US equity futures are flat at the end of a hectic earnings week and the return of meme traders in force. The market is waiting for next week's trading deluge when nearly 30% of the S&P reports, as well as additional trade deal headlines ahead of the Aug 1 tariff deadline, with focus on a potential 15% tariff rate deal with the EU. As of 8:00am ET S&P and Nasdaq futures are unchanged. Pre-market, megacap tech stocks are mixed with AAPL (+0.4%) leading gains and TSLA lagging (-0.9%); Energy is outperforming. Yields are higher as is the USD; 2-, 5-, 10-, 30-yr yields are 0.49bp, 1.25bp, 1.81bp, 2.69bp higher, with the 10Y tradinbg at 4.41%. Commodities are mixed with oil higher, while base and precious metals are lower. On today's calendar we get the June preliminary durable goods orders (8:30am) and July Kansas City Fed services activity (11am).

In premarket trading, magnificent Seven stocks are mixed (Apple +0.3%, Meta +0.3%, Microsoft +0.3%, Amazon +0.4%, Alphabet +0.3%, Nvidia -0.2%, Tesla -0.3%).

Traders have eased back on a rally that took the S&P 500 to its 10th record high in 19 days amid optimism around trade deals and corporate earnings. Next week is the busiest of the earnings season and investors are looking to the Federal Reserve’s interest-rate meeting on July 30 after data reduced the case for further cuts.

“Markets now see a greater chance that the Fed Chair will maintain a hawkish tone at the upcoming meeting” said Hebe Chen, an analyst at Vantage Markets in Sydney. “Political dynamics and economic indicators reinforce a more cautious Fed stance.”

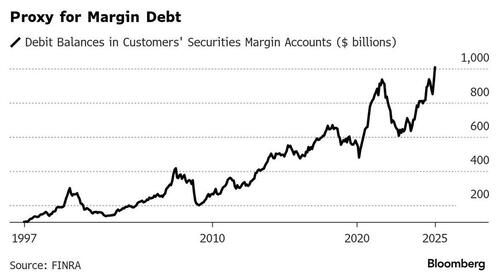

Bubbly valuations are also giving BofA's Michael Hartnett pause, although there are no signs of a reversal yet and the S&P 500 is set to notch a third month of solid gains. Hartnett warned of a “bigger retail, bigger liquidity, bigger volatility, bigger bubble” as global central banks ease policy and governments loosen financial regulation. US margin debt is starting to run too hot — a potentially concerning sign for the credit market, according to Deutsche Bank credit strategists. As shown below, brokerages have extended a record $1 trillion in margin credit to clients in June.

Europe's Stoxx 600 falls 0.3% as disappointing earnings fueled worries about the impact of tariffs. The financial services and telecommunications sectors were the biggest laggards, while consumer products and automobile stocks outperformed. Here are the biggest movers Friday:

Earlier in the session, Asian stocks fell, ending a six-day rally, as investors braced for the US tariff deadline and a Federal Reserve policy decision due next week. The MSCI Asia Pacific Index dropped as much as 1.2%, set for its worst loss since June 19. Tencent and Alibaba were among the biggest drags, while Shin-Etsu Chemical shares sank in Tokyo on weak guidance. Hong Kong led declines among regional gauges, with notable losses also in Japan, mainland China and India. Japanese stocks slipped as investors took profits from this week’s strong rally, while disappointing earnings from some manufacturers hurt sentiment. The Nikkei gauge fell 0.9%. Elsewhere, Vietnamese shares rose to a record high, aided by the return of foreign fund inflows amid optimism about a trade deal with the US. The benchmark VN Index rose 0.7% at the close, surpassing its last high in January 2022.

In FX, the Bloomberg Dollar Spot Index is up 0.3%, rising for a second day after US President Trump downplayed his clash with Fed Chair Jerome Powell during a tour of the central bank’s renovation project on Thursday. The yen is the weakest of the G-10 currencies, falling 0.6% against the greenback having only found a modicum of support after Bloomberg reported Bank of Japan officials see the possibility of mulling another interest-rate hike this year. The pound also underperforms after UK retail sales rose less than forecast.

