Authored by Peter Tchir via Academy Securities,

The “Liberation Day” Tariffs announced at the Rose Garden last week went into effect as of 12:01 am. The tariffs on China have been increased since then, as China already retaliated by increasing their tariffs. I, like many refer to them as the “Liberation Day” tariffs, as that is a talking point that seems to appeal to the President and avoids calling them “reciprocal” which they are not.

There have been some interesting “surprises” overnight.

U.S. stock futures dropped between 2% and 3% a little after midnight but are now down less than 1% or even in positive in some cases (depending on whether you focus on the S&P 500 or Nasdaq 100 futures). They are moving rapidly.

European stock markets are down 2.5% to 3% across the board.

What is interesting though, is that Chinese ETF’s (KWEB, FXI) are up over 5%.

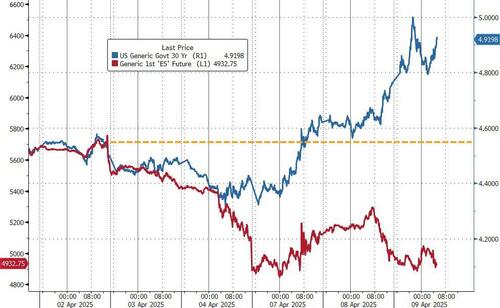

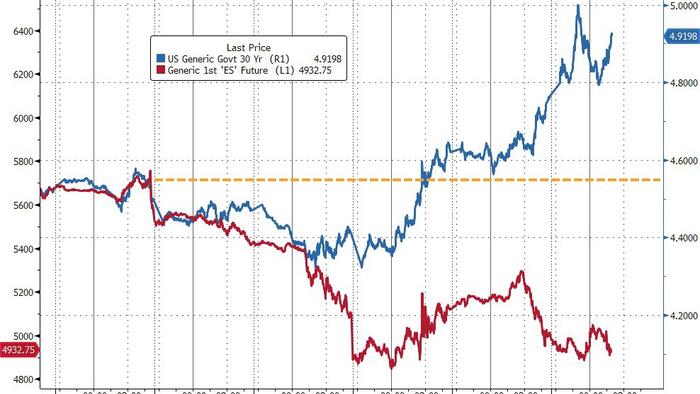

We will come back to stocks, but bonds were the big story overnight!

If you were up last night waiting to see if there was a last-minute reprieve, your social media likely got overwhelmed with stories about the bond market – with the U.S. longer dated maturities being the focal point.

The 30-year bond briefly breached 5%. The always important 10-year yield rose above 4.5% as yields marched incessantly higher from around 10 pm until just after midnight. They are currently back to 4.37%, about 7 bps higher than where they closed.

The yield story is the biggest, so here is our take on what happened:

What is helping risk assets right now?

On positioning, on a quick glance yesterday may have been a record day of inflows for ETFs. Whatever the sentiment (soft data) indicators are telling you, the hard data indicators (ETF flows) are telling us that we are positioned for a bounce. I think that trade will fail, yet again.

Corporate credit was quite weak yesterday. I will be watching the front end closely (VCSH is a good proxy for those of you not deep in the weeds of trading corporate bonds). I will be watching the discount to NAV on large corporate ETF’s like a hawk (to the extent I can watch anything in between meetings). When funds like HYG, JNK, LQD trade at a discount to NAV, it has a tendency to unleash the ETF Spiral™! I will try and send around some old notes on this, but basically my strong view is that the “arbitrage” that is created by large discounts to NAV, at the early stages of times of stress, leads to more selling! Since the arb itself is risk neutral (sell bonds, buy the ETF), some argue that it doesn’t exist, but experience tells me that when people are uncertain, that $1 of owning bonds feels far more risking than owning $1 of ETF/index and it promotes more selling.

Credit could turn today and perform well.

The Fed could indicate some interest in supporting markets.

We could see some details on potential deals.

Any and all of those would be positive, but I don’t think that it will be enough and am still extremely cautious on risk assets here.

I don’t mind buying some bonds here, even with the potential for foreign selling, but not until after the auctions!

Good luck and welcome to the post Liberation Day tariff world (which, as you can tell, I still don’t think the market is fully pricing in the risks).

Also, as last minute addition, changing correlations (like stocks and bonds both moving down together) tends to cause de-grossing (cutting positions) in any sort of strategy that relies on cross asset correlations (from true Risk Parity to Risk Parity Lite strategies, like 60/40 funds).