A much hotter than expected Core PCE print has sparked a dramatic hawkish response across markets.

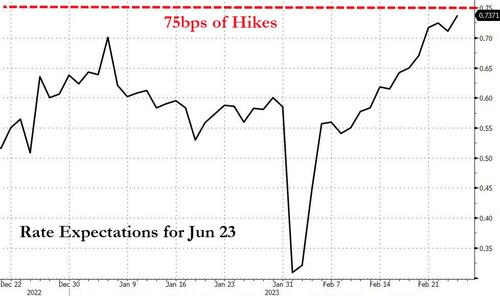

Expectations for The Fed's terminal rate has spiked to 5.39% and H2 2023 rate-cut expectations have dwindled to single-digits (just 9bps priced in)...

Source: Bloomberg

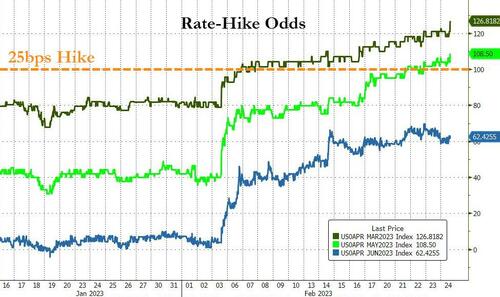

The market is now fully pricing in 3 x 25bps rate-hikes at the next three FOMC meetings...

With the odds of a 50bps hike in March now up at around 25% (and a 25bps hike fully priced-in for

All of which sent stocks reeling, below yesterday's lows...

And Treasury yields soaring higher at the short-end while the long-end has rallied (yields slower post-PCE)...

The yield curve (5s10s) is inverting deeper and deeper (pricing in recession/Fed policy error)...

The dollar is surging higher, erasing all of the losses since the January Payrolls slump...

Will the 0DTE gamers BTFD in stocks again?