Authored by Nick Giambruno via InternationalMan.com,

There’s a ridiculous and pervasive notion in finance that US Treasuries are “risk free.”

People repeat it without thinking. Financial institutions build portfolios around it. And for decades, the world has blindly accepted this trope as gospel.

As a result, bonds—especially US Treasuries—became the de facto savings account for many in the post-1971 fiat currency era. Widely regarded as a safe, conservative place to park capital, US Treasuries are the foundation of the massive global bond market.

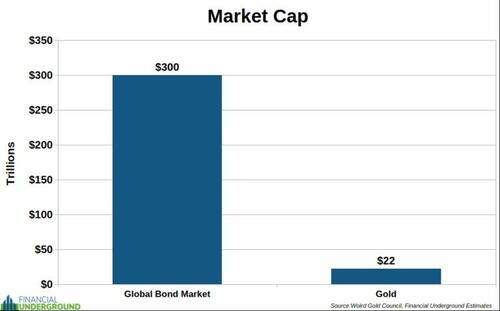

The global bond market is now estimated to be worth more than $300 trillion. Why? Because the masses were told this was the smart, safe thing to do.

Compare that to all the gold ever mined in the world: worth about $22 trillion. That’s a mere 7% of the global bond market.

But here’s the problem: bonds are on track to become a graveyard for capital.

They will no longer serve as a reliable store of value in the face of relentless currency debasement. I believe the opposite will happen—they’ll become a guaranteed way to lose value.

And when that reality hits, investors will flee in droves.

If bonds are no longer viable, where do people, companies, and nations park their savings?

Much of the $300 trillion parked in the global bond market will eventually move—either voluntarily into superior store-of-value assets, or involuntarily into the hands of bankrupt governments and their cronies as they accelerate the largest wealth transfer in history.

This is the Big Picture that most still don’t see… yet.

Until recently, bonds had been in a bull market that lasted more than 40 years. Therefore, it’s not surprising that complacency is ingrained and widespread.

It’s important to remember that bonds are simply contracts denominated in fiat currency. They’re like long-dated currency.

The issuer promises to repay the bondholder the principal amount at the bond’s maturity date, often with periodic interest payments.

The fatal problem with bonds is that they are denominated in fiat currency, which I think will be debased to a staggering degree as it’s the only way the US government can deal with its impossible debt situation.

Consider this.

The long-term average growth of the US money supply (M2) is around 7% annually—and I expect that rate to increase. You can think of this 7% as a baseline “debasement hurdle.” If your after-tax returns don’t exceed that rate, you’re losing purchasing power.

I expect this rate of debasement will far exceed the measly after-tax yield that Treasuries will offer.

That makes Treasuries a worthless promise.

Many Treasury holders are now practically assured of a negative real rate of return over the long term—and some may be completely wiped out.

The investment implications are profound.

So let’s stop pretending Treasuries are “risk free.” They’re not. They’re the opposite.

Notwithstanding any short-term bounces, the long-term trend is clear.

Given that outlook, how likely will Treasuries remain the world’s premier store-of-value asset?

Not likely, in my view.

That means people will look for alternatives to park their savings.

As an added risk, the US government can freeze or seize assets at will—just as it did with Russia’s reserves. China and other major Treasury holders have certainly taken note—especially those that might find themselves at odds with Washington.

Instead of parking their savings in Treasuries, I believe people, companies, and countries will increasingly park their savings in gold.

The last time we saw a global monetary shakeup like this was in 1971. What followed? Gold shot from $35 to $850 by 1980—a 24x gain. Gold mining stocks did even better.

This time around, the gains could be even more dramatic.

That’s because this coming gold bull market could fundamentally differ from other cyclical bull markets. It will be riding the wave of a powerful trend: the re-monetization of gold as the king store-of-value asset.

It could lead to the biggest gold bull market ever.

While this megatrend is already in motion, I believe the most significant gains are still ahead.

We’re entering the most dangerous economic crisis in a century—are you prepared?

This isn’t just about markets. It’s about your money, your freedom, and your future. In my latest special report, I break down:

???? Download “The Most Dangerous Economic Crisis in 100 Years” and get the clarity you need—before it’s too late.

The clock is ticking. Get ahead of the storm.