By Peter Tchir of Academy Securities

A few topics that we have touched on over the past few months continue to be relevant. What is interesting is that a few of those topics now seem to have garnered far more attention than in the past.

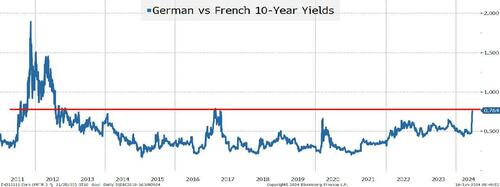

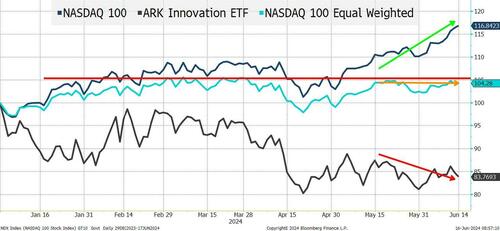

We will continue to focus on these issues, and it is interesting that they seem to be bubbling to the top (though off-hand, I’m not sure if that is good or bad for markets). The fact that the 10-year Treasury traded as high as 4.48% (the high end of our 4.3% to 4.5% range) and traded as low as 4.19% on the week (below the low end of our range) doesn’t give me a lot of comfort about the depth of liquidity. The CPI data and the Fed data helped, but the real boost seemed to come from concerns about Europe.

Hopefully, you can enjoy Father’s Day with family and friends and brace yourself for what is likely to be another round of corporate bond issuance as borrowers benefit from the reprieve in yields.