Authored by Mike Shedlock via MishTalk.com,

The Fed makes horrendous policy decisions because it does not understand inflation.

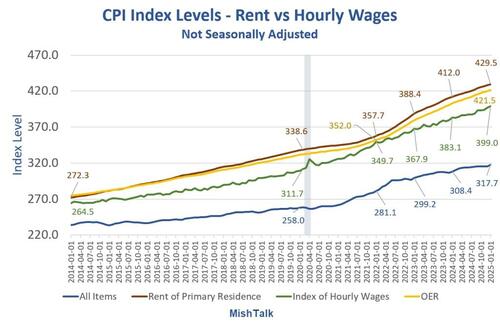

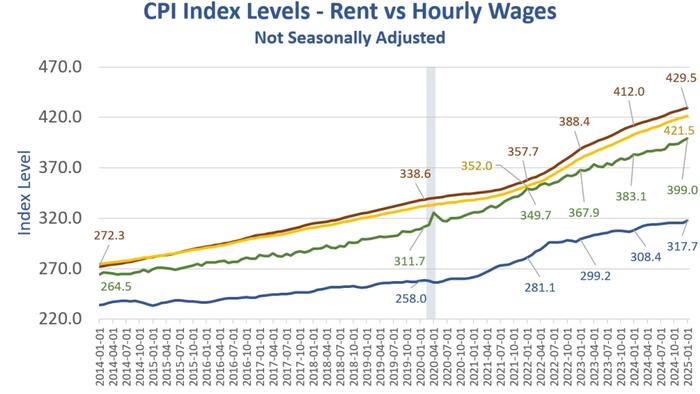

CPI and wage data from the BLS, chart by Mish

Q: Really?

A: Yes but Hell No

Q: Yes for Who?

A: People who own their own home.

Q: Hell No for Who?

A: People who rent.

Q: Does anyone pay OER?

A: No silly. No one rents their own house from themselves.

People who own they own home either own it free and clear or have a mortgage. If the former, they pay property taxes, insurance, and utilities. If the latter, also add in a mortgage payment.

But mortgages, for those who have them, are fixed. They do not go up like rent. On those grounds, people who do not understand inflation, especially asset inflation including houses, believe the CPI is overstated.

Q: What about renters?

A: The BLS says rent is 7.50 percent of the CPI. But also add in OER to arrive at 33.78 percent that the BLS applies to everyone.

The problem with a 33.78 percent is many people pay far more than 33.78 percent of their income on rent.

Those who do have been clobbered by inflation. The home ownership rate is 65.7 percent making the renter share 34.3 percent.

Those who rent are also more likely to have credit card debt and student loans. Interest on credit cards is not part of the CPI. Nor are housing prices.

That is what the proponents of Truflation tout. They believe inflation is only up 2.06 percent from a year ago.

Truflation does not count home prices as part of inflation, it downplays OER, and it uses measures of rent based on new leases only (about 10 percent of he market).

It’s a horribly flawed measure.

CPI year-over-year data from the BLS, chart by Mish

On February 12, I noted CPI Much Hotter than Expected, Core CPI Hotter than Expected

Year-over-year the CPI is up 3.0 percent with rent up 4.6 percent.

Those who spend a huge portion of their income on rent, their own medical insurance, or student loans will scoff at the notion of 2.1 percent truflation or even 3.0 percent CPI inflation.

So will anyone looking to buy a house, many of whom have given up on the idea they will ever be able to afford one.

Like the CPI and the ridiculous Truflation model, the Fed also ignores home prices. And when the Fed slashed interest rates to zero in the pandemic, mortgage rates fell to 3.0 percent or less.

Anyone with a mortgage refinanced putting extra money in their pocket every month to spend.

Those hoping to buy, watched home prices soar out of sight only to watch the Fed and other clueless economists say home prices don’t constitute inflation.

We have two economies, one for asset holders and another for non-asset holders.

It was the non-asset holders (young voters and Blacks) who switched to Trump and swung the election.

I posted that view many times in 2024, well in advance of the election.

Asset bubbles also contribute to strong spending for roughly 2/3 of the nation while the other third is in misery.

Economists like Krugman still praise the Biden economy.

I see budget deficits as far as the eye can see, and Trump will increase them.

Those budget deficits will increase inflation.

On January 23, I noted Trump “Will Demand Interest Rates Drop Immediately”

Trump repeated that call after the disastrous CPI report.

Instead, he should have blamed the Fed for cutting rates before the election.