SVB Financial Group, the company whose former subsidiary Silicon Valley Bank was taken over by the Federal Deposit Insurance Corporation last week, filed a voluntary petition for a court-supervised reorganization under Chapter 11 in the Bankruptcy Court for the Southern District of New York to "preserve value."

SVB Financial said it has approximately $2.2 billion of liquidity and cash and its interests in SVB Capital and SVB Securities. It also said it has "other valuable investment securities accounts and other assets for which it is also exploring strategic alternatives."

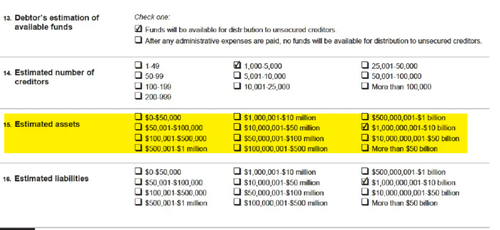

SVB Financial listed assets and liabilities of up to $10 billion in the filing.

SVB Financial said SVB Securities, SVB Capital, and other connected entities aren't included in the Chapter 11 filing. It said those entities would continue to operate normally as "SVB Financial Group proceeds with its previously announced exploration of strategic alternatives for these valuable businesses."

The failed bank already said the potential sale of its alternatives has "attracted significant interest:"

SVB Financial Group intends to use the court-supervised process to evaluate strategic alternatives for SVB Capital, SVB Securities and the company's other assets and investments. As previously announced, this process is being led by a five-member restructuring committee appointed by the SVB Financial Group Board of Directors. Centerview Partners LLC is assisting the restructuring committee with the strategic alternatives process, which is already underway and has attracted significant interest.

SVB Financial noted that funded debt is approximately $3.3 billion in aggregate principal amount of unsecured notes.

"The Chapter 11 process will allow SVB Financial Group to preserve value as it evaluates strategic alternatives for its prized businesses and assets, especially SVB Capital and SVB Securities," said William Kosturos, Chief Restructuring Officer for SVB Financial Group.

Read the full filing here:

*Developing...