Listing service Bright MLS summed up Washington, D.C.'s housing market in one troubling line: "Supply is towering over last year." That's been the trend for the last few months, with active listings well above multi-year averages for this time of the year. Add in the latest surge in mortgage rates—on top of mounting DOGE-related layoffs, now numbering in the hundreds of thousands—and the D.C. metro area appears to be heading toward a combination of housing and labor market pains.

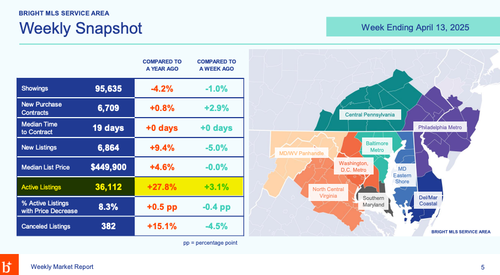

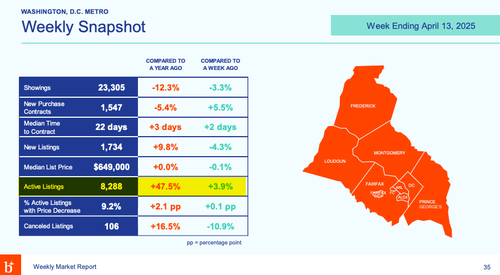

Here are three key takeaways from MLS's weekly report (for the week ending April 13) on the housing markets in Northern Virginia, D.C., and Maryland. The common denominator across all three regions: supply—and a lot of it. Inventory has surged this spring, well above levels seen over the last three years:

A snapshot of MLS' coverage area shows that active listings were up 27.8% for the week ending April 13 compared to the same period last year. Week-over-week, listings rose by 3.1%.

In Washington, DC, active listings were up 47.5% versus the same period one year ago. Week-over-week, listings rose 3.9.%

Visualizing the data...

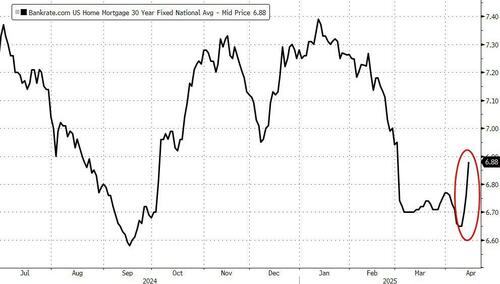

A growing number of homeowners in the D.C. area are listing their properties just as the average 30-year fixed mortgage rate climbed above 7% last week.

Coupled with news of 280,000 DOGE-related federal layoffs and declining consumer sentiment amid escalating trade war headlines, the outlook for the D.C. swamp has been darkening.