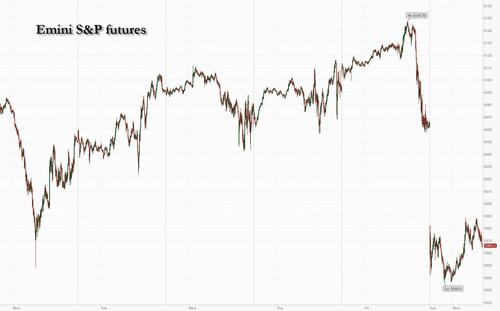

US equity futures tumbled as the market prepares for Trade War 2.0, with both tech and small-caps underperforming as the dollar soared more than 1% pre-mkt, trading near a two year high and the yield curve bear flattens after Trump announced tariffs on Canada, Mexico and China, and warned that European levies are coming. The Canadian dollar fell to its lowest since 2003 and the euro weakened. As of 8:00am ET, S&P futures are down 1.7%, but off session lows having tumbled as much as 2% earlier; Nasdaq futures slide 1.7% with the Mag7 all broadly lower (GOOGL -1.8%, AMZN -2%, AAPL -1.9%, MSFT -1%, META -2%, NVDA -3% and TSLA -3%). Pre-mkt, Mag7/Semis are providing no safety and Cyclicals ex-Energy are under pressure as the market analyzes whether "Trade War 2.0 ushers the end of US Exceptionalism" according to JPM. The 2Y yield is +7bps pre-mkt as the bond market forecasts an inflationary impulse from the tariffs, indicating the market is not selling off on growth but rather on inflationary fears. Trump is said to have calls scheduled with Canadian and Mexican leaders today but warns that tariffs will be implemented on Tuesday if no deal is achieved; sets EU as the next target. Today’s macro data focus will be on ISM-Mfg, Vehicle Sales, and Construction Spending.

In premarket trading, North American stocks most exposed to tariffs fall after President Trump followed through on pledges to impose tariffs on Canada, Mexico and China. Shares in automakers, chipmakers and energy companies decline (General Motors (GM) -7.3%, Ford Motor (F) -4.2%, Tesla -3%; Nvidia (NVDA) -3%, Broadcom (AVGO) -3%; Constellation Energy (CEG) -4%, Oklo (OKLO) -8%). Companies exposed to manufacturing or imports from China are also down: (AAPL -1.9%, DELL -3%). Here are some other notable premarket mover:

The impact of tariffs ricocheted across global markets. It wasn't just US stocks that got hit: European carmaker shares fell, with Volkswagen AG and Stellantis NV shedding more than 5%. Crypto was also hammered as Ether plunged 11% in a broad move away from risky assets. Meanwhile, oil prices climbed on worries about a disruption to supply.

Trump’s move is the most extensive act of protectionism taken by a US president in almost a century, with knock-on effects on everything from inflation to geopolitics and economic growth. Goldman Sachs strategists said there’s a risk of a 5% slump in US stocks because of the hit to corporate earnings, while RBC estimated the range at 5% to 10%.

"He seems to be like a poker player who’s betting his whole stash on the first hand,” Steven Englander, global head of G-10 FX research at Standard Chartered Plc, told Bloomberg TV on Monday. “The market just wasn’t prepared for it.”

The worry among investors is that US tariffs will force companies to raise prices in response, causing inflation to accelerate and consumers to pull back on spending. An analysis by Bloomberg Economics estimates the tariff impact may knock 1.2% off US economic growth and add 0.7% to the core personal consumption expenditures price index. “We doubt that many companies will be able to avoid the impact of tariffs,” said Kathleen Brooks, research director at XTB Ltd. “Their actual implementation and the retaliatory tariffs that followed felt like crossing the Rubicon.”

On the other hand, the market appears confident that the tariffs will be a short-term affair, with Polymarket giving 65% odds that the tariffs against Canada are removed before May.

European stocks also tumbled as investors brace for the region to be the next target of President Trump’s trade tariffs. The Stoxx 600 is down 1.3%, as automobile and technology shares are the worst-performing sectors, while telecommunications and utilities stocks are posting the smallest losses. Here are the most notable movers:

Earlier in the session, Asian equities fell across the board with the MSCI Asia Pacific Index tumbling as much as 2.8%, its biggest drop since Aug. 5. Some markets saw outsized moves following the Lunar New Year holiday, with Taiwan’s Taiex index briefly down more than 4%. Chinese stocks in Hong Kong trimmed some of their earlier declines, while trading remains shut on the mainland. Trump imposed a blanket 10% levy on China, and 25% duties on both Canada and Mexico. The weekend announcement poured cold water over hopes that there may be negotiations between the US and major economies. In addition to concern over tariffs slowing global and regional economic growth, traders worry the measures will spur inflation in the US, and limit the Federal Reserve’s easing room.