In rates, ten-year US Treasury yields rose two basis points to 4.42%. Euro-area government bonds extended their post-ECB selloff as traders continue to reduce their bets on a final interest-rate cut by the central bank this year this year. German 10-year yields rise another 5 bps to 2.76%. Gilts also decline, albeit to a lesser extent.

In commodities, gold extended a decline on Friday as the dollar rose after Donald Trump downplayed his clash with Federal Reserve Chairman Jerome Powell. Oil was steady on optimism over US trade talks ahead of a key deadline next week, and as tightness in diesel markets boosts sentiment. WTI rises 0.2% to near $66.19 a barrel. Spot gold falls $21 to near $3,347/oz. Bitcoin drops 3% and below $116,000.

On today's calendar, we have only the June preliminary durable goods orders (8:30am) and July Kansas City Fed services activity (11am). Fed officials remain in a communications blackout ahead of their July 30 rate decision.

Market Snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were lower after the mixed performance in the US and with light catalysts for markets outside of earnings. ASX 200 mildly retreated with the downside led by underperformance in key industries including mining, materials, resources and financials, while Whitehaven Coal failed to benefit despite posting higher quarterly output and sales. Nikkei 225 gave back some of this week's gains amid profit taking despite a weaker currency and mostly softer Tokyo CPI. Hang Seng and Shanghai Comp conformed to the downbeat mood but with the downside in the mainland cushioned after a firm PBoC liquidity effort which resulted in a net daily injection of around CNY 602bln via 7-day reverse repos, while participants await next week's US-China trade discussions in Sweden.

Top Asian News

European bourses (STOXX 600 -0.4%) opened lower across the board, continuing the downbeat mood seen in the APAC session. Downside which extended in the morning, but more recently a slight bounce has been seen across a few major indices such as the Euro Stoxx 50 and STOXX 600. European sectors hold a strong negative bias, with only a couple of industries holding afloat. Autos were initially the underperformer, but then flicked into the green as Volkswagen (+4%) pared initial losses, as traders fully digested the results and CEO commentary. Though its not all good for the sector, with Traton firmly in the red after it slashed its 2025 outlook amid US tariff uncertainty. LVMH (+4.5%) also bounced off lows seen at the open, to currently trade higher - the Co. reported a deeper than expected sales decline but its commentary on China was a little more upbeat.

European Earnings

Top European News

FX

Fixed Income

Commodities

US Event Calendar

DB's Jim Reid concludes the overnight wrap

The risk-on tone just about continued yesterday, as another batch of strong US data supported investor optimism, with the S&P 500 (+0.07%) ending a quiet session at a 4th consecutive all-time high. But whilst equities were rallying, sovereign bonds struggled across the board, as the latest data and a hawkish-leaning ECB decision saw investors dial back the likelihood of near-term rate cuts, particularly in Europe. So the 2yr yield in Germany (+9.1bps) and France (+9.0bps) both posted their biggest jump since May, and US Treasuries lost ground across the curve.

In terms of that ECB decision, the main headline was much as expected, with rates being left unchanged for the first time in a year. However, there were several aspects that leant in a more hawkish direction, which led to growing doubts about whether they’d deliver another cut anytime soon. The statement kept their options open with the ECB “not pre-committing to a particular rate path.”, while Lagarde said that they were “in a good place now to hold and to watch how these risks develop over the course of the next few months.” Moreover, Lagarde did not rule out the possibility of the next move being a hike when asked.

That meeting led to a clear reaction among European sovereign bonds, with yields on 10yr bunds (+6.3bps), OATs (+7.9bps) and BTPs (+8.9bps) all ending the day higher. That came as investors grew more sceptical that the ECB would cut again this year, and there was additional momentum after the flash PMIs for July were a bit stronger than expected. For instance, the Euro Area composite PMI rose to an 11-month high of 51.0 (vs. 50.7 expected), so it added to the sense that the European economy had held up after Liberation Day.

