Authored by Simon White, Bloomberg macro strategist,

The short-term interest rate curve is consistent with the Fed ending its cycle after today’s anticipated 25 bps hike.

After the galloping volatility of the last few weeks, the rates curve has settled for a quarter point increase today, and roughly a coin toss for the same again after that.

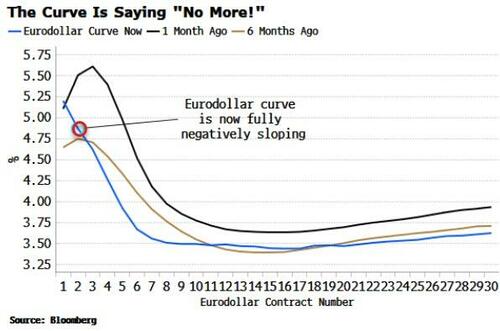

The expected peak rate has fallen quite sharply, and the time when it is expected to occur has also fallen to cycle lows. This means that the lowest-priced (non-serial) Eurodollar contract, i.e. the one with the highest implied rate, is the front contract for the first time in this hiking cycle. This leads to the negatively sloping curve in the chart below.

This was for instance the shape of the cure in May 2019, a few months before the first cut of that year.

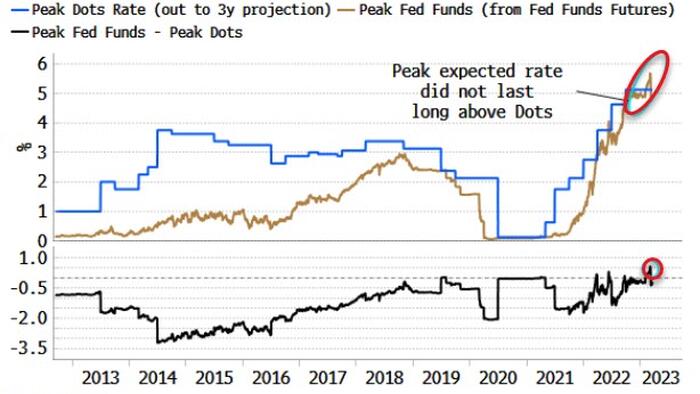

A lot has happened since the last meeting. The central bank finally managed to jawbone the market into pushing its expected peak rate above the peak rate desired by the dot plot.

This meant the market was -- for the first time -- amplifying Fed policy, rather than attenuating it. Perhaps the market knew best after all, because it wasn’t long before the wheels came off.

The Fed may raise its projections today, in a bid to sound tough even though behind the scenes it wouldn’t be surprising if they are a little concerned.

That’s fine - upping the dots is just talk after all – but perhaps they want to be careful about too-strongly guiding the market towards or above their projections again.

This is an economy that has remained more resilient after 450 bps of hikes than many expected. But it is not one that is completely impervious to tighter policy.

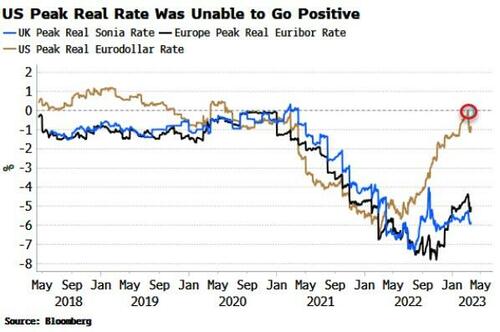

Indeed, the expected real peak-rate was barely able to get to 0% before reversing (and the UK and Europe have an even bigger structural inflation problem, with real rates still deeply negative).

The Fed will want to emphasize the separation principle – the distinction between financial stability and interest-rate policy.

But as we have seen, this is a conceit. Rate policy and financial stability are two sides of the same coin when you forcing duration risk back on the market through QT while raising rates faster than you have for decades.