“The Asia weakness might be more of a worry around the US tariffs causing inflation to go up again in US, thus preventing the Fed from cutting rates, which also means dollar strength relative to Asian currencies,” said Xin-Yao Ng, an investment director at abrdn Plc in Singapore.

In FX, the Bloomberg Dollar Spot Index climbed 0.9%, paring some of its earlier advance after a report that China has prepared an initial proposal for trade talks with the Trump administration. The yen reversed an earlier fall to trade slightly higher against the greenback. The Mexican peso underperforms with a 2% fall. The South African rand dropped 1.5% after Trump said the US would halt all future funding to the country because of a new law that allows the state to seize private land in the public interest.

In rates, the Treasury curve flattens as shorter-dated US bonds fall on inflation concerns - US two-year yields rise 7 bps. Bunds and gilts rally meanwhile as traders boost their ECB and BOE interest rate-cut bets. German and UK 2-year yields fall 7 bps each.

In energy markets, tariffs on imports from Canada and Mexico threaten to disrupt North America’s tightly integrated oil market and push up gasoline prices for American motorists. West Texas Intermediate jumped 2.4% above $74 a barrell. Reflecting expectations that refiners will face higher costs, gasoline futures soared as much as 6.2% in New York. Spot gold is steady near $2,795/oz. Bitcoin falls 2% to below $96,000.

The US economic calendar includes January S&P Global US manufacturing PMI (9:45am), December construction spending and January ISM manufacturing (10am); ahead this week are JOLTs job openings, ADP employment change and January jobs report. Scheduled Fed speakers include Bostic (12:30pm) and Musalem (6:30pm)

Market Snapshot

Top Overnight News

Trade War News

Here is a more detailed look at global markets courtesy of Newsquawk

APAC stocks sold off as all focus was on US President Trump's latest tariff action over the weekend in which he signed a tariff order which confirms 25% tariffs on Mexico and Canada (with the exception of 10% on Canadian energy products) and 10% additional tariffs on top of existing levies for China. ASX 200 declined with all sectors suffering firm losses while mixed data did little to spur demand. Nikkei 225 slumped firmly beneath the 39,000 level with Japanese automakers notably spooked by tariff jitters. Hang Seng conformed to the negative mood on return from the Chinese New Year holiday with demand constrained after disappointing Chinese Caixin Manufacturing PMI and amid the continued absence of mainland participants.

Top Asian News

European bourses (Stoxx 600 -1.5%) opened lower across the board following a dire APAC session as risk is hit by US President Trump's imposition of tariffs on Canada, Mexico, and China, whilst also keeping the EU in its sight. Broad-based losses are seen across the majors. Sentiment has attempted to improve in today's session but still reside firmly in the red. European sectors are entirely in the red, with a clear defensive bias; Autos are by far the clear underperformer today, with Tech and Basic Resources following behind - all of which are digesting the Trump tariffs. US equity futures are entirely in the red, with some underperformance in the economy-linked RTY (-2.1%) as traders weigh up the inflationary/economic impact on the US.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

Us Event Calendar

DB's Jim Reid concludes the overnight wrap

Standby for a manic Monday as the world tries to come to terms with the “shock” tariff announcements from Mr Trump’s administration on Saturday night. I say shock but all Trump did was follow through on exactly what he’s been saying he’s going to do since November. The market has refused to take that threat seriously though, completely under-pricing the risks. So, this leaves the weekend news as a severe shock.

You have probably all seen the details by now so we’ll only briefly recap the story and focus on some of the implications. The US announced 25% additional tariffs on imports from Canada (ex-energy imports at 10%) and Mexico, and a 10% additional tariff on China. These will start on February 4th and will be implemented under the International Emergency Economic Powers Act (IEEPA), citing a national emergency due to “the extraordinary threat posed by illegal aliens and drugs, including deadly fentanyl”. In response, Canada has retaliated by announcing 25% tariffs on CAD155bn of US goods, of which CAD30bn start on Tuesday and the remainder in three weeks' time. Mexico’s President said that she’d instructed the Economy Minister to “implement the Plan B” they’d been working on and has signaled that the details of this plan will come today. China have said they would “take necessary countermeasures to defend its rights and interests”. The Commerce Ministry also said they’d file legal proceedings at the WTO.

