A Japan-US Trade Deal was announced late on Tuesday, with reciprocal tariffs lowered from 25% to 15%.

Japanese stocks got an additional boost from news that auto tariffs will also be 15%, down from 27.5%, sending Toyota on its best day since 1987. Equities rose over 3.5% with the TOPIX closing just shy of all-time highs. In rates, re-pricing for BoJ hikes sent JPY yields higher; 10y JGB reaching 1.6%. USDJPY initially moved lower but has creeped higher on news of PM Ishiba considering to step down from office. However, PM Ishiba has since denied these reports (unclear just how he plans on staying in power after this weekend's catastrophic loss in the Upper House elections), which in turn hammered the USDJPY again.

Goldman Delta-One head Rich Privorotsky writes that Japanese autos surged double digits after the 15% tariff deal caught the market of, noting that guard (Polymarket had odds of a Japan deal by Aug 1 at ~20% ). In the context of 25% tariffs on Canada and Mexico, Rich thinks the market was "surprised Japan auto's securing a more favorable status, even compared to what some U.S. automakers pay to import their own supply chains." He adds that 15% Japan tariffs would have been unthinkable just months ago, but "now, Japan’s stock market is near all-time highs...art of the deal."

“By accepting a diluted 15% tariff and pledging symbolic investment flows, Japan has offered a blueprint: concede just enough to defuse escalation without triggering deep structural reform,” said Charu Chanana, chief investment strategist at Saxo Markets.

Here are the main Takeaways:

Below we excerpt from a note published by Goldman's trading desk focusing on the market reactions across different asset classes.

Earlier today, it was announced that US Tariffs to Japan will be reduced from 25% to 15%. Japan is the 5th country the US has reached bilateral agreements with following UK (10%) , Vietnam (20%), Philippine (19%), and Indonesia (19%). Notably, this deal includes auto tariffs which go "from from 27.5% (existing tariff of 2.5% + additional tariff 25%) to 15% (existing tariff of 2.5% + additional tariff 12.5%)" and Japan will "invest ¥80 tn in the US, create hundreds of thousands of jobs in the US, and open up the country to trade in automobiles, trucks, and other US agricultural products."

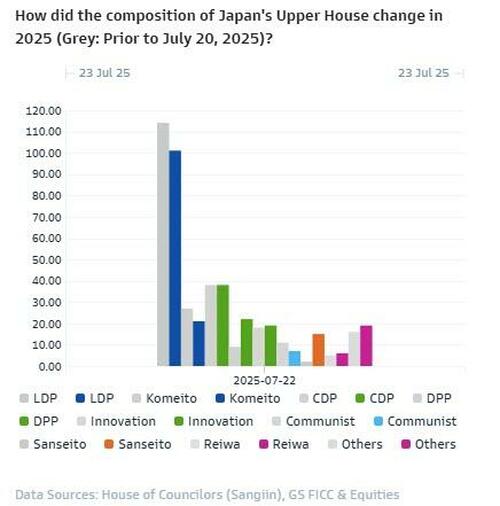

This agreement comes shortly after Japan's Upper House Election over the weekend in which the ruling coalition (LDP + Komeito) lost its majority. Following the defeat, PM Ishiba had indicated his willingness to continue as prime minister, citing the importance of political stability whilst trade negotiations with the US were ongoing.

Source: Goldman

Following the trade agreement, multiple news outlets reported midday that PM Ishiba has decided to step down by the end of August. However, PM Ishiba later denied these reports stating there is no truth to the reports he will be stepping down, even though it is unclear how he can credibly remain in charge after the huge drubbing in the elections.

