By Peter Tchir of Academy Securities

This follows directly from Friday’s Warning, for lack of a better word, which leaned heavily on last weekend’s Be Afraid of Certainty, Not Uncertainty. Since anything can happen between the time this is distributed and “Liberation” Day, it seemed like a good time to take a view from 20,000 feet. Which leads me to discussing After School Specials.

For those who don’t know, the After School Special was a type of TV show. Longer (1 hour) with a bigger budget than a typical show aimed at children. But there was always a message or a moral to the show.

The typical show ran something along the lines of:

Right now, the trade war looks a lot like this, with a few plot “twists.”

Basically, the global economy (and some of this may apply to the ongoing wars and attempts at peace) is living in an After School Special – though everyone seems to believe they are on the “good” side.

In theory an “eye for an eye” makes some sense. You poke out my eye, I poke out your eye. We are all even. We move on. Maybe this is where the concept of “reciprocity” fits in?

The problem is, in the real world, even at the After School Special level of preachiness, you can see how things can get out of control. No one can figure out who took the first eye, so it just keeps going on and on. Sound familiar to the tariff “negotiations” or rationalizations?

Okay, this sounds juvenile (and it is) but isn’t what we are witnessing on the global economic landscape (and possibly the geopolitical landscape) playing out at least something like this? My guess is that a lot of people are nodding their heads, comfortable in the knowledge that the other side is the “bad” team and they, the “good” team, are merely responding.

While After School Specials typically lasted only an hour, many longer and even bigger budget films were made in the likeness of the After School Special. It just takes longer for the results to play out.

The Karate Kid might be my favorite example.

While it might be a stretch to list Animal House in this genre, I’m going to. First, how can you go wrong with referencing Animal House? Second, it does fit the concept at least a little. Third, and most importantly, how else could I manage to wedge in this quote:

For some reason, this scene has been playing out a lot in my mind (almost every time I scroll through Twitter, I find myself wondering about when life imitates art). I won’t say any more as it will just get me in trouble, but the “forget it, he’s rolling” resonates as much as the line about the Germans bombing Pearl Harbor.

Sadly, the above is what passes as serious business for me.

Maybe we will get a reprieve on Liberation Day? Maybe the art of the deal will succeed, and I will be pleasantly surprised this week, and in the weeks ahead as well.

But I’m stuck with my existing mindset:

Finally, and most importantly, from my view, is that even if there is a deal, the actions and words of the past 2 months have set in motion changes that will reverberate for years to come!

This fits into the American Brand and When Jeans Symbolized Freedom risk we’ve been worrying about.

The HOW is affecting the WHAT and will continue to affect the WHAT going forward. This is the biggest change from Trump 1.0 (along with the tactics various countries have adopted this time around, versus Trump 1.0).

As recently as February, we were far more optimistic, and possibly naïve regarding tariffs and policy – The New Trump Tariffs.

We will continue to adapt to policies and our best estimate of their likely results.

On Friday in London, I was able to discuss some reasons why I think equities have another 10% or more downside in the near-term. Bloomberg TV (Academy starts at the 1:14:30 mark).

Bears positioned long risk. The sentiment might be incredibly bearish, but we continue to see dip buyers. Not just in “safe” assets or some of the most popular names, but also in the 3x leveraged Nasdaq 100 and 2x leveraged single stocks! I cannot think of a worse way to be positioned than to be long risk, for some bounce, while really quite pessimistic (sadly this was me as we headed into the weekend, as it seemed prudent to take off negative bets into Friday’s selling, especially after what happened last Monday).

Plus, it is quarter end, and month end, so we might see some rebalancing and even the infamous tape-painting.

But I think until “buy the dip” has been torched (and it is getting there) we will see new lows in risk assets. With major U.S. indices sitting at or near 5-month lows, anyone who didn’t take profits is treading water, at best.

We haven’t seen a true capitulation in a long time (see comments on fund flows earlier in this section and last weekend). Even last August, when VIX spiked over allegations of the yen carry trade unwind, there was no capitulation (buying the dip was the mantra) and even the “gap higher in VIX” was largely a bogus calculation since it didn’t show up in futures trading levels.

We’ve been arguing that you should, for now, begin trading this market like it was the GFC or European Debt Crisis, by selling rips and being net bearish. We think that continues to be the modus operandi until there are real signs of capitulation in equities. Friday had the first hints of capitulation, but that is just likely to bring out the bears (especially bears caught long risk) leading to further downside in the coming days (unless we are pleasantly surprised about deals around Liberation Day).

