By Peter Tchir of Academy Securities

Thank goodness for Friday. Or maybe I should just thank Bostic because his comments on Thursday seemed to turn the markets around.

The view (presented in last week’s Surprise, Surprise and Acceptance Stage of Rate Hike Grief) that the market was getting tired of pricing in higher yields and dragging stocks down got off to an okay start, but it became pretty shaky in the middle of the week.

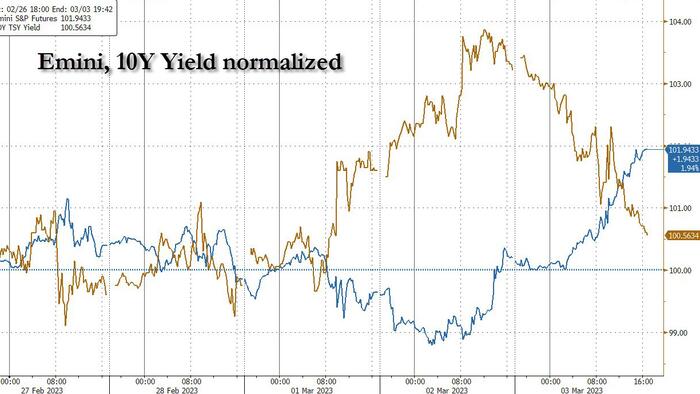

The 10-year Treasury ended last week at 3.95% (it got as low as 3.89% before grinding steadily higher to 4.09% on Thursday). But TGFF because it recovered and closed basically unchanged on the week. Not a win as a bond bull, but I’ll take it.

The S&P 500 followed a rate dependent path and things got a little hairy on Thursday when the S&P dipped below the 200 DMA (around 3,940). Ultimately Bostic seemed to help (along with too much bearishness). I believe that too many people were betting on more rate hikes and that caused yields to go higher (which in turn dragged stocks lower).

As we head into this week:

I see no reason to change last week’s bottom line (accept for adding more on credit).

Bonds can do well with the 10-year having a 3.7% target.

Risk assets can do well with a 4,200 target for the S&P 500 and CDX IG heading towards 60 (the semi-annual roll should be another factor that helps push spreads tighter). If the new issue calendar remains robust, credit could lag for a bit. However, if there are any signs of issuance slowing, the rally should be strong.

Despite the Summit starting on a day where San Diego was having worse weather than Chicago (the hail/30 mph winds made it an “experience”), the San Diego weather came through in the end!

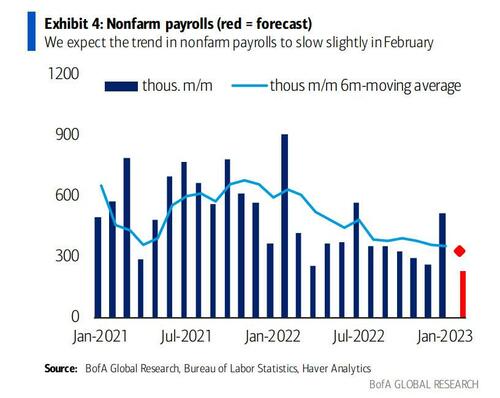

Good luck this week and jobs are going to be interesting. I’m more worried that the jobs data could be bad (downward revisions, etc.) than I am that the data will be too strong, though both of those extremes would hurt my position on risk assets.

Maybe this Friday will give another reason to proclaim “Thank Goodness for Friday (TGFF)”!