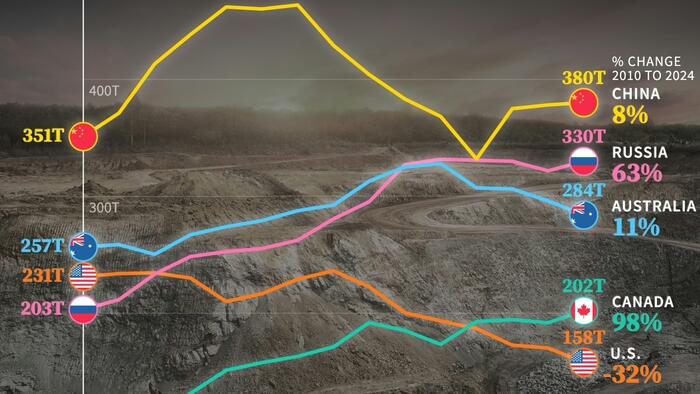

Global demand for gold has remained strong over the last decade, driven by central bank reserves, investment demand, and jewelry consumption. This infographic tracks the five largest gold-producing countries from 2010 to 2024, highlighting shifts in output and global rankings.

While some nations have ramped up production significantly, as Visual Capitalist's Niccolo Conte shows in the following chart, others have seen notable declines.

The data for this visualization comes from the World Gold Council.

China has been the world’s leading gold producer for over a decade.

In 2024, the country produced 380 tonnes of the yellow metal, up just 8% from 351 tonnes in 2010. Despite the modest growth, its dominance reflects long-term investments in domestic mining and refining infrastructure. China’s state-supported mining industry also helps insulate it from global volatility.

Russia has boosted its gold output by 63% since 2010, reaching 330 tonnes in 2024. This growth is driven by increased investment in mining projects and a strategic focus on building national reserves.

Canada saw the most dramatic increase among the top five, with a 98% jump in production. From just 102 tonnes in 2010, it now produces 202 tonnes.

The U.S. is the only country in the top five to post a decline. In 2024, it produced 158 tonnes, down from 231 tonnes in 2010—a 32% drop. Environmental regulations, lower ore grades, and the closure of key mines have all contributed to this decline, pushing the U.S. to fifth place globally.

If you enjoyed today’s post, check out How Many Gold Bars It Takes to Buy a Home? on Voronoi, the new app from Visual Capitalist.