Will the dreaded tariff-flation show up this time? Or will the excuse factory be required to spin the Trump-policy-driven price hike expectations as coming next time?

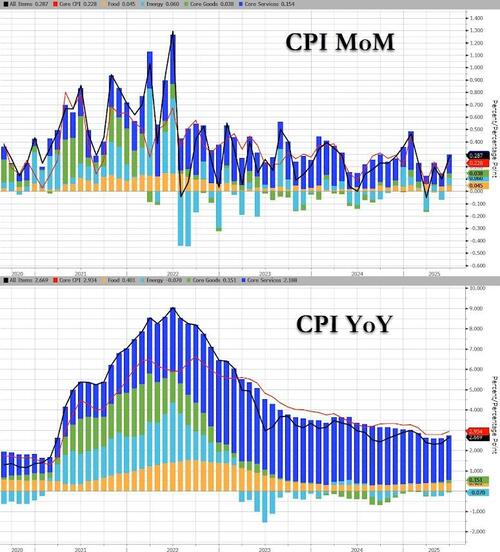

Expectations were for a modest acceleration in prices in June and headline Consumer Prices did just that rising 0.3% MoM (as expected) and +2.7% YoY (up from +2.4% prior and hotter than the +2.6% YoY expected)...

Source: Bloomberg

The MoM acceleration was driven by a flip from deflation to inflation for Energy prices...

Source: Bloomberg

New and Used Car prices are dropping!!! That's not supposed to happen...

CPI Highlights: the index for shelter rose 0.2% in June and was the primary factor in the all items monthly increase. The energy index rose 0.9% in June as the gasoline index increased 1.0% over the month. The index for food increased 0.3% as the index for food at home rose 0.3% and the index for food away from home rose 0.4% in June.

The index for all items less food and energy rose 0.2% in June, following a 0.1% increase in May. Indexes that increased over the month include household furnishings and operations, medical care, recreation, apparel, and personal care. The indexes for used cars and trucks, new vehicles, and airline fares were among the major indexes that decreased in June.

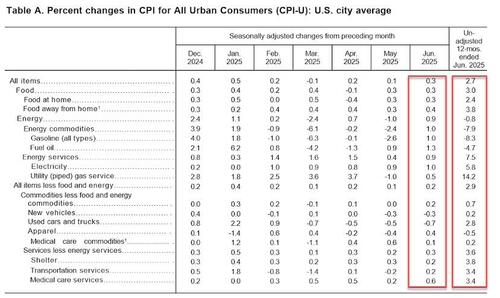

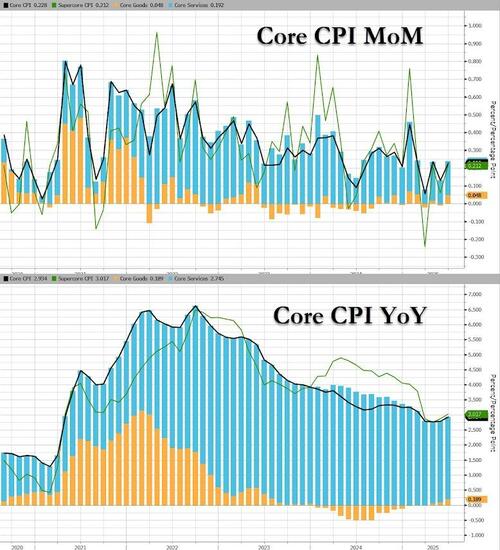

The headline CPI YoY is the hottest since February but Core CPI printed cooler than expected (+0.1% MoM vs +0.2% MoM exp) with the YoY rise higher at +2.9% (as expected)...

Source: Bloomberg

Core Goods prices are accelerating on a YoY basis...

Source: Bloomberg

More details on Core CPI which rose 0.2%, below the 0.3% 3 estimate:

The index for all items less food and energy rose 2.9% over the past 12 months. The shelter index increased 3.8% over the last year. Other indexes with notable increases over the last year include medical care (+2.8%), motor vehicle insurance (+6.1%), household furnishings and operations (+3.3%), and recreation (+2.1%).

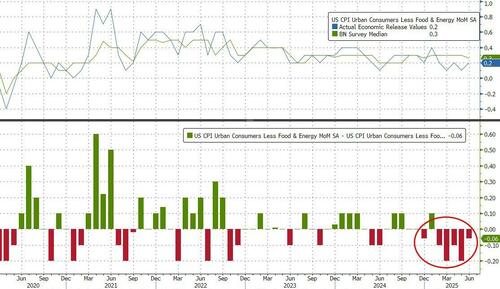

This is the 5th monthly 'miss' for Core CPI in a row - the sky is falling analyst crowd continues to be wrong...

Source: Bloomberg

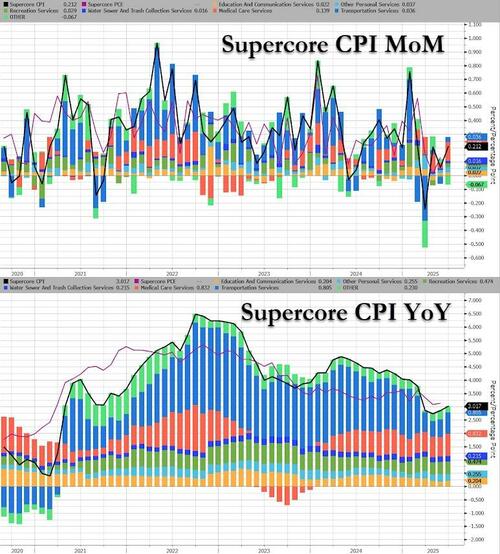

SuperCore CPI (Services ex-shelter) rose 0.36% MoM, lifting prices 3.34% YoY - highest since feb but well off the YTD highs

Source: Bloomberg

Medical Care Services costs are also starting to accelerate (not exactly tariff-driven)...

Source: Bloomberg

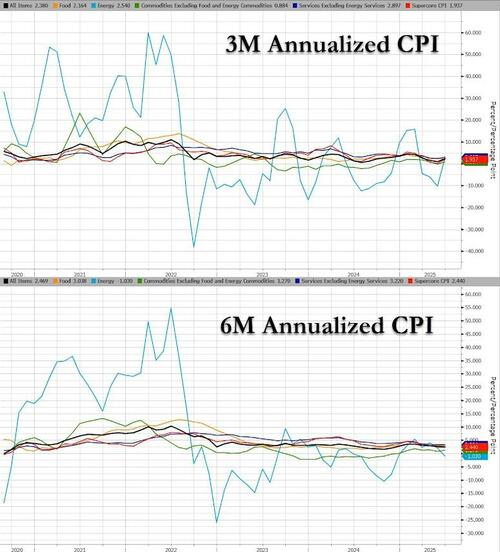

On a 3m- and 6m- annualized basis, there are no signs of the tariff-driven price hikes as yet...

Source: Bloomberg

Not exactly the damning evidence of terrifying tariff-flation that the establishment wants us to believe is coming...

Developing...