By Michael Every of Rabobank

Right now, the focus shouldn’t be on the little data we have. German industrial production figures were shockingly bad and take output to the lowest level since 2005, but that was an obvious trend years ago to those who wanted to see it.

Neither should it be on the Fed. The FOMC minutes said they are minded to cut rates further this year, after being adamant that wasn’t necessary a few weeks ago (i.e., why listen to them?), but are still worried about inflation risks – in sharp contrast to the RBNZ, for example.

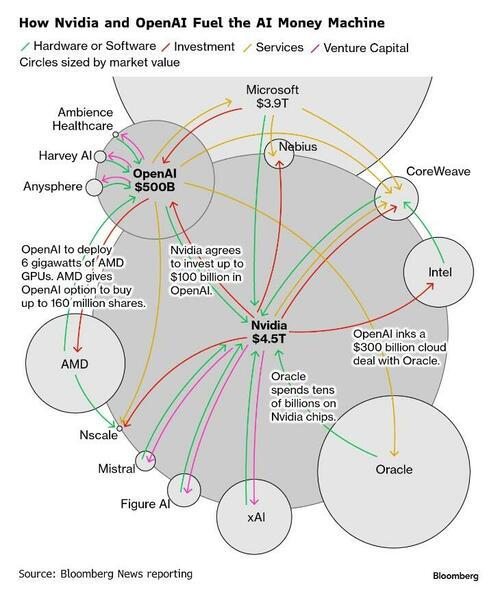

Rather, it needs to be on the deals that are underway – and I don’t mean the circular investment/logic/firing squad(?) that we are seeing in US AI.

Against a backdrop of Israel denying a Politico report saying Qatar had dictated the telephone apology PM Netanyahu offered to the country for its attack in Doha, Israeli negotiators and Hamas signed Trump’s peace deal. All living hostages could be home by Saturday, the two-year anniversary of their kidnapping in the Jewish calendar, and an Israeli withdrawal begin. President Trump may fly to Israel to address the Knesset (and the Nobel Peace Prize committee) shortly.

If this proceeds, with all the usual caveats, expect the Middle East to start to change rapidly, and in the US’ favor. For just one example, there are reports Qatari-owned Al Jazeera, which runs anti-Israel/US stories, has seen a change of editorial staff to tone down its (English-language) rhetoric. Far more significant shifts in investment and logistics are likely to follow. As they say, ‘watch this space’. Which is what Europe will be doing – just watching.

On Europe-Russia, Denmark is to allocate billions of Euros for new US fighter jets as well as a Greenland military HQ - to protect it from the US or others, and Greenland itself or the Northern Passage from China to Europe via the Arctic? That’s as Polish PM Tusk announced he won’t follow the German extradition request for a Ukrainian national wanted by EU authorities for suspected involvement in the Nord Stream 1 & 2 explosions; and as Russia accused Ukraine of supporting terrorism in the Sahel.

Severe delays have also developed along one of Russia’s key overland supply routes from China, as Kazakhstan has intensified customs inspections at its border crossings looking for military- or dual-use goods subject to sanctions: some 7,500 trucks are reportedly stuck there. Welcome to how economic statecraft can work if countries choose not to keep exporting as normal via look-the-other-way transshipment – albeit at an economic cost.

After China stopped buying Aussie iron ore, demanding it pay in CNY not USD, its new alternative source of iron ore supply in Guinea suffered an explosion: coincidence or sabotage? Despite the market largely ignoring it, what may have transpired there could be a template for other supply chains in the current geopolitical environment: in fact, make me the argument for why it wouldn’t be the case without saying, “because markets”.

That’s as the Pentagon has begun receiving shipments of tungsten via Trinity Metals, in which it now holds a stake, straight from Rwanda: no more private commodity trade on that front. Expect that trend, which had been predicted here, to accelerate.

Nikkei Asia says US chip plant capex will outpace China, Taiwan and South Korea from 2027, with global chipmakers expected to spend nearly $400bn on advanced equipment.

“As expected, Labor has spent more than A$500bn of public money adding Glencore’s Mount Isa copper smelter and Townsville refinery to its growing list of manufacturing bailouts” (AFR), which argues: “If the ALP insists on underwriting fading relics rather than pioneering areas of strategic gain, it will risk not just burning more taxpayer cash but consuming Australia’s future competitiveness.” Strategic areas like… like… like…. Look! House prices are going up again!

Mexican officials are planning to push back against new US 25% tariffs on heavy trucks planned to start on 1 November, but talks are ongoing. Canada still isn’t buckling to Trump yet, But Bloomberg notes that millions of Canadians’ jobs are at stake, which underlines which way the decision is ultimately likely to go.

The EU “sees new US trade demands hollowing out deal struck by Trump,” says Bloomberg, with Europe unhappy that steel and aluminium tariffs apply proportionately to imported items using those metals… as the EU’s own steel tariffs were apparently already considering adding exactly the same feature ahead.

Moreover, the US is demanding the EU exempt its firms from its green rules. Doesn’t the EU get to regulate their own economy? Yet this is also Europe regulating US firms to their disadvantage. there is a cost involved with compliance here. despite pledging to rebalance trade through various mechanisms. Europe risks security, energy, trade, and Eurodollar crises if it walks away over the green issue; or a massive compromise in its principles --and the competitiveness of its own firms vis-à-vis the US-- if it bends. But realpolitik deals are about power, not technocratic committee win-wins.

Meanwhile, as Politico puts it, ‘Socialists cave to centre-right demons to slash EU green rules’, while @JavierBlas notes the “Spanish grid asks for urgent measures (to be implemented in 5 days) to stabilise the electricity network as voltage swings again sharply (the situation is similar in early autumn to spring during the blackout). It warns the grid’s safety is at risk.”

In politics, French President Macron has promised to name a new French PM by Friday as outgoing Lecornu said the prospect of a snap parliamentary election is receding - so who has compromised on what in that tranche of realpolitik? Again, please answer assuming it does not involve “because markets.”

In Japan, talks between LDP leader Takaichi and Komeito leader Saito have failed to produce a deal, with the possibility of a breakdown in the 26-year relationship between the two political parties rising, further muddying the waters on where Japan, and JPY, goes from here.

That’s as Argentina sees its rates exceed 80% as a Peso crisis is sparking a cash crunch, according to Bloomberg: the US Monroe Doctrine carrot of a $20bn swapline was not enough, it seems. How much larger does it then need to get? Pick a number… or dollarisation? Who knows in this geopolitical climate!

On top of that, Bloomberg notes ‘US Stablecoin Dream Is a Nightmare for China’ - and not only China: Europe and others will all have to deal with it. Their argument is that “The US is shaping dollar stablecoins as a means to carry America's influence around the world, which is seen as a new front of geopolitical competition.” Indeed: we wrote on that topic and angle recently at a time when most in markets were either asking “Who is stablecoin?” or talking about how it just meant ‘buy all the things’, not who would be buying whose things.

It’s the latter that matters: that’s the real deal being played out, contested market by market and geography by geography