BoJ Hikes : Pricing Returns to Front-End Yields

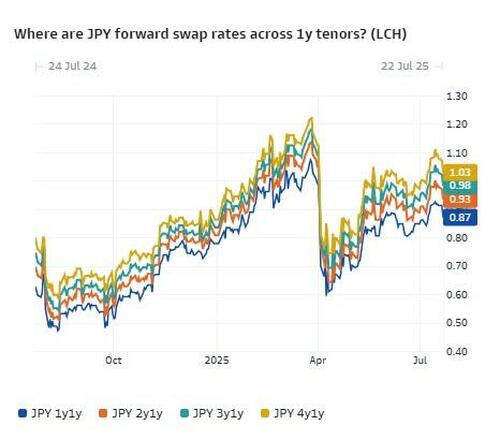

With more clarity around US Tariffs on Japan and announced reduced tariff impact, markets are repricing for an earlier BoJ hike.

According to Goldman STIR trader, Hosik Moon, "[The] Tariff deal has come much earlier than market expected and 15% should be considered satisfying result comparing with other countries. This will potentially pull the timing of BOJ's next hike earlier as the Trump Tariff has been the only reason that pushed the October hike consensus to January next year".

Front-end pricing in JPY Rates has moved higher to reflect this shift in sentiment. 1y1y JPY OIS Swap has risen to 96bp while 2y1y is now at 107bp. Hosik notes that this coincides with levels that "are traded when terminal rate expectations are 1.25%-1.5%".

Moving higher than these levels would require a repricing of terminal rate expectations.

Source: Goldman

JGB Curve: 40y Auction Low Demand, Curve Bear Flattening

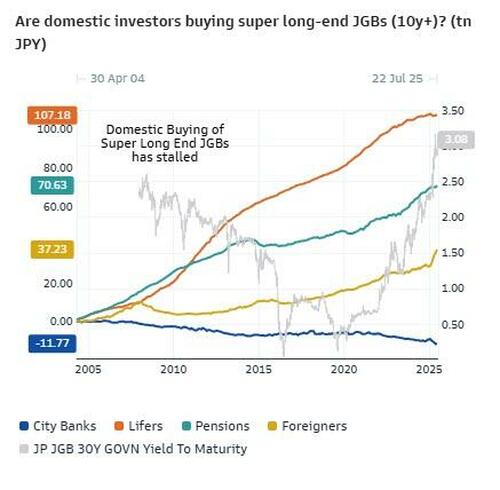

The front-end of the curve led sell-offs on the resurgence of BoJ hiking bets. The belly and back-end of the curve also saw strong selling pressure as 10y JGBs reached 1.6%. The 40y JGB auction also took place today, resulting with the weakest demand since 2011 as supply-demand dynamics have deteriorated in the sector.

Given the Upper House Election results, fiscal expansion concerns will likely continue to drive back-end yields higher. Furthermore, as front-end pricing likely has reached the higher end of its range (that reflects terminal rate of 1.25%-1.5%), the curve can continue to steepen from here.

Goldman Japan rates strategist Sung Mo Koo highlights that "[a]s in Deputy Governor Uchida's press conference today, the agreement contributes to lower uncertainty in Japanese economy and higher likelihood of achieving the 2% inflation target. Market should find better demand at current level for up to 10y sector, whereas the ongoing fiscal concern due to political uncertainty is likely to drive back-end yields higher. Ultra-long end sector has been supported by foreigners in CY2025 as their net purchase amount skyrocketed by more than sevenfold year-to-date, but such trend is unlikely to continue long term."

Source: Goldman

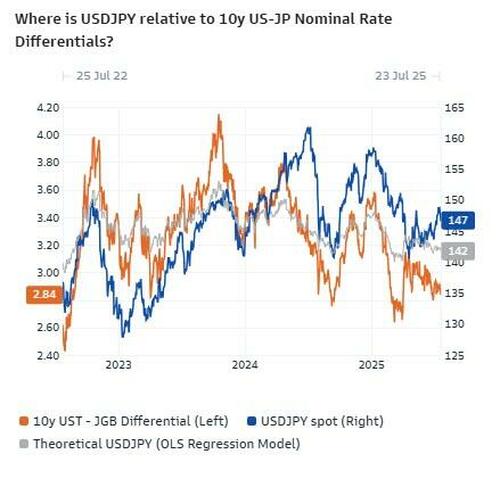

USDJPY : Rangebound, Bouncing on headlines

USDJPY initially moved lower on the back of Japan-US Trade deal. However, headlines around PM Ishiba potentially stepping pushed the USDJPY back above 147. As a result, USDJPY has been stuck range bound in the 146-147 area.

