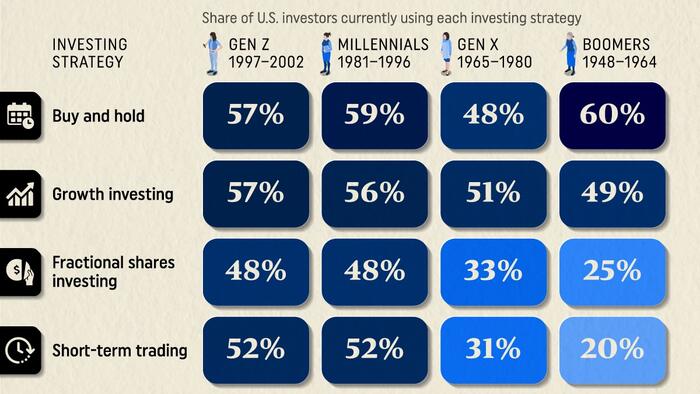

When it comes to investing, each generation has their own mix of strategies, and younger generations like to try a bit of everything.

This graphic, via Visual Capitalist's Kayla Zhu, visualizes the breakdown of how each generation uses each of the following types of investing strategies:

The data is based on a Charles Schwab Modern Wealth survey of 1,000 U.S. adults, and is updated as of March 2024.

Americans of all generations mostly rely on the buy and hold strategy, with boomers relying on this strategy the most (60%) and Gen X relying on it the least (48%).

Across the board, younger generations tend to adopt a wider range of investing strategies than older generations. Specifically, Gen Z and Millennials tend to use newer investing strategies more often, including fractional shares investing (48% for both) and short-term trading (52% for both).

Both younger generations also use technology-driven strategies like robo-advisor investing much more than the older two generations.

Robo-advisors are online investing platforms that use algorithms to create and manage investment portfolios, like Betterment and Wealthsimple.

Younger generations are also increasingly turning to social media to inform their financial choices.

According to the Charles Schwab survey, 72% of Gen Z respondents considered financial advice from social media, compared to 57% of Millennials, 38% of Gen X, and only 19% of Boomers.

Gen Zs are also starting to invest earlier. On average, Gen Zs started investing at 19 years old, compared to 25 for Millennials, 32 for Gen X, and 35 for Boomers, according to Charles Schwab.

Investing earlier allows investors more time to grow their wealth, as compounding interest can significantly increase returns over the long term.

To learn more about Americans’ investing patterns, check out this graphic that visualizes shows the percentage of financial assets allocated to corporate equities among U.S. households and non-profits.