Container volumes at one of America's busiest ports are falling fast. President Trump's 145% tariffs on Chinese goods entering the U.S. are wreaking havoc on trans-Pacific containerized trade, triggering a sharp decline in shipments from Chinese ports.

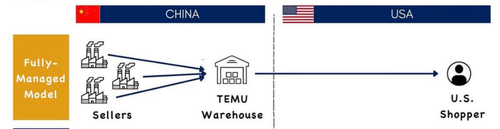

On Friday, Chinese e-commerce giant Temu halted U.S. deliveries after the Trump administration closed the "de minimis" loophole, which had previously allowed a flood of Chinese junk under $800 to enter tariff-free.

The move signals a further decline in Chinese imports to the U.S.

Ahead of Friday's end of the de minimis exemption for China-made goods, Temu hiked prices and rolled out a complete breakdown of customer import charges. Singapore-based e-commerce website Shein Group also hiked prices.

Temu confirmed late Friday to the New York Times: "This shift is part of Temu's ongoing adjustments to improve service levels."

The use of de minimis by Chinese e-commerce has surged in recent years, with Temu and Shein connecting U.S. consumers with cheap Chinese goods priced 20% to 30% less than U.S. competitors like Amazon.

According to the U.S. Customs and Border Protection, nearly 1.4 billion shipments entered the U.S. in 2024 through the de minimis loophole, up from 637 million four years earlier.

The nuking of the de minimis loophole comes from President Trump, who has previously called the exemption "a big scam" that hurts small American businesses.

Kim Glas, the president of the National Council of Textile Organizations, said the exemption allowed "unsafe and illegal Chinese goods" to flood the U.S. duty-free for years.

"Today's action by the administration is an important step forward to help rebalance the playing field for American manufacturers," Glas told the NY Times.

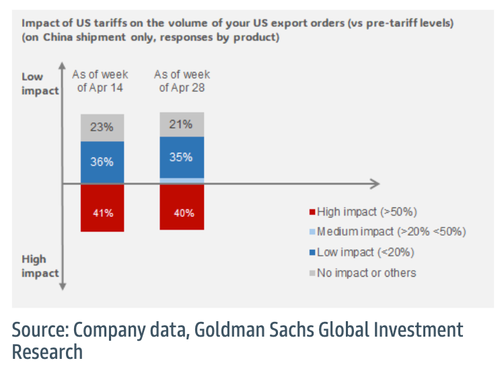

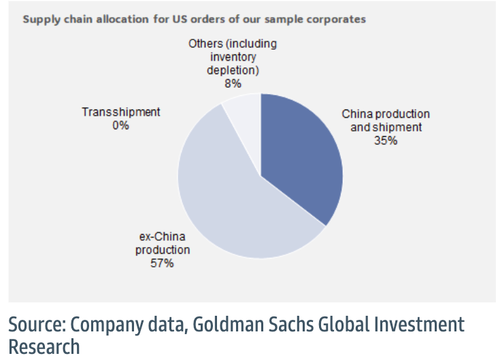

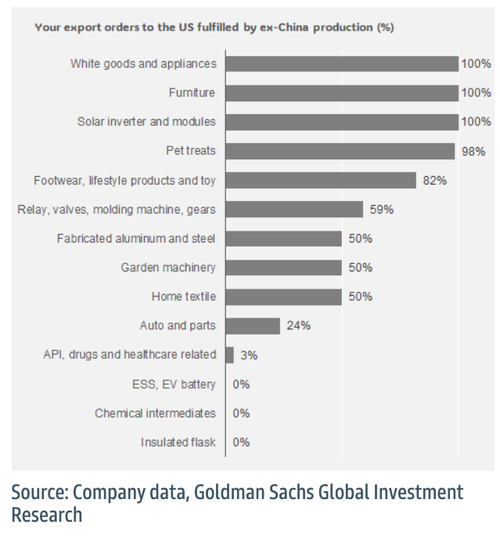

Separately, the second edition of Goldman analyst Trina Chen's China Export Tracker—covering 48 companies representing 70% of China's export value to the U.S. by product group—offers new insight into trade flows and growing uncertainty across key trans-Pacific shipping lanes linking Chinese ports to the U.S. West Coast.

Here are some of Chen's findings:

Nearly 40% of products are seeing substantial impact on their China shipments for U.S. orders, as of week of April 28

U.S. orders were fulfilled- 35% from China shipments, and 57% from ex-China production, as of week of April 28

Impact of U.S. tariffs on the volume of U.S. export orders by product (for China shipment) - as of week of April 28

Ex-China production provides significant supply chain flexibility for many consumer related products

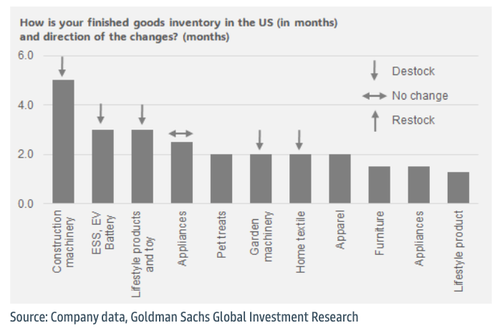

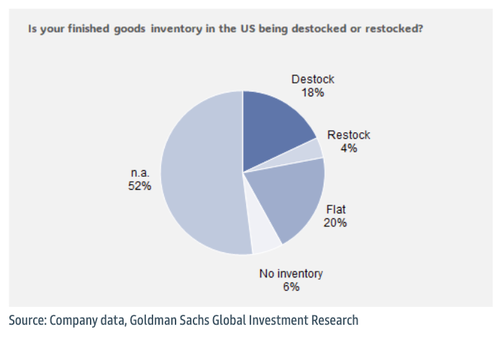

Finished goods inventory in the U.S. quoted by producers and shippers ranged from 1.5 months to 5 months

U.S. monthly container imports are still in positive growth as of March-25, but total imports are projected to fall by nearly 30% in the coming months

Comments from exporters:

. . .