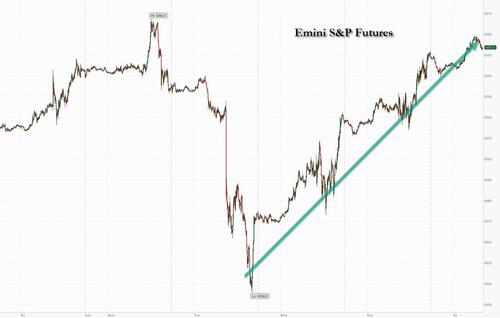

After stocks successfully recovered from a mid-week rout following the much hotter than expected CPI print, resulting in a burst of BTFD and flurry of 0DTE buying, on the last day of the week, S&P 500 futures were up 0.2% - amid bigger gains in European stocks ...

... and were on pace to dodge a weekly red candle in the process setting up a record 15th weekly gain of the past 16, as the market no longer drop. Ever. Meanwhile, the euphoria was even more ridiculous over in tech world where Nasdaq futures accelerated their silly meltup, rising 0.5%, propelled by Applied Materials rising ~13% in premarket trading while the current generation's Gamestop, Supermicro, was up another 6% premarket, sending its RSI to a record 98.

Treasuries declined, sending the 10Y yield up 3bps to 4.27% after Atlanta Fed President Raphael Bostic said there’s no rush to cut rates with the US labor market and economy still strong.

In premarket trading, Applied Materials, the largest US maker of chipmaking machinery, jumped 13% in premarket trading after giving a bullish revenue forecast that signalled some of the largest semiconductor companies are increasing their investments in new production. The update pushed up shares in European peers including Aixtron SE and ASML Holding NV. Here are some other notable premarket movers:

The S&P 500 climbed to its latest record high Thursday, erasing all this week’s losses, as a drop in US retail sales tempered investor worries about overheated consumer demand. Data on US producer prices later will draw higher-than-usual scrutiny after a hot consumer price index earlier this week roiled financial markets, with traders resetting their bets on Fed rate-cuts in 2024.

Meanwhile the latest bubble euphoria just won't stop, as US equity funds registered inflows of $11 billion in the week through Feb. 14, the most in seven weeks, according to Bank of America. On the downside, breadth of the S&P 500 is currently the weakest since 2009 as the top five stocks in the index have fueled 75% of its gain so far this year, according to the Bank of America report.

“Q4 earnings have helped equities to cope with rates volatility,” said Emmanuel Cau, a strategist at Barclays Plc, in a note to clients. “Sticky US inflation keeps Goldilocks in check, but post the latest hawkish repricing, rates expectations have converged more toward the Fed forecasts.”

European stocks rise for a third day meanwhile, tracking a broadly positive session in Asia. Mining stocks led the advance in Europe that took Europe’s Stoxx 600 index to its fourth consecutive week of gains. Glencore Plc and Anglo American Plc both rose more than 3% amid optimism of a rebound in Chinese demand for metals. European commercial real estate stocks also gained after major US peer CBRE Group reported strong fourth-quarter earnings and suggested the worst was over for the downtrodden market for office leasing. Shares of CBRE, the world’s largest commercial real estate stock, jumped to the highest level in almost two years. Here are the most notable movers in Europe:

Earlier in the session, Asian stocks gained as Japanese equities steamed closer to their first record high in 34 years and Hong Kong stocks extended their rally to a third day. The MSCI Asia Pacific Index climbed as much as 1%, headed for its highest close since April 2022. Japan’s Toyota, Recruit Holdings and Mitsubishi UFJ Financial contributed most to the advance. The regional gauge is on course for a fourth-straight week of gains, its longest win streak in over a year. Key measures were higher in nearly every market except Taiwan.

In FX, the pound is down 0.1% having briefly gained after UK retail sales topped estimates. The yen is the weakest of the G-10 currencies, falling 0.2% versus the greenback.

In rates, treasuries were slightly cheaper across the curve, holding losses from Asia session after Fed Atlanta President Raphael Bostic said there’s no rush to cut rates with the US labor market and economy still strong. “My expectation is that the rate of inflation will continue to decline, but more slowly than the pace implied by where the markets signal monetary policy should be,” Bostic said in a speech Thursday in New York. He said policy decisions would be taken “without oppressive urgency.”

As a result, TSY yields are cheaper by 2bp-3bp across the curve with 5s30s spread flatter by around 1bp as belly and front-end underperform; 10-year yields around 4.26%, slightly outperforming bunds and gilts in the sector. According to Bloomberg, dollar issuance slate empty so far; Intel and British American Tobacco headlined a six-deal, $6.8b calendar Thursday, bringing this week’s volume to $37b. Early expectations for next week are in the $45b to $50b range, with some acquisition-related offerings possible

In commodities, oil prices decline, with WTI down 0.9% near $77.35 though near the highest close in three months as the risk-on mood in wider markets and signs OPEC+ members are complying with supply cuts overshadowed a gloomy demand outlook from the IEA. Spot gold is flat around $2,006/oz.

