September was an ugly month for Texas with both Manufacturing and Services surveys chock-full of disappointment and stagflationary signals.

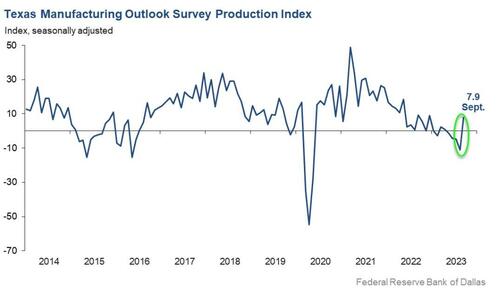

The goods news - growth in Texas factory activity resumed in September, according to the Dallas Fed Manufacturing survey, with the production index rebounding a somewhat shocking 20 points to +7.9 - its highest reading of the year.

The bad news - everything else...

As one respondent put it: "The summer funk has not relented."

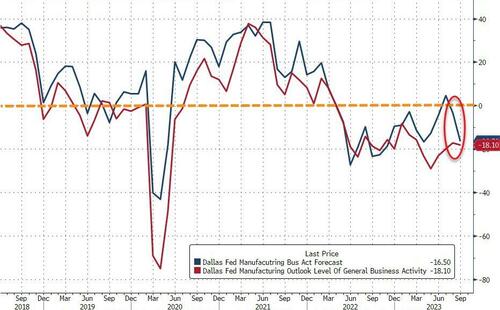

Perceptions of broader Manufacturing business conditions continued to worsen in September. The general business activity and company outlook indexes remained largely unchanged at -18.1 and -17.5, respectively.

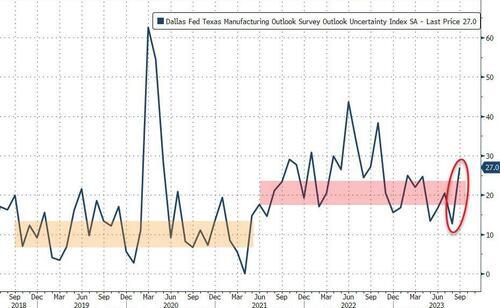

Uncertainty regarding outlooks picked up notably, with the corresponding index pushing up 14 points to 27.0, its highest reading in nearly a year.

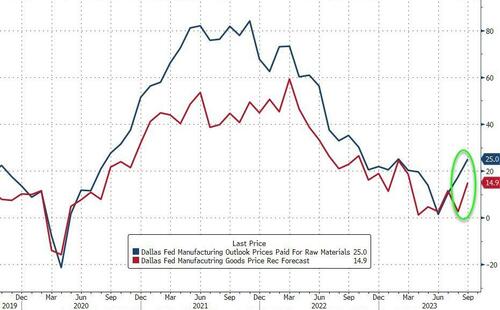

And more exciting still, prices paid (current) and expectations for prices received (i.e. expected price pressures for end clients) are both on the rise...

Respondents were mixed but 3 themes were evident:

1: China weakness

- Taxes & Regulation

- Interest rates

Finally, this one respondent summed things up very well:

As a member of the industrial production segment, we have had a very hard time hiring qualified personnel. For the last three years, we as a country are trying to reshore our manufacturing back to the U.S. and become more independent of China and Taiwan. The federal government is doing very little to incentivize bringing manufacturing back to our country.

Our capital equipment customers are telling us that they are looking for specific manufacturing capabilities, and they are not finding them here at home. They have all moved to China in the last 30 years.

I don’t have to say that raising interest rates to this level does affect the capital equipment purchases in a big way, obviously.

Most of them are sold in leases, and over the last 35 years in this industry, our company has experienced the same every time interest rates go up beyond 5 percent. Hiring in the industrial production environment is a lot more difficult and costly than in the consumer industry.

We are living under completely different economic circumstances to have high interest rates.

Isn’t it time to start lowering interest rates and have the country’s backbone manufacturing industry become more confident in the economy?

Good question!

And more problematically, there is continued weakness in the Services sector (which had briefly trended stronger).

The Texas Service Sector General Business Activity Outlook index tumbled to -8.6 in September (in contraction for the 16th straight month)...

Labor market indicators pointed to slower growth in employment (the employment index fell from 9.3 to 2.7, its lowest level in six months).

Looking forward, respondents' expectations regarding future service sector activity fell from 3.9 to -3.4.

And finally piling on on... Retail sales declined in September, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, fell from -0.6 to -4.4, marking its fifth consecutive month in negative territory.

Respondents in the Services sector echoed the Manufacturing business fears: "Inflation, uncertainty about China and the U.S. political situation are the three largest distractions for business development."

And finally, this seemed to sum things up succinctly: "We do not believe the Federal Reserve has navigated a soft landing. We think they have delayed the recession. We say that because it seems business is more difficult in the last 45 days."