The total volume of oil passing through the Strait of Hormuz stands around a staggering $600 billion.

While a blockade of the strait is considered a distant possibility, its closure could ripple across global supply chain networks. In particular, Japan, China, and India would be impacted the most. Furthermore, a shock to oil prices would likely affecting production costs, in turn raising the price of consumer goods.

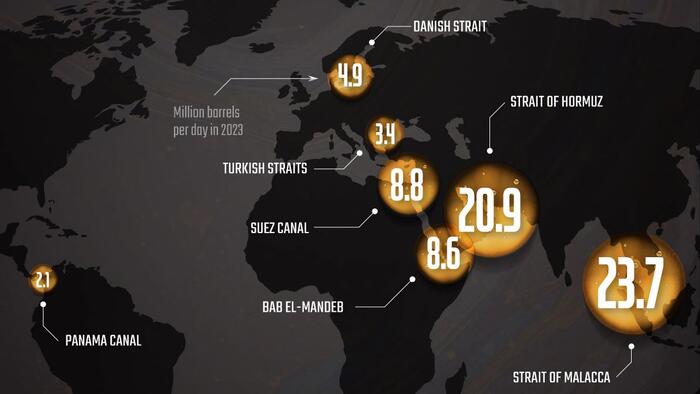

This graphic, via Visual Capitalist's Dorothy Neufeld, shows the most vital oil transit chokepoints, based on data from MUFG.

Below, we show how the Strait of Hormuz sees the second-highest volume of oil passing through its corridor globally:

In 2023, 20.9 million barrels of oil flowed through the Strait of Hormuz, which lies between Iran and Oman.

Iran largely controls this waterway, where 20% of global oil consumption is transported across this shipping route. In response to Israel-Iran conflicts, oil production surged by 950,000 barrels per day in June—largely driven by Saudi Arabian output.

While tensions have recently flared between Israel and Syria, it remains to be seen if conflict will resurface with Iran. Earlier in July, Israeli officials met with Trump to discuss certain scenarios that would justify a future attack on Iran—including the resumption of nuclear enrichment activities.

To learn more about industrial resources from a global perspective, check out this graphic on the top 25 countries by proven oil reserves.