphasis on, you guessed it, AI - in the first quarter while selling financial stocks as the banking sector imploded.

The combined value of institutional investors’ investments in Facebook parent Meta Platforms increased by $8.5 billion in the first three months of the year through March 31, the second largest change by market value, according to Bloomberg’s analysis of data from 13F filings. Occidental Petroleum was the most purchased stock, while AI leader Nvidia, Salesforce and Netflix were also among the names institutional investors bought.

But while everyone bought tech, a handful of billionaire investing titans such as Stanley Druckenmiller and David Tepper loaded up on aggressively on artificial intelligence stocks during the first quarter.

According to Bloomberg, Druckenmiller’s Duquesne Family Office increased its stake in Nvidia, which more than doubled this year, making it one of the top performers in the S&P 500 Index. The fund added more than 208,000 shares of Nvidia during the first quarter, increasing the market value of the firm’s holding in the chipmaker to about $220 million.

“AI is very, very real and could be every bit as impactful as the internet,” Druckenmiller said at the 2023 Sohn Investment Conference last week.

Duquesne Family Office added a large new position in Microsoft which now makes up 9% of the firm’s roughly $2.3 billion US equities portfolio. Microsoft has a $10 billion investment in OpenAI, whose ChatGPT tool has lit up the internet. Druckenmiller’s firm also added a new position in Iqvia Holdings, a health-care technology company that says on its website it has “transformative AI capabilities” to help with its research and commercial efforts. Duquesne bought about 474,500 shares of the company during the first quarter with a market value of $94 million.

Meanwhile, Tepper’s Appaloosa Management also added a new position in Nvidia, buying 150,000 shares with a market value of about $41.7 million. The firm also bought 500,000 new shares of Cathie Wood’s ARK Innovation ETF, which invests in companies that create disruptive technologies. While the fund has lost three-quarters of its value since its high in early 2021, it has gained 23% this year.

While they were buying tech, and/or AI, institutional investors were also reducing the value of their investments in financial shares by the most for any industry, unloading $1 billion of SVB Financial Group as its Silicon Valley Bank collapsed. Meanwhile, as we reported last night, Berkshire Hathaway eliminated US Bancorp and Bank of New York Mellon from its holdings.

Curiously, the SPDR S&P Regional Banking ETF, the KRE, was a top buy among hedge funds last quarter as the fund fell 25%. Among the investor group trying to catch the falling knife, 16 cut or exited positions, while 50 added shares. The buy ratio was among the highest for securities that had at least 50 position changes, according to Bloomberg’s analysis of 13F filings by 1,099 hedge funds.

Bloomberg analyzed 13F filings by 1,056 hedge funds and other institutional investors. Their combined holdings amounted to roughly $1.5 trillion, compared with $1.4 trillion held by the same funds three months earlier. Here are some of more notable findings:

Developing: we will have more after the close once we get all the late reporters