Tesla shares plunged more than 9% at the cash open on Thursday after CEO Elon Musk lamented the company faced some 'rough quarters' ahead on its Q2 earnings call Wednesday evening.

Here is what Tesla reported for Q2:

The stock was steady until the company's conference call, where it started to slip about 5% before falling further in this morning's pre-market, and then cash, session.

During the call, Musk acknowledged the company was entering a “transition period” due to the loss of U.S. electric vehicle tax credits and the gradual rollout of autonomous technology.

“We probably could have a few rough quarters,” he said. “But once you get to autonomy at scale in the second half of next year, certainly by the end of next year, I would be surprised if Tesla’s economics are not very compelling.”

Despite pushing long-term ambitions for robotaxis and AI, investors were left frustrated by the lack of detail on Tesla’s core business and product roadmap. Analysts noted that the company offered “remarkably little detail” on key developments, such as its upcoming affordable vehicle or the progress on its humanoid robot, Bloomberg wrote. One observer remarked, “There was a lot of uncomfortable realism mixed in with the futurism.”

“There are some teething pains as you transition from a pre-autonomy to a post-autonomy world,” Musk had noted on the call.

Truist Securities analyst William Stein said: “The company offered remarkably little detail on some of the most important factors". That makes “our outlook lean more on imagination than realistic targets.”

Tesla's problems extend beyond North America. In Europe, Tesla’s vehicle sales fell 33% in the first half of 2025 compared to the same period last year. June sales in the EU alone dropped 40%, and Tesla’s market share in the region declined to 1.6%. While the refreshed Model Y helped slightly in the UK, sales across the EU, Norway, and Switzerland continued to struggle. Musk’s political alignment with far-right parties and past support for Donald Trump have further damaged Tesla’s brand image in the region.

Musk openly criticized the EV policy changes enacted by the Trump administration, calling the new tax law a “disgusting abomination.” The law removed key incentives for EV buyers and eliminated penalties for automakers failing to meet fuel-economy standards, both of which had previously supported Tesla’s bottom line. Musk conceded that “we are in this transition period where we will lose a lot of incentives in the U.S.”

Tesla executives confirmed that production began in June on a more affordable EV resembling the Model Y, but said they would delay its release until after tax credits expire at the end of September. Meanwhile, the company continues to promote its robotaxi initiative. The pilot program in Austin, Texas, launched last month, and Musk claimed Tesla aims to expand the service across the U.S. this year.

“We’ll probably have autonomous ride-hailing in about half the population of the US by the end of the year,” Musk said. “That’s at least our goal, subject to regulatory approvals.”

Still, investors were hoping for more immediate progress. “All eyes are on how Austin is going to play out, and we didn’t hear much,” said Gene Munster of Deepwater Asset Management. Concerns are also growing about Musk’s attention being diverted from the core car business, with critics warning that Tesla is beginning to resemble traditional automakers more than a high-growth tech company.

Musk also used the call to argue for greater control over Tesla, following a Delaware court decision that voided his multibillion-dollar compensation package. “I think my control over Tesla should be enough to ensure that it goes in a good direction, but not so much control that I can’t be thrown out if I go crazy,” he said.

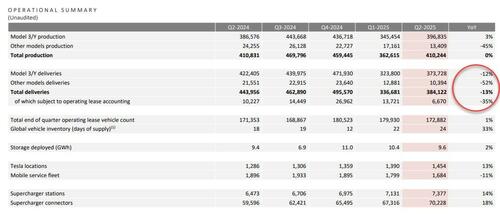

As we noted yesterday, here is the financial summary for Q2:

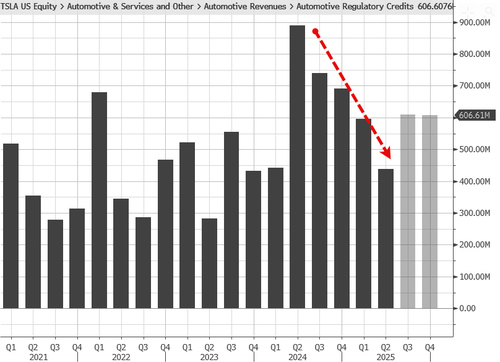

And visually:

As has been the case in recent quarters, both revenue and profitability were hit by lower regulatory credit revenue. Tesla still recognized $439 million of automotive regulatory credits in the second quarter, down from $595 million in the first quarter and down from $890 million a year ago.

While the information was already reported previously, deliveries fell across models, but the hardest hit category was the one that includes the Tesla Cybertruck. Deliveries of Model 3 and Y cars dropped 12% from a year ago, compared to a 52% plunge for other models.

One bright spot is a 17% jump in “Services and Other Revenue” to $3.05 billion. Tesla attributed that, in part, to more revenue from its industry-leading Supercharging network. It said it added more than 2,900 Supercharger stalls on a net basis, an 18% increase from a year ago.

As an aside, gross profit for the energy generation and storage division reached a record $846 million.