By Howard Wang of Convoy Investments

The US economy is as bipolar as I've ever seen it, with some parts cold and other parts running hot. Below I provide a summary of my current views on the economy, then some select charts from our economic dashboard with additional commentary.

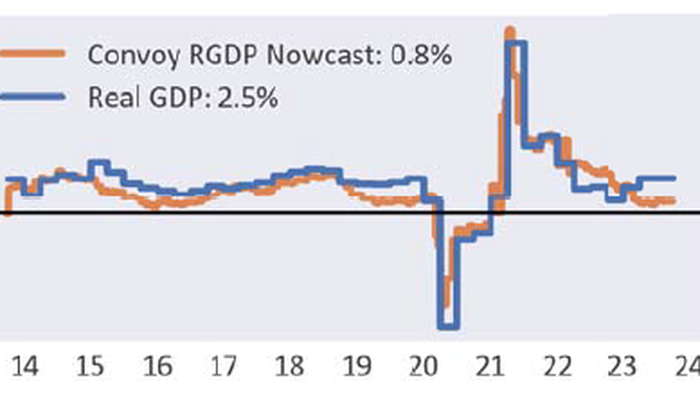

Some charts on the points above, with some brief commentary. I combine all the relevant economic indicators into a "nowcast" to provide my real time estimate on US economic growth, which I plot below relative to actual real GDP growth. My nowcast suggests we are now growing at a modest 0.8% year-over-year rate. Not recession territory yet but certainly slowing down.

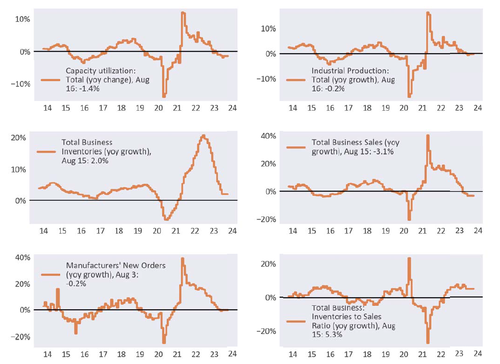

Below I show some key economic activity indicators. Capacity utilization, industrial production, total business inventory/sales/orders are all at zero or negative growth after a few blockbuster years. Inventory to sales ratio is now also growing.

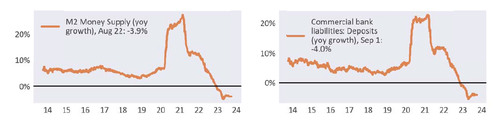

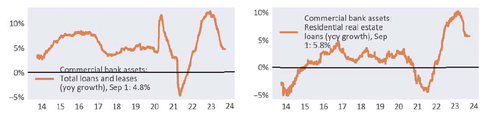

As M2 money supply contracts, commercial banks are losing their deposit base, leading to failures for some of the more aggressively positioned regional banks.

More importantly, it means they are also finally tightening up their lending standards. I wrote a paper about why Fed Fund Rates going up weren't actually slowing down the economy because most checking accounts had zero rates so bank loans were still growing very fast in the early part of this year. But this is finally beginning to slow down as banks (get squeezed in the middle. This is why I believe inflation is coming down and growth is finally cooling.

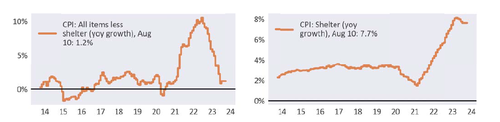

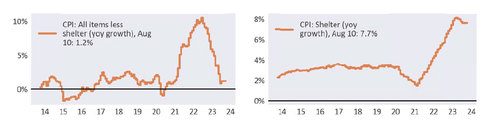

On the prices front, CPI is coming down, particularly CPI ex-shelter, which is already below the 2% target. Shelter prices will take some additional time to adjust as 1) housing prices went up far higher and faster than shelter CPI, so there is an additional gap to still work out of the system 2) most of the mortgages in the US are fixed, which means those who locked in a low rate during Covid don't want to sell, which artificially limits supply, keeping prices elevated. I believe CPI will remain above the 2% target for some time to come.

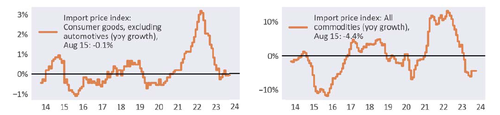

From the producers side, goods and commodities prices are negative year-over-year, services prices are at about 2%, both bodes well for inflation management.

At the same time, the dollar continues to rise and the rest of the world is slowing down, this means cheaper imports, i.e. importing deflation.

On the jobs front, payroll continues to grow at a modest 2% pace, but the number of job openings are dropping rapidly. This is closing the gap between labor supply and demand, which should continue to moderate wage growth, which is still elevated, but dropping.

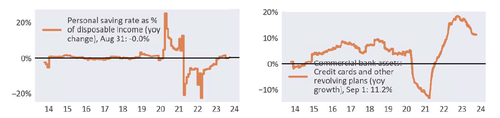

From a household balance sheet point of view, US households finally spent down their excess savings from Covid, and now savings rates are flat year over year. The recent spending has largely been powered by credit card debt, which is still piling up fast, but the rate of growth is slowing as interest rates continue to rise and household balance sheet deteriorates.

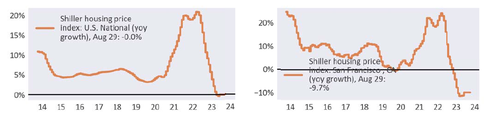

On housing prices, year-over-year growth is now zero on average across the country, but prices have remained stubbornly high. Shelter will remain a key driver of CPI for some time to come. Certain pockets that saw bigger price bubbles during Covid are experiencing steeper drops (e.g. San Francisco, Texas, Las Vegas).

From federal balance sheet point of view, the recent rise in deficit has been driven more by low federal receipts, which suffered from a 2022 market drop, than outlays, which have stabilized after the Covid handouts ended. In the short-term, I expect deficits to stabilize as federal receipts catch back up to the market recovery this year. I don't expect this to be a major driver cause of concern for the bond markets in the short-term. Long-term is of course more of an open question, which I've gone into details in other commentaries.

Overall, I see an economy that is inevitably slowing - it is just a matter of time. Just like it took time for the money printing to flow through to inflation in 2021/2022, it will take some time for the tightening to flow through to a cooling down of inflation. Inflation will likely remain higher than 2% for a long time due to fixed mortgage rates in the US keeping housing prices high. The Fed will likely need some patience in fixing the long-term problems created by near zero 10-year rates and mass helicoptering of money.