By Mish Shedlock of MishTalk

Renters dreaming of homeownership are priced out of secondary cities they might've flocked to years ago.

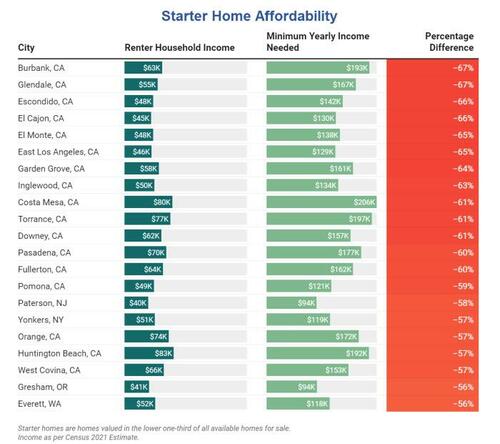

Point2Home notes First-Time Buyers, Second Thoughts: Starter Homes Long Past Affordability, Even in Secondary Markets

With main markets no longer an option for first-time buyers, Point2 looked at the country’s 100 largest secondary cities for the median price of a starter home and renter households’ median income. Defined as large non-core cities within a metro, these cities used to be fruitful house-hunting grounds for first-time buyers exploring less-expensive options away from main cities. But as it turns out, unaffordability can put a dent in homeownership plans regardless of city type or size.

That’s because secondary cities — orbiting the principal cities within their respective metros — have seen increased competition from real estate investors, second-home buyers, and even downsizing Baby Boomers. As a result, this pushed the already scarce affordable options even further out of reach of those looking to get on the property ladder. Add sky-high prices and interest rates to the mix and you’ve got the recipe for postponing buying and renting until further notice — which is the case for the vast majority of Americans navigating today’s housing market.

California has the dubious distinction of having the top least affordable starter home cities.

A starter home, according to the Census Department is priced in the bottom third of homes in the area.

Pomona, CA, is in fourteenth place. The average renter in Pomona makes $49,000 a year and needs to get to $121,000 a year. That's nearly 2.5 times current salary.

In Burbank, CA, the average renter makes $63,000 year an needs to get to $193,000. That's over 3 times current salary.

In no market can the average renter make the plunge.

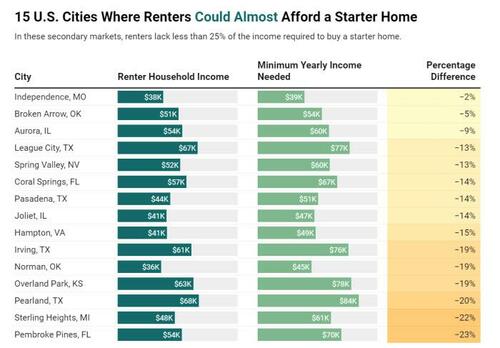

But in Independence, Missouri, or Broken Arrow, Oklahoma, the average renter is respectively just 2% and 5% short of the amount needed for a starter home

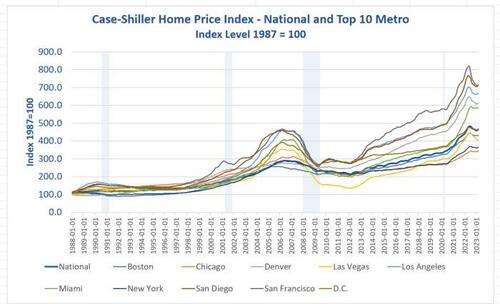

None of this is shocking. It matches one one should expect looking at Case-Shiller home prices and mortgage rates.

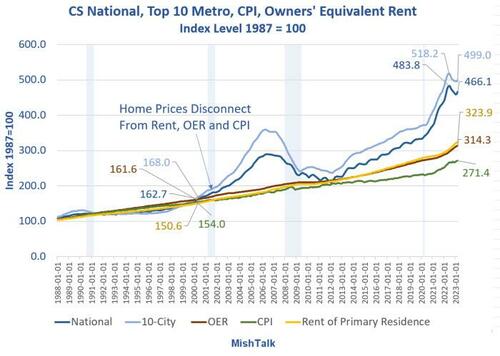

The Fed wanted to produce inflation and it did. But for years the Fed did not even see the inflation because the manifestation of inflation was in asset prices, not the price of consumer goods.

On May 30, I noted Case-Shiller Top City Home Prices Decline From Year Ago for the First Time Since May 2012

However, the decline is but a drop in the bucket compared to price increases since 2011.

Meanwhile, the average mortgage rate is 6.89 percent according to Mortgage News Daily.

Until the price of homes crash, or prices steady and mortgage rates crash, those looking to buy an affordable starter home will be out of luck.

This has widespread implications for household formation and the economy.