THE AMERICA ONE NEWS

Oct 4, 2025 |

0

| Remer,MNSponsor: QWIKET

Sponsor: QWIKET

Sponsor: QWIKET: Sports Knowledge

Sponsor: QWIKET: Elevate your fantasy game! Interactive Sports Knowledge.

Sponsor: QWIKET: Elevate your fantasy game! Interactive Sports Knowledge and Reasoning Support for Fantasy Sports and Betting Enthusiasts.

topic

ZeroHedge

6 Jul 2023

Soaring ADP employment data and tumbling continuing claims are not what The Fed wants to see, and Dallas Fed President Lorie Logan unleashed the hawkish hammer, refinforcing her belief that more restrictive policy is needed for FOMC to reach its goals.

Putting it all together, markets swung chaotically.

Stocks plunged...

Bond yields spiked with 10Y back above 4.00%...

The 2Y Yield spiked back above 5.00% (and above the pre-SVB highs), back to its highest since June 2007...

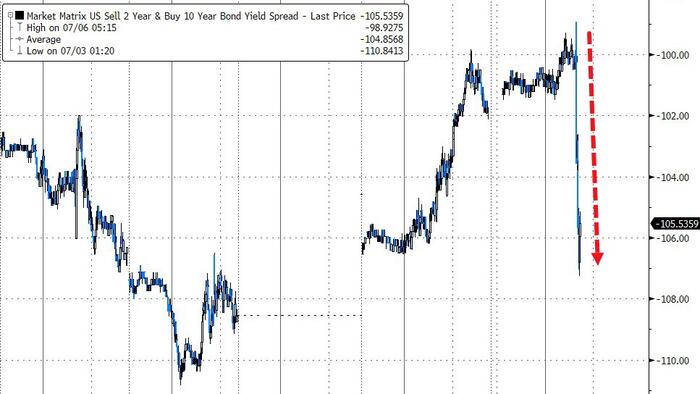

The yield curve crashed...

Gold plunged...

Oil dropped...

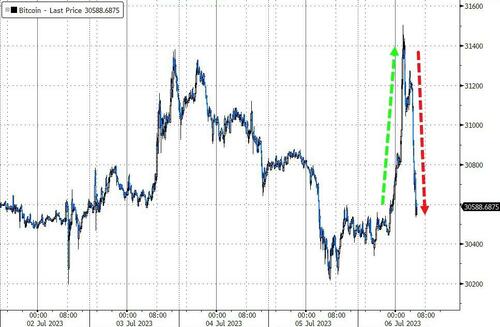

Bitcoin pumped and dumped...

Good news is bad news again and stocks seem to suddenly be aware that higher rates are bad for long duration assets.