Goldman's FX trader Kentaro Kawahara chimes in and notes that USDJPY remains "in a range with the rates price action in the driver seat". He sees both USD Rates and JPY Rates contributing to the current USDJPY move. In terms of the next catalyst, he notes PM Ishiba stepping down would contribute to fiscal concerns with the outcome dependent on who becomes the next PM. Given the Upper House Election results, fiscal expansion concerns will likely drive USDJPY higher.

At the moment however, more clarity is needed on the political front and USDJPY will remain range bound led by rate differentials.

Source: Goldman

JP Equity: All-time high and abundant with themes

The Topix is close to an all-time high while the Nikkei index closed 3.51% higher. Needless to say, the trade agreement provides a huge boost to Japanese corporations as trade related sectors receive a massive boost to their outlook.

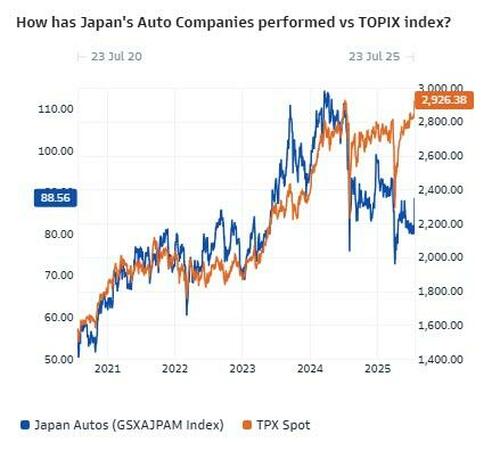

According to Goldman Sales Trader Sophie Stanton, following the tariff announcements, themes around "Exporters vs Domestic Demand have surged". Particularly, beneficiaries of this deal are "AUTOs with better than expected tariff rates (15%) & 15% YTD underperformance vs Topix (GSXAJPAM Index) and USD Earners (GSXAJPIN Index)." On the other hand, Inbound Tourism (GSXAJPTR Index) and Domestic Demand (GSXAJDCO Index) saw retracements as rotation into the prior themes took place."

Source: Goldman

Sophie also highlighted that "Banks are finding bids after being 'neglected' as of late given the improved risk sentiment along with Semiconductors with relative underperformance following global peers".

Source: Goldman

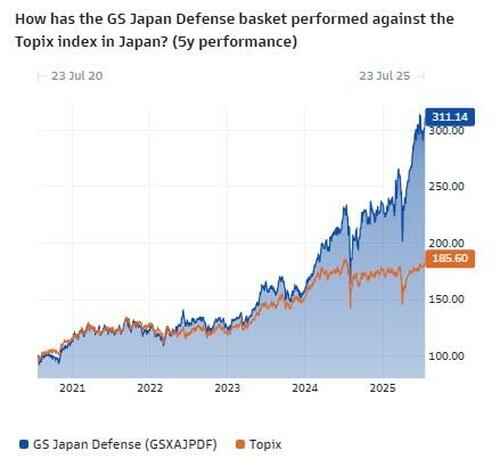

Another interesting theme that has emerged following the Upper House Election results is the decrease in defense spending. Enna Hattori (Equity Derivative Sales) writes that "[i]t's difficult to ascertain where Nikkei goes in the event Ishiba resigns as the market is likely already pricing in the possibility to some degree. That said, the pocket of the market that is most likely to be impacted is Defense, given Ishiba's support for defense spending. The sector remains well-loved, but a resignation could trigger an unwind either in the sector specifically or across MOMO more broadly."