Crypto drifts in and out of the T-Report, and has wormed its way into today’s report. Lately it has behaved more or less like a “risky” asset. It has its own ebbs and flows but seems increasingly tied to stocks. As we have highlighted in the past – crypto has infiltrated the stock market. MSTR is clearly tied to crypto and is in the Nasdaq 100. MSTX and MSTU (2x leveraged MSTR stocks), and some other strategies linked to MSTR, are in people’s equity accounts. The Bitcoin ETFs also reside in people’s equity accounts, which I think links them more than in the past to equities.

While the linkage might be small, I think it has the potential to be like the butterfly flapping its wings in Tokyo triggering rain in NYC. Small flows can impact the broader market and act as a catalyst to larger unwinds. With yet another company (or 2 if you look across the globe) joining the list of companies issuing bonds or equity to buy crypto for their Treasury portfolio, you’d think we’d be higher. Crypto was supported while those entities were engaged in buying crypto, but has sold off since. With Don Jr. touting crypto on social media and a barrage of “governments need to buy crypto” headlines (strategic reserves at the Federal and State level as far as you can see them), you’d think we’d be higher. Yet we aren’t.

Maybe some of the recent actions seem too “circular” to be believable. If you espouse the benefits of crypto, then buy more crypto. Rinse and repeat. Maybe that is wearing thin? Crypto is far from the highs.

Maybe as we face challenges with DOGE, Tariffs, and Peace/War, the ability to convince D.C. that we need to buy crypto is fading? At least until we see major wins across the board? There are wins, no doubt about it, but so far there is a decent amount of controversy, and let’s face it, stocks are down over 10% from their highs.

I’m the most bearish I’ve been on crypto in a long time and think it has the potential to have a GFC type of moment where the interlinked products, leveraged in many cases, create a vicious cycle, where each loss triggers concerns about another product, accelerating losses, rather than bringing in buyers.

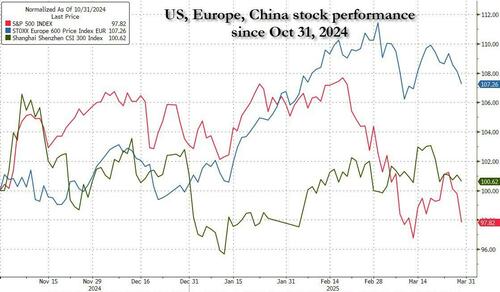

More risk-off. All risky assets will be repriced lower. The U.S. will lead the way lower. Sure, the old adage applies that if the U.S. sneezes, the world gets a cold, but I think the starting points on valuations, capital flows, and the perception of who is “good” versus who is “bad” will hit U.S. assets harder. If we use GDP as a metric for how people perceive the good vs bad then the U.S. has $30 trillion or so on its side, but it is far from clear how the other $80 trillion or so lines up.

Credit will not be spared. The longer the current methodology (and lack of any great deal) plays out, the more people will start discussing whether the recession will be a big “R” or little “r” recession, rather than doubting if we get one. I’m heading rapidly to the big R camp and might start breaking ground on the “D” word.

Rates could go lower in a global risk-off trade, as central banks will have to cut and there will be a flight to safety (in each region) but the inefficiencies of trying to redevelop global trade in months, instead of years, will keep rates (especially at the longer end) more elevated than they should be.

Last week, we highlighted the Nikkei and wondered what people were thinking in Japan as the late eighties ended. I presume they saw the world as their oyster, only to have it yanked away.

After spending the week in Ireland and London, I’ve been thinking about the saying “The Sun Never Sets on the British Empire.” The Empire under Queen Victoria was so vast that it is difficult to fathom.

Things change. And no, I’m not that dire and pessimistic, but I’ve also learned not to take things for granted.

Maybe by the time you read this, some grand bargains will have been struck, making the negative outlook irrelevant or completely wrong. But I’m no longer convinced that any bargains are at the end of this risk-off movement. It could just be the start of the second phase (and we may not even get those bargains).

In any case, this report went from the warm and fuzzy nature of an After School Special, to a dark place, rather quickly. If I’m wrong and markets rip higher (which would be really great) then I will be stuck rivaling Mr. Blutarsky’s GPA of “zero POINT zero.”