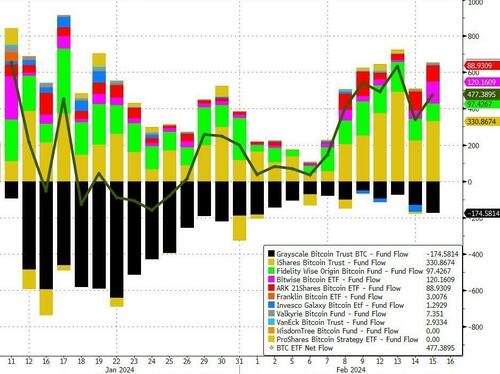

Bitcoin is firmer on the session, though still holds just shy of the USD 52k mark, as bitcoin ETF inflows just won't stop.

Turning to the day ahead, the US economic data calendar includes January PPI data, January housing starts/building permits, February New York Fed services business activity (8:30am) and February preliminary University of Michigan consumer sentiment (10am). Scheduled Fed speakers include Barkin (8am), Barr (9:10am) and Daly (12:10pm). Elsewhere we have the UK January retail sales and the Canadian International securities transactions.

Market Snapshot

Top Overnight News

Earnings

A more detailed look at global markets courtesy of Newsquawk

APAC stocks sustained the positive momentum from Wall St where yields softened after the US data deluge. ASX 200 was led higher by the mining sector but with the upside capped as large insurers faltered post-earnings. Nikkei 225 rallied and briefly approached within 100 points of its record high before reversing some of the gains. Hang Seng climbed back above the 16,000 level with notable gains in biopharmaceuticals and property with the latter underpinned after a court dismissed liquidation petitions against Chinese developer Logan Group.

Top Asian News

European bourses, Stoxx600 (+0.6%) began the session entirely in the green and continued to grind higher throughout the morning. The AEX (+1.0%) is the European outperformer, lifted by strength in semi-conductor names after US-listed Applied Materials (+13.2%) reported strong earnings after-hours; BE Semiconductor (+3.2%), ASM (+3.2%), ASML (+1.3%). European sectors hold a positive tilt, with Basic Resources leading, boosted by higher underlying base metal prices. Tech benefits in a read-across from Applied Materials results. Telecoms lags, hampered by losses in Vodafone (-1.0%). US Equity Futures (ES +0.2%, NQ +0.5%, RTY +0.1%) are mixed, with clear outperformance in the NQ, with optimism permeating within the index after Applied Materials (+13.2%) reported strong results.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Yesterday was a busy one in terms of data, with a complicated message coming out of the releases ahead of what’s become the most important US PPI print for a while today. PPI will provide an update on some key services components of PCE inflation, including healthcare, airfares, and portfolio management. The first two of these areas saw strong increases in the CPI print earlier this week, but this often does not match the details of the PPI all that closely.

In contrast to that hot CPI print earlier this week, yesterday’s retail sales print threw a conflicting message to that we’ve become accustomed to in recent weeks. The markets largely took what was mixed data in their stride though, with the S&P 500 (+0.58%) managing to post a new all-time high, while 10yr Treasuries (-2.5bps) were well off the yield lows for the day by the close.

Onto that data, and the headline US retail sales missed to the downside, falling -0.8% month-on-month (vs -0.2% expected), and with the December reading revised down from 0.6% to 0.4%. This is the weakest report since last March and showed a broad-based cooling with nine of the 13 spending categories declining. Seasonal factors can sometimes lead to a steep fall in January after the end of the holiday season, but the details of this print and the December revision were not suggestive of this. The retail control group, which excludes vehicles, gas, food services and building materials, and has the strongest correlation with the GDP number, also fell -0.4% (vs 0.2% expected), the first decline since last March. Moreover, retail control growth was revised lower for both December (from +0.8% to +0.6%) and November (from +0.5% to +0.2%). Interestingly, non-store retailers like Amazon accounted for most of the decline in retail control. The category had been a supportive force for retail spending in previous prints.