Later in the session, there was then a Bloomberg article which said that those pushing for another cut “face an uphill battle”, and that another hold “looks like the baseline for September”. So that fit into the message from the press conference, and meant that yields got a fresh push higher into the close. Our own European economists see the ECB as signaling an extended pause and while another rate cut is possible, it may not be immediate. They also think the first hike could come sooner than most assume. See their full reaction here.

In the meantime, US Treasuries also struggled thanks to a strong batch of US data. In particular, the weekly initial jobless claims fell for a 6th consecutive week, falling to 217k over the week ending July 19 (vs. 226k expected). Bear in mind that this series had seen a decent move higher in May, with the 4-week moving average up to its highest in almost two years, so that had contributed to fears the labour market might be softening. So the recent run of declines has led to a lot more optimism, and the 4-week moving average also fell to a 3-month low. And that came alongside some better-than-expected flash PMIs, with the composite reading for the US up to a 7-month high of 54.6 (vs. 52.8 expected).

With that strong data in hand, investors dialled back the likelihood of Fed rate cuts this year, and the amount priced in by the December meeting fell -1.9bps on the day to 43bps, the joint lowest it has been since February. And in turn, that meant US Treasury yields moved higher, with the 2yr yield up +3.6bps to 3.92%, whilst the 10yr yield was up +1.5bps to 4.40%.

Yesterday also saw Trump visit the Fed’s renovation project, whose cost overruns have drawn criticism from the President and Congressional Republicans. Trump again brought up the project costs and his desire for lower rates during the visit, but he largely downplayed his clash with Powell. Trump claimed there was “no tension” between him and the Fed Chair and said “I just don’t think it’s necessary” to fire him. However there was an open disagreement between the two live on camera about the scope of the renovation works at the Fed which was a remarkable spectacle to watch. You'll be able to see a similar clash tonight at my home as the scope and budget of our redecoration work continue to get debated over pizza and a glass of wine.

For equities, it was another (slightly) up day thanks to the robust data, with the S&P 500 (+0.07%) and NASDAQ (+0.18%) both hitting a fresh record high. There were bits of softness, with the equal-weighted version of the S&P 500 down -0.33%, but overall it was a quiet session with the S&P seeing a trading range of just 0.35%, its narrowest since February. Tesla (-8.20%) was one of the worst performers as investors reacted to their earnings results after the previous day’s close. So that meant the Magnificent 7 ended up falling -0.21%, despite gains for each of the other 6 companies. Meanwhile in Europe, the STOXX 600 (+0.24%) moved up to a two-week high, and the FTSE 100 (+0.85%) reached another all-time high.

Overnight S&P 500 (+0.21%), Nasdaq (+0.16%) and STOXX 50 (+0.04%) futures are edging up even if most of Asia is on the decline. The Hang Seng (-1.13%) is the largest underperformer, while the CSI (-0.53%) and the Shanghai Composite (-0.34%) are also retreating, although they are on track for a robust week. Elsewhere, Japanese shares have been the standout performers this week; however, mixed inflation data is dampening some of the optimism, with the Nikkei (-0.75%) and the Topix (-0.74%) both trading significantly lower. Meanwhile, South Korea's KOSPI stands out today, increasing by +0.30% following some favorable earnings reports.

Coming back to Japan, the Tokyo Consumer Price Index (CPI) mostly eased more than anticipated in July, but core-core stayed at 3.1% YoY as expected marking the fifth month above 3% YoY. The core CPI rose by +2.9% year-on-year in July, falling short of the expected +3.0%, and down from the +3.1% recorded in the previous month. Additionally, headline CPI inflation was also a tenth lower than expected at 2.9% in July, down from the prior month's 3.1%. 10 and 30yr JGBs are -1bps and -3bps lower respectively. 10yr USTs are -1bps in a quiet session.

To the day ahead now, and data releases include the Ifo’s business climate indicator for Germany in July, UK retail sales for June, US preliminary durable goods orders for June, and the Euro Area M3 money supply for June.