In the latest blow to China's so-called recovery, overnight Beijing reported that China’s exports and imports fell more sharply than expected in July, adding to the worst trade slump since the covid collapse which is fuelling concerns over growth prospects for the world’s second-largest economy.

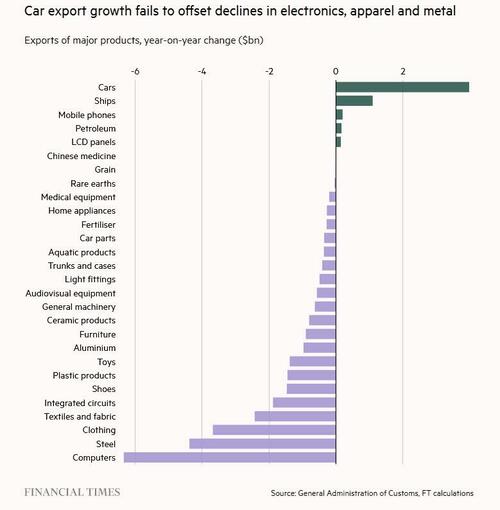

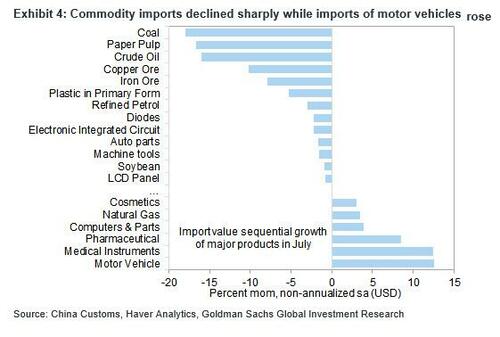

Exports declined by 14.5% year on year in dollar terms, worse than the -12.5% expected, worse than last month's 12.4% drop and the steepest fall since the outset of the coronavirus pandemic in February 2020; at the same time imports tumbled 12.4%, nearly three times as bad as the -5.0% expected and nearly double last month's -6.8% drop and the biggest decline since a wave of infections hit the mainland in January and one of the worst in recent years.

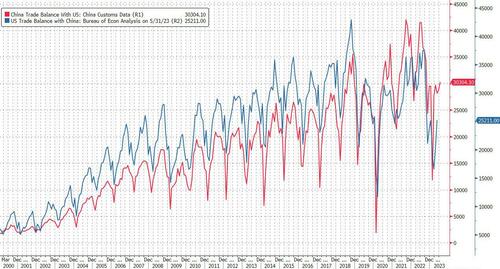

China reported that exports to the US tumbled even more, sliding a whopping 23.1%, and while the trade balance reported by the two sides has traditionally not overlapped, the trend is clear: global trade between the world's two superpowers is collapsing.

In a statement, China’s customs administration said imports were down 7.6 per cent to $1.46tn in the first seven months of the year, while exports were down 5 per cent at $1.94tn.

Global trade weakness has emerged as one of the main sources of pressure for policymakers in Beijing, who are also grappling with a freefalling property sector that has sparked whack-a-mole defaults, and flagging domestic demand since anti-pandemic measures were lifted in December.

As the FT notes, "China’s exports helped prop up its economy during three years of closure to the world, but have struggled in 2023 as high global inflation and rising interest rates damped demand for its goods. Exports have declined year on year in each of the past three months, dropping 12.4 per cent in June, when imports also shed 6.8 per cent." The drop has accompanied a tumble in manufacturing activity which has also contracted for four straight months, according to PMI data, reflecting a far weaker export environment and undercutting one of the anticipated engines of China’s economic recovery.

July’s unexpectedly severe fall in imports also demonstrated how disappointing domestic consumption was fueling trade concerns, more than half a year after Covid-19 swept through the country; it also renewed speculation that Beijing has no choice but to do a bazooka stimulus, yet emperor Xi refuses to do so for now, trapped by too much debt.

“The imports data was pretty bad,” said Julian Evans-Pritchard, head of China economics at Capital Economics. “On our estimates, pretty much all the recovery in import volumes since the start of the year was unwound in July, which is concerning, to say the least, and suggests the domestic picture was weakening quite rapidly in the last month or two.”

Some more details on the trade data from Goldman:

Needless to say, the market did not like the latest data: Hong Kong's Hang Seng China Enterprises index shed 2.2% following the trade data release. “There’s a lot of selling happening today on the back of this export data,” said Louis Tse, managing director of Hong Kong-based broker Wealthy Securities.

President Xi Jinping’s government has set a cautious growth target of 5% this year, the lowest in decades. In the second quarter, the economy added 6.3 per cent compared with the same period last year, when Shanghai and other big cities were locked down, but growth was just 0.8% in quarter-on-quarter terms.

Beijing has not enacted major stimulus but has gradually cut cornerstone borrowing rates and taken steps to encourage activity.

Inflation data, which is set to be released on Wednesday, has for months been edging closer to deflation and will provide further evidence on domestic spending.