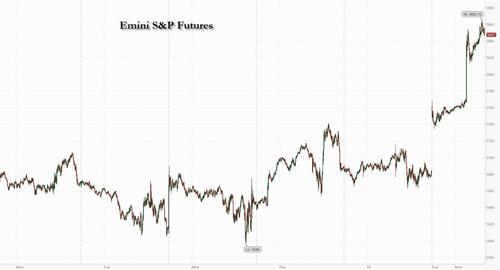

US equity futures and the dollar soared after China and the US agreed to slash tariffs and de-escalate a trade war that had sparked turmoil in global markets. Treasuries and gold tumbled after the US cut China tariffs from 145% to 30% while China slashed US tariffs from 125% to 10% for 90 days. With the countries agreeing that they do not want to de-couple, there is optimism that a longer-term deal can be reached. As of 8:00am, S&P futures surged 3% and Nasdaq futures spiked almost 4%. JPM writes that while Trade War 1.0 tariffs remain, as do sectoral tariffs but, this is an unambiguous positive for all global risk assets and will allow markets to look through any near-term weakness in macro data but if CPI, PPI, and Retail Sales surprise to the upside, then that will provide another tailwind to risk assets. Premarket Mag7 names are higher with many up more than 3%, Semis/Cyclicals are also higher as the market will need to reset its growth expectations higher. Commodities are higher, led by Energy, despite a spike in bond yields/USD.

In premarket trading, Magnificent Seven stocks jumped as trade tensions ease: Apple rises 6.3% after the WSJ reported that the company is considering raising iPhone prices (Amazon +7%, Tesla +7.9%, Meta Platforms +5%, Nvidia +4.8%, Alphabet +2.8%, Microsoft +2.2%). Pharmaceutical plunged fall after US President Donald Trump said he planned to order a cut in US prescription drug costs to bring them in line with other countries, prompting concern that profits will take a hit (Eli Lilly -4%; Pfizer -2.7%, Bristol-Myers Squibb -2%, Merck -3%). Semiconductor, travel, shipping and consumer stocks also rally on trade news (Advanced Micro Devices +7%, Delta Air Lines +7%, United Parcel Service +4%, Nike +6%, Estee Lauder +6%). Precious metals mining stocks dropped as gold falls, with demand for haven assets declining as the US and China agree to lower tariffs on each other’s products for 90 days (Barrick Mining Corp. -5%, Coeur Mining -6%). Here are some other notable premarket movers:

Risk appetite erupted across the globe after Treasury Secretary Scott Bessent hailed the trade discussions as “very robust and productive.” US megacap tech stocks, which had been hard hit this year, were on track to tally some of the biggest gains, pushing Nasdaq 100 futures up 4%, with the index set to re-enter a bull market. The dollar topped a one-month high. Gold fell more than 3%. The 10-year Treasury yield climbed seven basis points to 4.45% as traders pushed back the timing of possible interest-rate cuts.

The breakthrough in the China-US talks delivers a shot of relief to investors who were bracing for the possibility that a spiraling trade war between the world’s biggest economic powers might cause a global recession. The countries will lower tariffs on each other’s products for 90 days, according to a joint statement released in Geneva.

“The risk of a deep and protracted US recession has gone,” said Guy Miller, chief market strategist at Zurich Insurance Co. “From a company earnings perspective the headwind to revenues has clearly diminished.”

The trade war has been the biggest driver in markets this year and investors went into the weekend talks eager for clear signs the rebound from Trump’s “Liberation Day” announcement of tariffs on April 2 could be sustained. Rounds of retaliation had raised US levies on imports from China to 145%, while the Chinese put in place a 125% duty on US goods. That stoked fears of stagflation and recession, even though calmer minds warned that all of this was just negotiating strategy by the White House.

“In our view, equity markets are returning to where they would have moved to if Liberation Day had not happened and Trump had just applied the 10% universal tariff,” said Roberto Scholtes, head of strategy at Singular Bank. “Corporate fundamentals are healthy, first quarter results have substantially surprised on the upside, and there’s plenty of cash to be invested.”

Not everyone was celebrating however: pharmaceutical companies missed out on the broader rally as drug-company stocks fell across the world after Trump said he planned to order a cut in US prescription costs to bring them in line with other countries, prompting concern that profits will take a hit. Trump said in a social media post that he’ll sign the executive order at 9 a.m. Monday in Washington. Novo Nordisk A/S, AstraZeneca Plc and Roche Holding AG slid, while in Asia, the pharmaceuticals subgroup in Japan’s Topix Index posted its biggest one-day loss since August. Shares in US drugmakers were also weaker, with Eli Lilly, Pfizer, Bristol-Myers Squibb and Merck all down in premarket trading in New York.