Adding to the data weakness, industrial production for January also came in softer than expected, falling -0.1% month-on-month (vs 0.2% expected). These reports point to a potential loss of US growth momentum at the start of the year and from a weaker starting point, with the Atlanta Fed GDP nowcast for Q1 down from 3.4% to 2.9% as a result. That said, this is still very decent and other data yesterday was less downbeat. Weekly jobless claims came in modestly below expectations at 212k (vs 220k expected) even if continuing claims rose more than expected to 1895k vs (1880k expected). To continue with the flip flopping nature of the data, we also saw the US February Philadelphia Fed factory index post an upside surprise of 5.2 (vs -8.1 expected), up from -10.6. This is the first-time we’ve seen a positive reading since last August, pointing to improved industrial conditions for the district.

The opening equity reaction to the data was largely neutral but positive sentiment then dominated through the course of the day, with the S&P 500 (+0.58%) closing at another all-time high. This was a broad rally with banks (+2.91%) and energy stocks (+2.48%) the best performers within the S&P 500. Bank outperformance saw the KBW regional bank index rise by +3.64%, its strongest gain in two months. Small caps also posted strong gains, as the Russell 2000 (+2.45%) reached a YTD high 2 days after seeing its worst fall since June 2022. On the other hand, tech stocks underperformed, with the NASDAQ (+0.30%) and the Magnificent 7 (+0.20%) posting only modest gains.

There were some contrasting moves within the Magnificent 7. Tesla rallied +6.22% as a filing showed Elon Musk increasing his stake in the company. At the other end, Alphabet lost -2.17% on news that OpenAI was developing a web search product that could compete with Google. Nvidia also retreated -1.68% from its all-time high. For more on Nvidia, and the 2024 outlook on semiconductors, see our chartbook earlier this week here. There were some more encouraging news for chipmakers late on as Applied Materials, the largest US market of chipmaking machinery, posted upbeat sales guidance.

On the rates side, we initially saw a sizeable rally on the back of the US releases, as December 2024 Fed funds futures fell by 8bps, but this move reversed by the end of the trading session, with the amount of cuts expected by the December meeting unchanged on the day. Fed fund futures have given up another 10bps of 2024 cuts overnight, after Atlanta Fed Governor Bostic said he was “not yet comfortable that inflation is inexorably declining to our 2% objective”, suggesting it may take “some time” for this rate-cut condition to be met. As we go to print ECB Villeroy (slight dove) has just been quoted as saying that the "risk of cutting too late at least as big as too early".

10yr Treasury yields fell by c. 3pbs immediately after the data, trading almost 7bps lower on the day, but retraced much of the decline to finish the day down -2.5bps at 4.23%, while 2yr yields were down -0.4bps, having traded -8bps down early on. This backdrop saw the broad dollar index decline for the second day in a row (-0.41%) after its three-month high on Tuesday. Overnight, yields have edged back higher with 10yr and 2yr yields both c.+2.5bps to trade at 4.255% and 4.60% respectively.

Over In Europe, fixed income sold off yesterday, as 10yr bunds rose +2.3bps, while OATs (+1.5bps) and BTPs (+0.5bps) saw more modest weakness despite dovish remarks from Malta central bank governor Scicluna, who stated he was “open to rate cut in March as inflation fades”. He is the first to throw in explicit backing for an imminent cut, but also lies clearly on the dovish end of the Governing Council.

Over in the UK, data showed that the economy slipped into a technical recession in the second half of last year, as GDP fell by a larger-than-expected -0.3% quarter-on-quarter in Q4 (vs -0.1% expected and -0.1% prev.), driven by weak consumption and net trade. This saw the expected 2024 BoE rate pricing fall intraday, but this reversed shortly after with 75bps of 2024 cuts priced by the close. The FTSE 100 rose +0.38%. Gilts were largely flat on the day, with the 10yr yield up +1.0bps.

Asian equity markets are extending overnight gains on Wall Street with Hang Seng (+2.44%) leading the way and with the Nikkei (+0.97%) hitting a fresh 34-year high and within touching distance of its all-time high level of 38,916 which was set as long ago as December 1989. Elsewhere, the KOSPI (+1.20%) and the S&P/ASX 200 (+0.68%) are also higher with markets in China remaining closed for the Lunar New Year holidays. US stock futures are fairly flat.

Early morning data showed that the unemployment rate in South Korea dropped more than expected to 3.0% in January compared to a downwardly revised +3.2% level in December. The stronger than expected data indicates that the nation’s labour market remains tight.

Briefly on commodities, oil gained yesterday even as the International Energy Agency trimmed its 2024 demand growth projection relative to January’s forecast. Brent crude rose +1.54% to $82.86/bbl, and WTI crude by +1.81% to $78.03/bbl.

Now to the day ahead. In terms of US data, we have January PPI, housing starts, building permits, the February University of Michigan survey, New York fed services business activity. Elsewhere we have the UK January retail sales and the Canadian International securities transactions. We will also hear from the Fed’s Daly and Bostic, and the ECB’s Schnabel.