These three countries make up around 40% of imported US goods, at around $1.35tn. To put this is some perspective, in the first Trump administration, the US targeted around $350bn of Chinese goods. So this is huge versus anything seen for decades with regards global trade and at face value takes us back to the protectionist period between the two world wars in terms of scale of tariffs. The average duty rate on US imports would move from 2.3% to around 10% assuming no trade redirection.

Before we look at the implications, we should say that it’s still possible these tariffs get negotiated away within hours, days or weeks. It’s also possible there are legal challenges which reverse their implementation. It will be interesting how the US courts respond. Trump doubled down on social media yesterday saying “This will be the golden age of America! Will there be some pain? Yes, maybe (and maybe not!). But we will make America great again, and it will all be worth the price that must be paid. We are a country that is now being run with common sense - and the results will be spectacular!!!” Last night, Trump did say that we would hold separate calls with the leaders of both Canada and Mexico on Monday morning, but added that “I don’t expect anything very dramatic” from these. So while we can’t rule out a last-minute deal, there is no sign that he is about to enter into a grand bargain and his “pain” comments are a warning to those who think he'll backtrack if US equity markets fall. Separately, last night, Trump also renewed the threat of tariffs against the EU, saying they “will definitely happen” and “it’s going to be pretty soon.”

In terms of implications, if implemented and prolonged, Canada and Mexico would likely go into an imminent recession and potentially see a bigger shock than Brexit was for the UK. It should ensure US core PCE hovers around (or above) 3% rather than dip below 2.5%. It would make it more likely that our view that the Fed won't cut this year proves correct and if growth holds up it could encourage a hike. The US is less exposed to the retaliatory tariffs announced so far in terms of size relative to their economy, but you would still expect several tenths of a percent to be shaved off GDP although how much the raised tariff revenue allows for more tax cuts provides uncertainty. Of course, the dollar should initially be higher.

Although tariffs have not been levied on the EU, this is still a serious blow given what will now probably lay ahead. Aside from direct tariffs, many German automakers serve the US market via Mexico, where they produce final and/or intermediate goods. If the EU has to endure 10% tariffs, our economists' analysis has previously suggested it would be worth 0.5-0.9% off GDP all other things being equal. We have budgeted 0.5pp in our current assumptions. The weekend news does makes it more likely our 1.5% terminal rate call on ECB rates by December will materialise. Markets have been hovering comfortably above 2% this year.

In terms of the reaction of markets in Asia, Taiwan’s Taiex (-3.80%) is the biggest underperformer after falling -4.4% at the open, led by a plunge in semiconductor heavyweight TSMC. Elsewhere, the KOSPI (-3.12%) is also tumbling with the Nikkei (-2.42%), the S&P/ASX 200 (-1.83%) and the Hang Seng (-1.25%) also seeing sharp losses in early trade. Meanwhile, Chinese markets remain closed for the Lunar New year holiday and are going to reopen on Wednesday.

US and European equity futures are lower with those on the S&P 500 -2.04%. Stoxx 50 and DAX futures are -2.78% and -2.45% lower as I type. 2yr Treasuries are +4.1bps higher at 4.24% while yields on 10yr USTs are -3.2bps lower trading at 4.51%. In terms of market pricing, money markets have reduced the amount of Fed rate cuts priced by the December meeting by -4.7bps to 42bps.

In FX markets, the Canadian dollar is -1.50% lower, at 1.4762 against the dollar, its lowest since 2003 while the Mexican peso (-2.77%) is also weakening, trading at 21.27 against the dollar, touching its lowest since March 2022.

Early morning data showed that China’s factory activity grew at a slower pace in January amid US tariff fears. The Caixin manufacturing PMI grew 50.1 in January (v/s 50.6 expected) down from 50.5. The Caixin data comes just a week after the official PMI data, which showed manufacturing sector activity unexpectedly shrinking in January.

