Tesla will report its second-quarter 2025 earnings today after the close. A conference call with executives, including CEO Elon Musk, is scheduled for 5:30 PM ET.

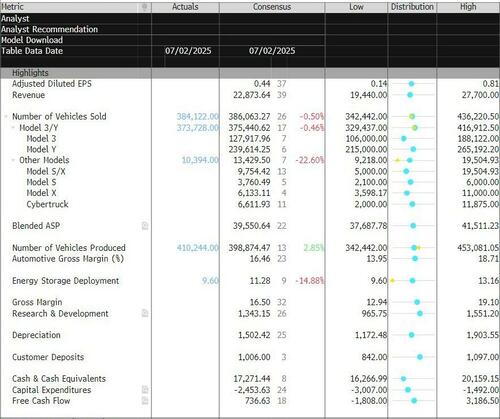

Here is a snapshot of expectations:

TSLA Q2 TL/DR:

Forecast for the year :

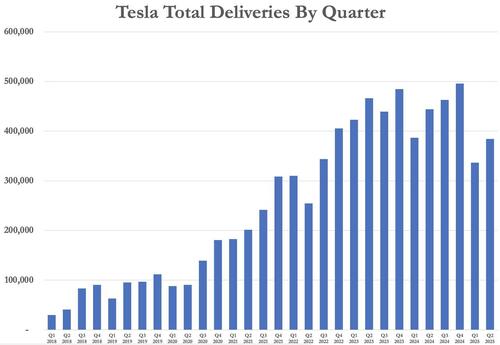

And visually:

Today's earnings report comes at a pivotal time for Tesla: while Elon continues to frame the company as a technology and robotics firm, the reality is that automotive sales remain the primary driver of financial performance and cash flows, and that business has hit some bumps.

Recall, deliveries were mostly in-line to start the third quarter, avoiding the worst whisper numbers from Wall Street. Production beat expectations. Tesla built 410,244 vehicles, compared to the forecast of 400,083. Model 3 and Model Y deliveries totaled 373,728, slightly under the estimate of 377,295.

The “Other Models” category, including the Model S, X, and Cybertruck, showed Tesla delivered 10,394 vehicles, below the expected 14,644. Production of these models also came in slightly under, at 13,409 compared to the estimate of 13,616.

Model 3 and Y production reached 396,835 units, higher than the expected 383,567, suggesting Tesla had ramped up output of its most popular models.

Ahead of Tesla’s Q2 2025 delivery report, expectations are subdued amid signs of continued demand weakness and investor concerns over the company’s growth trajectory. Analysts widely anticipated another disappointing quarter, despite hopes pinned on the rollout of a refreshed Model Y and the company’s long-term robotaxi ambitions. Investors will look for clarity on these issues during today's call.

Profitability will also be a key focus. Tesla’s once-leading gross margins are expected to fall well below 17%, pressured by continued price cuts, the expiration of federal EV tax credits in the U.S., and tariff-related challenges under President Trump’s new trade policy regime. Here's what else we think investors are going to be watching most on tonight's call.

One of the central questions going into the report is whether Tesla can reinvigorate demand in its automotive segment while delivering on its more speculative technology promises. Recall, the Tesla Model Y was the world’s best-selling car in 2024, a landmark achievement that underscored its global appeal and dominance in the EV market. Praised for its combination of performance, utility, and technology, the Model Y outpaced even long-established rivals from Toyota and BYD.

With the upcoming “Juniper” refresh introducing updated design and interior features, Tesla aims to maintain the Model Y’s leading position in an increasingly competitive global landscape.

This year, sales have weakened across key regions, including sharp declines in Europe and softening demand in the U.S., partly due to rising competition and political controversy surrounding Elon Musk. To maintain volume, Tesla has relied heavily on price cuts, promotions, and regulatory credits, which has in turn put pressure on profit margins.

Overall, revenue from the auto segment is down roughly 10–11% year over year, reflecting the broader slowdown. Investors will look for guidance heading into the back half of 2025 on whether demand has bottomed or is improving at all.

Investors are also watching closely for updates on the Robotaxi program. Tesla has begun a limited pilot in Austin, Texas, using modified Model Ys with human safety operators.

While the program launched on schedule, rider feedback has been mixed, and early incidents—such as vehicles veering into wrong lanes—have raised safety and regulatory concerns. Still, many expect Musk to spotlight autonomy as Tesla’s future direction. Barclays analyst Dan Levy noted, “The earnings call also presents an opportunity for Tesla’s robotaxi/AV narrative to shine… We could see Elon Musk potentially discussing fleet growth targets or expansion plans.”

We noted Goldman Sachs' full response to the June Robotaxi launch here. Goldman, led by Mark Delaney, described Tesla’s initial Robotaxi rollout in Austin as promising but early-stage, noting generally smooth rides with some concerning navigation errors. They expect scaling to remain slow in the near term due to limited geographic coverage, required human supervision, and tech readiness concerns.

