Tesla is once again cutting prices for its vehicles in the U.S., in a sign that the company continues to look to spur more demand after disappointing the market with its Q1 2023 deliveries number just days ago.

The company cut the Model S and Model X vehicles by $5,000 to $84,990 and $94,990 and cut its Model 3 and Model Y vehicle by $1,000 and $2,000, lowering their base prices to $41,990 and $49,990, the Wall Street Journal reported Friday morning.

These cuts mark the fifth time Tesla has cut prices since January.

Days ago the company reported that it sold 88,869 units of China-made electric vehicles for the month of March, a 35% increase from a year ago, according to data from the China Passenger Car Association (CPCA).

The figure was up 19.4% sequentially after Tesla delivered 74,402 vehicles in February. Competitor BYD remains the name to watch in China, however, selling 206,089 vehicles last month.It marked the "second-highest China-made vehicle sales ever for the company, just behind the 100,291 units that were sold in November of last year," according to the Teslarati blog.

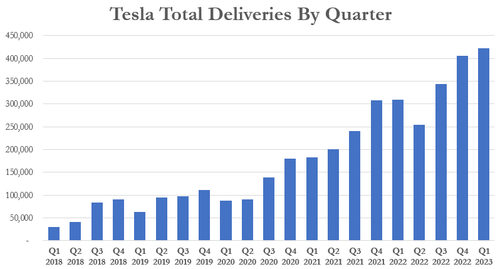

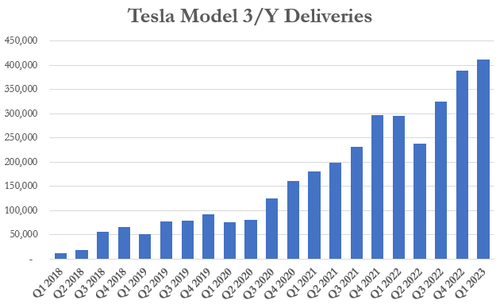

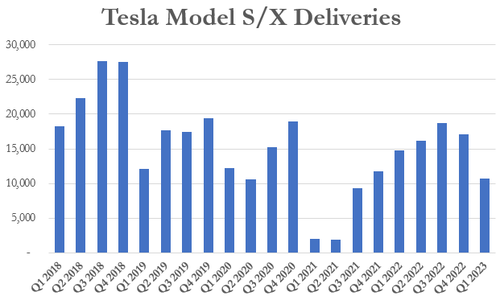

Recall we also posted Tesla's Q1 delivery numbers for the U.S. just days ago. Tesla reported Q1 2023 deliveries, posting a figure of 422,875 vehicles delivered. The company delivered 10,695 Model S/X vehicles and 412,180 Model 3/Y vehicles.

Original analyst expectations were for 430,008 vehicles, according to Refinitiv data cited by Reuters. Multiple outlets reported the number as a miss (it was, compared to original estimates) and a beat (it was, compared to current lower-balled estimates).

This Q1 figure was a 36% increase year over year and a 4% increase sequentially, compared to the 405,278 deliveries the company posted in Q4 2022. Bulls are likely to see the beat as good news, while bears will likely argue that the "beat" wasn't enough given the drastic price cuts Tesla has put into place since the end of last year.

"We continued to transition towards a more even regional mix of vehicle builds, including Model S/X vehicles in transit to EMEA and APAC," the company's release said. Despite this mix change, the Model S and Model X are becoming dwindling contributors to Tesla's delivery bottom line.

Martin Viecha, Tesla's head of IR, said last week: "Sequential growth continues even in the first quarter."

With these new price cuts, it looks like Tesla wants to make sure that trend will continue. The only question, naturally, is how the cuts will affect margin and the company's bottom line. Analyst Gordon Johnson says that despite the robust China numbers, Tesla's earnings could be setting up for an "epic disaster" on margin compression.

The company is set to report earnings in less than two weeks on April 19.