Elsewhere, shares in India jumped almost 4% and those in Pakistan rallied 9% after the two nations agreed to an immediate ceasefire after four days that saw the worst fighting between the countries in half a century. And after a weekend of hectic diplomacy, Ukraine’s Volodymyr Zelenskiy said he will travel to Istanbul on May 15 where Russian President Vladimir Putin has proposed direct negotiations between the two countries.

In Europe, the Stoxx 50 rallied 1.7%. Miners, consumer products and tech are the strongest-performing sectors in Europe. FTSE 100 lags, adding 0.4%, as shares of pharmaceutical companies fall globally after President Donald Trump’s plan to cut US drug prices. Here are the biggest movers Monday:

Earlier in the session, stocks in Asia jumped after the US and China said they will temporarily lower tariffs on each other’s products, a move that gives the world’s two largest economies more time to resolve their differences. The MSCI Asia Pacific Index advanced as much as 1.2% Monday, headed for its highest close since October. Chinese tech sector leaders Tencent and Alibaba, as well as South Korea’s Samsung Electronics, offered the biggest boosts to the benchmark. The risk-on rally was evident from the opening in the region’s markets, with investors remaining optimistic that the US and China would reach a deal after they touted “substantial progress” on their trade discussions. The combined 145% US tariffs on most Chinese imports will be reduced to 30%, while the 125% Chinese duties on US goods will drop to 10%, according to a statement and officials in a briefing Monday.

In FX, the Bloomberg Dollar Spot Index eyes its best day since April 4 as it climbs by as much as 1%. The euro falls as much as 1.5% to $1.1084, on track for its worst day this year. Haven currencies and assets underperform; JPY and CHF lag G-10 peers.

In rates, front-end bonds lead a broad selloff. Bund, Treasury and gilt curves all bear-flatten. The US 10-year yield climbs 7 basis points to 4.45%, its highest in nearly a month. Japan’s 30-year government bond yield climbs to its highest level in almost 25 years.

In commodities, oil leads a commodity rally. Brent crude added as much as 3.7% in London to above $65 a barrel and copper rose 1.4%. Most base metals trade in the green while spot gold falls roughly $100 to near $3,229/oz. Spot silver loses 1.6% near $32. Bitcoin fades gains after failing to break above its January record high, trading around $104,535.

Today's US data slate includes April Federal budget balance at 2pm; besides CPI, retail sales, PPI and University of Michigan sentiment are ahead this week. Fed speaker slate includes Kugler at 10:25am. Chair Powell is scheduled to give remarks on the framework review at the Thomas Laubach Research Conference on Thursday

Market Snapshot

Top Overnight News

Tariffs/Trade: In one line: US and China agree to bring down reciprocal tariffs by 115ppts for 90 days, sparking immediate risk on price action; DXY, ES, Crude bid; XAU & Fixed hit

CHINA'S STATEMENT ON U.S.

US TREASURY SECRETARY BESSENT

USTR GREER

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week with mild gains amid hopes related to a US-China trade deal after substantive progress was said to have been made during talks in Switzerland over the weekend, but with gains capped given a lack of details announced so far and with the sides to provide a joint statement later today. ASX 200 was led higher by the commodity-related sectors with outperformance in energy after the recent oil rally. Nikkei 225 advanced at the open with the help of a weaker currency but then briefly wiped out all of the gains with pressure seen in pharmaceuticals after US President Trump announced he will sign an executive order on Monday with prescription drug and pharmaceutical prices to be reduced almost immediately by 30%-80%. Hang Seng and Shanghai Comp were underpinned following US-China trade talks over the weekend in which both sides noted that progress was made and they agreed to establish a China-US trade consultation mechanism, although further upside was capped given the actual lack of details and after Y/Y Chinese CPI and PPI remained in deflation.

