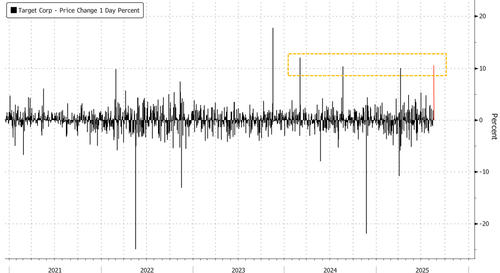

Target shares plunged as much as 11% in premarket trading after the retailer announced longtime CEO Brian Cornell will be replaced by CFO Michael Fiddelke. The abrupt leadership change, expected in 1Q26, comes as the company's turnaround plan has failed to gain traction. Target also reported second-quarter results showing continued sales declines, weaker traffic, and guidance that points to persistent softness through year-end.

Target's board has unanimously elected Fiddelke, currently CFO, as its next CEO, effective February. He will also join the board of directors. Cornell, who has led the retailer since 2014, will shift positions to executive chair. The leadership change comes as Target's turnaround falters and the retailer continues to lose ground to rivals such as Walmart and Amazon.

"I'm stepping in with urgency to rebuild momentum and return to profitable growth," Fiddelke told analysts on the earnings call. "I've seen us at our best and I've seen us when we are not at our best, and that informs my candid assessment of today where we have work to do."

Christine Leahy, lead independent director of Target's board, stated, "It is clear that Michael is the right leader to return Target to growth, refocus and accelerate the company's strategy, and reestablish Target's position as a leader in the highly dynamic and fast-moving retail environment."

Target plunged as much as 11% in premarket trading following the abrupt leadership announcement.

The selloff may reflect disappointment among institutional investors who were hoping for a fresh hire outside of the company for a reset strategy after a series of marketing disasters, from embracing DEI initiatives to backtracking on all things woke.

The retailer managed to spark boycotts from customers on both sides of the political aisle.

Data compiled by Bloomberg shows the retailer's sales are still shrinking, margins are weaker, and traffic is sliding for the second quarter ended Aug. 2:

Sales Trends

Comparable sales: -1.9% → Negative, but better than expected (estimate -3.0%). Still marks a reversal from last year's +2%.

Digital sales: +4.3% → Growth beat estimates (+3.8%), but it's a big slowdown from last year's +8.7%.

Stores: Store comps were weak at -3.2% (vs. +0.7% last year), though not as bad as feared (-4%).

Customer Behavior

Transactions: -1.3% → fewer customers coming in, compared to +3% last year.

Basket size: -0.6% → each trip was slightly smaller, but not collapsing.

Profitability

Operating margin: 5.2% → down from 6.4% last year, but in line with expectations.

Operating income: $1.32B (-19% y/y), slightly above estimates. Adjusted EPS: $2.05 vs. $2.01 expected → a narrow beat, but well below last year's $2.57.

Gross margin: 29% → still pressured but not collapsing.

Some of the initial reads from the second quarter:

The takeaway from the full-year forecast is that Target is holding guidance steady, signaling the turnaround plan has yet to materialize ahead of the back-to-school shopping period in late summer or early fall:

All in all, the management shake-up set to take effect next February is not surprising given the limited traction in Target's turnaround plan. The mistake the retailer likely made, and why the stock plunged in premarket trading, was failing to bring in fresh outside talent to lead.

Recall last month, Goldman analysts led by Kate McShane told clients that it was "still too early to call a turnaround" in Target.