Another unresolved question is the timeline for Tesla’s long-promised affordable EV, often referred to as the “Model 2.” Last year, Musk suggested it would begin production in the first half of 2025, but that milestone has quietly passed without a product unveiling or confirmed factory site.

Some analysts now expect Tesla to delay the launch until the fourth quarter, potentially to boost demand ahead of the federal EV tax credit expiration on September 30. Levy wrote, “Tesla’s forthcoming low-cost model seemingly missed its target… which could be perceived negatively.”

Tesla investors also will likely want to hear about the company’s Full Self-Driving (FSD) technology, as promises of imminent breakthroughs have repeatedly gone unmet while some safety concerns continue to mount.

Despite Elon Musk’s years-long insistence that unsupervised FSD is just around the corner, the system still requires active human oversight and remains far from regulatory approval. Recent incidents, including a fatal crash in Arizona and a growing number of NHTSA investigations, have heightened skepticism about the readiness and safety of Tesla’s autonomous tech.

On tonight’s earnings call, investors will be looking for more than just vague assurances—they’ll want specific updates on progress toward removing human supervision, details on regulatory timelines, and concrete milestones for broader deployment. Without that clarity, many fear the FSD narrative may lose its power to prop up Tesla’s premium valuation.

Tesla investors will also look for updates on the company's Optimus humanoid robot, which Elon Musk has touted as a future revenue driver potentially worth trillions. For now, Optimus appears to be still limited to basic, highly scripted tasks like moving battery packs around Tesla factories—often under human teleoperation.

On tonight’s conference call, investors will be looking for Musk to provide concrete updates on Optimus’s development roadmap, including technical milestones, timelines for broader deployment, and any early signs of commercial interest or partnerships. Clarity on when Optimus could begin generating meaningful revenue—or at the very least, operating independently—would help address growing doubts about whether the robot is a viable near-term product or just another long-term ambition keeping the narrative afloat.

Additionally, Tesla's involvement with xAI, Elon Musk’s artificial intelligence startup, could increase. While Musk has ruled out a merger between the two companies, he has proposed that Tesla invest in xAI—a decision that will be put to a shareholder vote this November. The move could deepen collaboration between the two entities without fully combining them.

Tesla is already integrating xAI technology into its products. Its vehicles have begun including Grok, xAI’s conversational AI assistant, as part of the in-car software experience. Though Grok can’t yet control vehicle systems, it offers features like intelligent navigation support and real-time responses via voice command.

Behind the scenes, xAI has reportedly drawn on Tesla’s resources, including engineering talent and Nvidia GPUs originally acquired for Tesla projects. This overlap has raised concerns among some shareholders, including lawsuits alleging conflicts of interest. Critics argue Musk may be blurring the line between his various ventures, potentially diverting Tesla assets to benefit xAI.

The upcoming shareholder vote will be a key moment in defining how closely Tesla aligns its future with Musk’s broader AI ambitions and Musk will likely address this on today's conference call.

There’s also growing investor discomfort over Musk’s increasingly visible political activity. His launch of the “America Party” and break with Trump have added reputational risk to Tesla’s brand and stock. Major investors, including several large pension funds, are now pressuring Musk to devote more time to Tesla’s operations, with some calling for at least 40 hours per week.

Wedbush analyst Dan Ives famously floated the idea of “ground rules” to rein in Musk’s outside distractions earlier this quarter—only to be publicly dismissed by Musk himself who simply responded "Shut up, Dan".

Meanwhile, shareholder questions submitted via the Say platform ahead of the call are focused on robotaxi expansion, the timeline for full self-driving deployment, and updates on the Optimus humanoid robot. Despite claims that Optimus could drive trillions in revenue, the robot currently performs limited factory tasks under human supervision and remains far from commercial viability.

Sentiment on Wall Street heading into the report is split, with a growing number of analysts expressing concern about Tesla’s ability to support its valuation with fundamentals alone. UBS has reiterated a Sell rating, calling Tesla “fundamentally overvalued.” JPMorgan maintains a price target of $115, well below current trading levels, and sees no short-term catalyst to justify the premium. William Blair recently downgraded the stock to Market Perform, citing increased investor fatigue and unfulfilled promises.

Baird analyst Ben Kallo has taken a cautious stance, keeping a Hold rating and pointing to elevated risk around full-year estimates. RBC’s Tom Narayan remains more optimistic, maintaining a Buy rating and $319 target, and expressing confidence that a more affordable Tesla vehicle will arrive later this year.

On the most bullish end of the spectrum, Wedbush has reaffirmed its $500 price target. Analyst Dan Ives continues to defend Tesla as “a transformational AI play disguised as an auto company,” and sees the current weakness as a buying opportunity.

Here is a snapshot of how the Sellside views TSLA:

Ultimately, the second-quarter results will be less important than the tone Tesla sets for the rest of the year. Musk’s ability to shift the conversation from declining financials to a vision of autonomous and AI-powered growth could determine whether Tesla’s stock holds its ground—or starts to lose the support of even its most loyal believers.