UBS' latest European Economic Perspectives note to clients highlights the current and future state of defense spending by European nations. Much like AI stocks are driving U.S. markets, defense names are heating up across Europe over increased spending trends and targets.

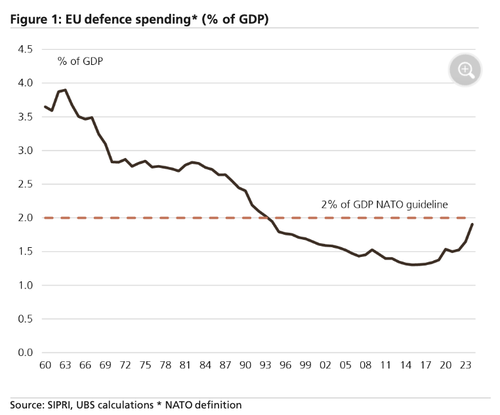

According to UBS analysts, led by Anna Titareva, the European defense sector is at a critical inflection point. Russia's invasion of Ukraine prompted the bloc to reverse a long-standing decline in military spending. EU defense spending is estimated at €326 billion in 2024—roughly 1.9% of GDP—a sharp increase in recent years, yet still falling just short of NATO's 2% guideline. Excluding non-NATO EU members, most countries barely meet the threshold at 2.2%.

"The Russian invasion of Ukraine has brought the EU defence sector into the spotlight. The European Commission's analysis shows that years of underspending on defence have led to gaps and shortfalls in EU military inventories and reduced industrial production capacity. Given the commitment by the European heads of state to bolster the European defense capabilities, we expect developments in the defense sector to remain under close scrutiny over the coming years," Titareva wrote in the note.

Some of the most aggressive defense spending increases have come from Eastern Europe. Poland now leads the EU with defense spending at 4.2% of GDP, while the Baltic states and Greece all exceed 3%. Meanwhile, Germany and France hover around 2%, with Italy and Spain lagging below the NATO spending benchmark.

The inflection point has arrived: EU defense spending, as a percentage of GDP, declined from around 4% in the early 1960s to about 1.5% in 2020.

The buying spree of foreign weapons begins.

A closer look at the EU's defense spending ramp-up began several years before Russia invaded Ukraine.

Poland spends the most on defense among EU countries.

The timeline illustrates the breakdown of EU defense spending by country, expressed as a percentage of GDP.

"Overall, the changes in defense spending since the start of the Russia/Ukraine war and the recent announcements about future spending plans from national governments signal regional differences in the appetite and urgency to boost spending, with more ambitious targets from the central and eastern European states, and more conservative increases from the western European states," the analysts said, adding, "Similarly, among the 16 countries − Belgium, Bulgaria, Czechia, Denmark, Germany, Estonia, Greece, Croatia, Latvia, Lithuania, Hungary, Poland, Portugal, Slovenia, Slovakia and Finland − that have so far requested activation of the national escape clause of the Stability and Growth Pact (SGP) to boost defense spending, the majority are from central/eastern Europe."

Top 25 Defense Firms In EU By Revenue

Timeline of the EU defense policy

Meanwhile...

Reinforcing the EU defense theme that will remain well in play through the end of the decade, as the 2030s are expected to be a very volatile period with the world currently fracturing into a bipolar state, British Prime Minister Keir Starmer overhauled the UK's defense posture last week.

"We are moving to warfighting readiness," Starmer said while unveiling the government's 130-page "Strategic Defence Review," which calls for strengthening military forces to deter Russia and other adversaries across Europe and for ramping up weapons production.

In the U.S., we recently cited a Goldman note by Noah Poponak and others, which highlighted L3Harris Technologies as the standout U.S. defense firm following the unveiling of President Trump's multibillion-dollar missile defense project, dubbed the "Golden Dome for America."

UBS analyst Daniel Graf made a very interesting point last week, "Defense Is To Europe What AI Is To The US"...