Top Asian News

European bourses are broadly in positive territory with sentiment in Europe boosted after the US and China agreed to lower tariff levels by 115ppts each for a period of 90-days. The announcement sparked immediate upside across the equities complex, and now currently resides just off highs; DAX 40 +1.2%, Europe paring given Bessent's "EU is much slower" language. To recap the main points; 1) US to cut tariffs on Chinese goods to 30% (prev. 145%) for 90 days, 2) China to cut tariffs on US goods to 10% (prev. 125%) for 90 days, 3) Bessent said both sides came to an agreement, 4) there was no discussion on currency with China, while fentanyl remains an issue. European sectors are mostly firmer, with the risk-tone boosted after the aforementioned US-China talks. The typical cyclical sectors outperform today, with the likes of Basic Resources and Autos leading whilst Utilities is towards the foot of the pile. Healthcare underperforms in Europe today, with pharma names broadly in the red after US President Trump said he will sign an executive order on reducing the price of prescription drugs, by 30-80%. Roche (-3.2%), AstraZeneca (-3.5%).

There is some underperformance in Novo Nordisk (-5.9%) after Eli Lilly’s study suggests Zepbound outperforms Novo’s Wegovy for weight loss.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: India-Pakistan

US event calendar

Central Banks (All Times ET):

DB's Jim Reid concludes the overnight wrap

I'm off to the West Coast this morning. LA and San Fran rather than Cornwall or Wales, although I think the latter two are warmer than the former two at the moment. I coached my first U8 cricket match over the weekend in glorious sunshine and my record as coach is now 100% positive. I saw enough weaknesses though to suggest that record might not last forever. Hopefully the board give me time to work my own ideas into the team.

Let's start with all the weekend news which includes "positive" US/China trade talks, a Ukrainian and European (and US backed according to Macron) 30-day ceasefire plan for the war, and an Indian/Pakistan ceasefire (mediated by the US). The US/China talks seemed to go well but remember with tariffs currently at 145% and 125% it doesn't take much to improve the situation. Treasury Secretary Bessent and Greer (US Trade Representative) suggested "substantial progress" was made even if neither side has announced any specific measures. China’s Vice Premier He Lifeng stated that both sides had reached an "important consensus" and agreed to launch another new economic dialogue forum. Bessent had indicated that the US and China will jointly provide details on the progress at some point today so we will see if we get this.

On the war in Ukraine, Zelenskiy and European leaders have demanded a 30-day ceasefire from today to allow for negotiations. If this doesn't happen Russia will face new sanctions that the US has seemingly approved according to Macron. Putin in return has countered and agreed to talks in Turkey with Ukraine on Thursday without addressing the ceasefire issue. Rather ambiguously Mr Trump said that Ukraine should “IMMEDIATELY” agree to the talks, as “at least they will be able to determine whether or not a deal is possible”. So we do seem to be moving towards talks but it's unclear on what terms.

Elsewhere, after four days of tense clashes that pushed India and Pakistan close to war, a ceasefire appears to be holding after being announced on Saturday. The US played a role in encouraging a de-escalation, facilitating behind-the-scenes talks that led to the agreement between the two nuclear-armed nations. The NIFTY 50 has surged +2.88% as I type in early trading.

Moving to broader Asian markets, equities are edging higher on all the weekend news. Chinese stocks are outperforming with the Hang Seng (+0.93%) leading gains while the CSI (+0.62%) and the Shanghai Composite (+0.37%) are also trading in positive territory. Elsewhere, the KOSPI (+0.65%) and the S&P/ASX 200 (+0.22%) are also trading up while the Nikkei (+0.04%) is fairly flat. S&P 500 (+1.46%) and NASDAQ 100 (+1.95%) futures are rallying harder on the trade progress though with 10yr USTs +2.7bps higher, at 4.406% as we go to print.

In terms of economic data over the weekend, China's factory-gate prices (-2.7% y/y) posted the steepest drop in six months in April, worse than a -2.5% decline in March while "better" than Bloomberg’s forecast for a -2.8% decline. At the same time, consumer prices eased -0.1% y/y last month, matching a -0.1% drop in March and the Bloomberg forecast.

Staying with inflation, the main event this week will be US CPI tomorrow but generally we start the April hard data reporting cycle now and it'll be interesting to see any early impact of Liberation Day. It might be a bit too soon but watch CPI and PPI (Thursday), US Retail Sales (also Thursday) and Consumer Confidence and Housing Starts and Permits (both Friday), alongside some regional manufacturing surveys in the US. Within the Consumer Confidence data the inflation expectations will continue to be very important and something the Fed are looking at. Talking of which, Powell speaks on Thursday.