A preview of the week ahead feels a little parochial now given the weekend news but we’ll plough ahead. In the US, we have the jobs report on Friday, and the ISM indices (today and Wednesday) leading the way. Elsewhere, the focus will be on the BoE decision in the UK (Thursday) and Alphabet (Tuesday) and Amazon (Thursday) earnings as part of 124 S&P 500 and 77 Stoxx 600 companies reporting.

Looking first at payrolls, our economists look for a moderation in the headline (175k vs. +256k previously) and private (150k vs. +223k) release but with higher uncertainty than usual around this. Firstly, the LA wildfires occurred during the survey week, which our economists estimate could reduce payrolls by -20k based on historical comparisons. Secondly, January's gains have been large over the last two years with the low layoff rates perhaps colliding with aggressively seasonal adjustments, although it could have been warm weather that was not prevalent this January. Thirdly, there are BLS benchmark revisions to deal with after last August's preliminary estimates. This could also influence the unemployment rate and make the data discreet from the December release which would now have a different population control to January's with the new revisions.

Staying in the US, other notable US data includes the University of Michigan's consumer sentiment on Friday (DB forecast 73.1 vs 71.1) including the inflation expectations series which has seen some extreme partisan differences in expectations since the election. See my CoTD here on this for a fascinating chart. There will also be the US Treasury borrowing estimates (today) and the quarterly refunding announcement (Wednesday) with our strategists' preview of this here. There are also lots of Fed speakers this week and this will give them their first chance to opine on possible policy implications of the Trump tariff news. We have a selection of these highlighted in the day-by-day week ahead calendar at the end.

For the Bank of England, our UK economist expects the MPC to deliver its third rate cut of the cycle, taking Bank Rate to 4.5% (75bps below its peak) with a 8-1 vote tally. There will also be new economic projections from the MPC as well as a supply projections update from the Bank. See more in our economist's preview here. We’ll also see January CPI for the Eurozone today with the regional numbers already out. In China, notable releases feature the Caixin PMIs (services on Wednesday after manufacturing earlier today) after the official gauges released last week came in below forecasts. Remember China is on holiday until Wednesday.

Looking back at last week now, assuming you’re still here after a lengthy edition this morning. It was a week bookended by equity sell-offs, with a surprisingly blissful calm in-between. The first came with major US tech sell-off on Monday, as the release of DeepSeek’s new AI model led to major questions about their valuations. And while US equities rebounded from that, the S&P 500 then fell by more than 1% in the latter part of Friday’s session after comments from the White House press secretary and then Trump himself confirming the February 1st tariff plans that we heard more about on Saturday. Ultimately, the S&P 500 ended the week down -1.00% (-0.50% Friday). Tech stocks were overall underperformers, with the NASDAQ down -1.64% over the week (-0.28% Friday) as some of the most affected stocks struggled to recover, with Nvidia’s share price down -15.81% (-3.67% Friday). But the equity softness broadened on the tariff news, with the equal-weighted S&P 500 falling -0.77% on Friday (and -0.54% over the week). By contrast, European markets, which closed before the headlines from the White House, saw a stronger performance, with the STOXX 600 up +1.78% (+0.13% Friday) to reach a new record high, in what also marked its 6th consecutive weekly gain.

Meanwhile, sovereign bonds rallied, with the 10yr Treasury yield falling -8.1bps over the week to 4.54% despite a +2.4bp increase on Friday on the tariff headlines. The bulk of the decline took place on Monday, as investors priced in more Fed rate cuts amidst the sharp equity decline. Yields also declined in Europe, with 10yr bund yields down -11.0bps to 2.46%. This mostly took place towards the end of the week, including -5.9bps on Friday, following growth and inflation data that was softer than expected. In particular, the Euro Area economy was stagnant in Q4, contrary to expectations for +0.1% growth. Then on Friday, France’s flash CPI prints for January surprised on the downside, with EU-harmonised CPI at +1.8% (vs. +1.9% expected), while Germany’s was in line with expectations at +2.8%.

Elsewhere in markets, gold prices closed at a record high of $2,798/oz, having risen +1.00% last week (+0.10% Friday) in their 5th consecutive weekly gain. But several other commodities lost ground, with Brent crude oil down -2.22% (-0.14% Friday) to $76.76/bbl, whilst copper fell -0.97% (-0.66% Friday). In the meantime, Euro IG credit spreads closed at their tightest in three years, at 91bps. However, US credit spreads widened, with IG spreads up +1bps, and HY spreads up +5bps.