Moving on to European data, this week's highlights include March's monthly GDP (Thursday) and labour market indicators (tomorrow) in the UK and the May ZEW survey in Germany (also tomorrow). Over in Asia, Japanese Q1 GDP (Friday) is the highlight (DB expect -0.4% QoQ annualised) but the BoJ summary of opinions from the April meeting is also out tomorrow. The full day-by-day week ahead is at the end as usual.

Looking into the main US upcoming data in more detail, for US CPI tomorrow, DB expect the headline (+0.26% forecast vs. -0.05% previous) number to be slightly below that of core (+0.29% vs. +0.06%) with consensus for both at 0.3%. Both DB and consensus expect the YoY rate to remain unchanged at 2.4% and 2.8%, respectively. One of the main reasons our economists are expecting a firm core goods print is due to strong gains in vehicle prices after robust new vehicle sales in recent months. The risk to this month though is that dealers refrained from price rises in April knowing that with tariffs coming they will have to raise them soon. So we know auto price rises are coming but it may not be April.

Indeed April overall may be too early for tariff price rises to show up but our economists advise looking out for any early signs in some of the import-heavy categories such as apparel and household furnishings and supplies. In addition food prices could be another place to look for any early signs of the tariffs that went into place in February. Our economists note, that the effects from the washing machine tariffs in early 2018 took about two months to start showing up in the CPI data. Regular readers will note that perhaps I need to buy my new tumble dryer quickly.

For PPI on Thursday, DB and the consensus expect a 0.3% monthly print on headline and core but we'll pay more attention to the components that feed into core PCE as usual. Retail sales on the same day will be the other big release of the week. Our economists expect slight dips in auto sales and gasoline prices to weigh on headline (unch. vs. +1.5%) and ex-autos (+0.2% vs. +0.6%) sales. However they expect retail control (+0.4% vs. +0.4%), which feeds into GDP, to remain solid. The potential curveball is if consumers have front loaded purchases ahead of tariffs and we get strong data. Thursday is a busy day as Powell speaks and this will provide him with an opportunity to comment on the data if he's sees anything meaningful within it. So one to watch especially given that Powell said last week that "we don't know which way this is going to shake out".

Quickly rounding out events in politics, there will also be Eurogroup (today) and Economic and Financial Affairs Council (tomorrow) meetings in Brussels. An informal gathering of NATO foreign ministers will take place in Antalya on May 14-15. In Asia, APEC trade ministers meet in South Korea on May 15-16 and the sixth meeting of the European Political Community will take place in Albania on Friday.

Recapping last week now and the risk-on tone continued at a global level, with markets mostly seeing a further unwind of their moves since Liberation Day. That was driven by several factors, including hopes for a de-escalation between the US and China, not least given the news that they’d be starting talks in Switzerland. That was further support by the deal the US reached with the UK, raising hopes that further agreements might follow shortly. Then on top of that, several data releases continued to point away from a recession, which gave a further boost to support risk appetite. For instance, the ISM services index unexpectedly rose to 51.6 in April, whilst the weekly initial jobless claims fell back to 228k as well.

That backdrop generally proved supportive for markets, with several equity indices moving higher last week. That included the DAX, which hit a new record as it posted a fourth consecutive weekly advance, rising +1.79% (+0.63% Friday). Similarly in Japan, the Nikkei also posted a fourth weekly gain, up +1.83% (+1.56% Friday). However, the main exception to this pattern were actually US equities, with the S&P 500 down -0.47% over the week (-0.07% Friday).

More broadly, there were several other signs that stability was returning to markets. For instance, the VIX index of volatility fell to its lowest level since Liberation Day, closing at just 21.90pts on Friday. Credit spreads tightened further, with US HY down -9bps last week (+1bps Friday) to 343bps. Other risk assets climbed as well, and Bitcoin ended Friday at $103,195, which was its highest level since January. Meanwhile, Brent crude oil prices recovered from their 4-year low at the start of the week, moving up +4.27% over the week as a whole to $63.91/bbl.

Finally, the risk-on move put sovereign bonds under pressure, and yields moved higher as the Fed’s latest meeting signalled they weren’t in a rush to cut rates. That helped push the 10yr Treasury yield up +7.0bps (flat on Friday) to 4.38%, and the 2yr yield also rose +6.7bps (+1.6bps Friday) to 3.89%. Over in Europe, the 10yr bund yield also rose +2.9bps (+2.9bps Friday) to 2.56%. And over in Japan, the 10yr bond yield was up +10.5bps, closing at 1.37%.