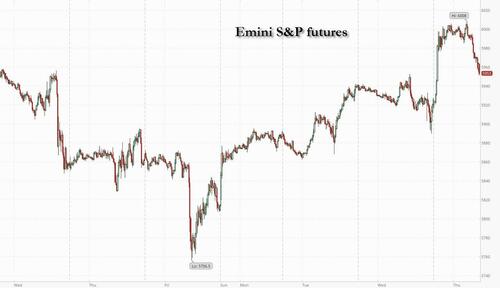

US equity futures are higher, but well off session highs and rapidly losing altitude, after stronger NVDA earnings and a surprise legal block (for now) of Trump’s YTD tariffs, triggering a global risk-on rally. As of 8:00am, S&P futures are up 0.8% at 5,952, erasing half of the overnight post NVDA/tariff gains which briefly saw spoos rise above 6,000. Nasdaq 100 futures are up 1.4% boosted by NVDA which is +6% after delivering a solid sales forecast, and Jensen Huang saying the AI computing market is still poised for “exponential growth.” Mag7/Semis/Cyclicals are outperforming. Bond yields are higher pushing the 10Y yield to 4.52% but so far equities are mostly unbothered. USD is flat, also erasing all overnight gains, while commodities are higher led by energy. Today’s macro data focus is on the first revision to Q1 GDP, jobless claims, and pending home sales. The tariff rule, for now, has pushed the US back to global outperformance with EU the lagging.

In premarket trading, Mag 7 stocks are higher: Nvidia (NVDA) surges 5% after CEO Jensen Huang soothed investor fears about a China slowdown by delivering a solid sales forecast, saying that the AI computing market is still poised for “exponential growth.” Elsewhere Apple +2%, Amazon +2.5%, Tesla +2.3%, Alphabet +1.2%, Meta +1.4%, Microsoft +0.7%. Semiconductor stocks also rally after Nvidia delivered a solid sales forecast, soothing investor fears about a China slowdown. Here are some other notable premarket movers:

The ruling by the US trade court to block most of Trump's Liberation Day tariffs heralded the latest twist for markets that have swung wildly since Trump announced his so-called reciprocal levies at the start of April. In the ruling, a panel of three judges at the US Court of International Trade in Manhattan sided with Democratic-led states and small businesses that accused Trump of wrongfully invoking an emergency law to justify the bulk of his levies. The order applies to Trump’s global flat tariff, elevated rates on China and others, and his fentanyl-related tariffs on China, Canada and Mexico. Other tariffs imposed under different powers, such as the levies on steel, aluminum and automobiles are unaffected.

“This is a reminder of what the end state is probably going to be — that we end up with a 10 percentage point tariff which, in a very long-term context, is an average number,” said Luke Hickmore, investment director at Aberdeen Group Plc. “Anything under the mid-teens the market will take positively.”

However, as we first reported overnight, many analysts cautioned that Thursday’s optimism could be short-lived, saying that Trump’s administration would find alternative ways to implement its policies. The final decision in the tariff case may also ultimately rest with higher courts, including the US Supreme Court.

“We are unlikely to see the end of the tariff chapter,” Benedicte Lowe, an equity derivatives strategist at BNP Paribas SA, told Bloomberg TV. “Trump is likely to fight for his tariff negotiations. It’s kind of too early to tell.”

Before the trade decision markets were already in a buoyant mood as Nvidia’s solid sales forecast reignited enthusiasm for artificial-intelligence products, despite a drag from China. Tech stocks led gains in premarket trading, with Marvell Technology, Super Micro Computer and ARM Holdings rising more than 3%.

“The AI story is still very much at the frontier of all global productivity for the next decade or two if not longer, so you still want to get exposure when you can,” Seema Shah, chief global strategist at Principal Asset Management, told Bloomberg TV.

“The uncertainty level, already high, has been notched up another step,” said Kit Juckes, head of FX strategy at Societe Generale SA. “More investing and spending decisions will be delayed and foreign holders of US assets will be slightly more uncomfortable than they were.”

European stocks are also higher, pushing the Stoxx 600 up 0.3% and tracking gains in their Asian counterparts. Cyclical sectors such as consumer products, miners and autos outperform, while defensive stocks including utilities and real estate are the biggest laggards. Among individual stocks, ASML rises after Nvidia’s strong sales forecast, while Auto Trader falls on analyst warnings about the outlook for automotive marketplace. Here are the most notable movers:

Earlier in the session, Asian equities climbed the most in two weeks, as a US court order against President Donald Trump’s tariffs lifted sentiment. The MSCI Asia Pacific Index rose as much as 1.1%, set for highest close since Sept. 27. Toyota, Sony and Meituan were among the biggest boosts to the regional benchmark. Semiconductor shares gained after Nvidia gave a bullish outlook. Most of Asia’s markets were in the green as worries over US tariffs eased slightly after a trade court deemed the bulk of Trump’s new levies illegal. Gauges in South Korea, Japan and Hong Kong rose more than 1%. Trump’s administration has filed a notice to appeal the ruling.

Asian stocks look set to end May with a second-straight monthly gain as a weaker dollar and Trump’s policies bolstered inflows into the region. Still, uncertainty remains over the outcome of Trump’s appeal and progress on individual countries’ trade deals with the US.

In FX, the Bloomberg Dollar Spot Index is little changed having surrendered most it’s early rally. The Swiss franc and Japanese yen are the weakest of the G-10 currencies, falling 0.2% each. The Dollar initially rallied across the board on the headlines but managed to retrace these gains by the time NY sat down while futures climbed higher. Such price action highlights that the USD can underperform as non-US investors increase their hedge ratios rather than meaningful changes in risk asset allocations. FX vols have remained stable as front-end gamma climbed higher, which our traders note (Costello) is justified by spot moves and a premium for further on/off headlines/appeals over the next month or so. The Euro complex is trading mostly flat, underperforming overnight relative to their typical beta to risk. CNH and CAD are marginally gaining on the Dollar and outperformed overnight which reflects the more direct relief for their domestic economies implied by a potential suspension of the current US tariffs.

In rates, treasuries are heading lower, pushing US 30-year yields up 3 bps to 5.01%, after a court ruling blocked some of Trump’s import tariffs, resulting in an annual funding shortfall of about $250BN which will have to be plugged with more debt. Downside pressure on Treasuries also seen after positive sentiment from Nvidia Corp. posting another set of strong results. US yields are cheaper by 3bp to 4.5bp across the curve with losses led by intermediates, cheapening belly of the curve vs. front and long-end. US 10-year yields trade around 4.515% with bunds and gilts both outperforming by around 2bp in the sector. US session focus includes $44 billion 7-year note sale, adding duration risk for the session, along with a bunch of Federal Reserve speakers and weekly jobless claims.

In commodities, oil is climbing, with WTI rising 1.2% to $62.60 a barrel, while Bitcoin is up 1% and above $108,000. Spot gold is down $4 to around $3,280/oz.

On today's calendar US economic data includes 1Q second GDP estimate, initial jobless claims (8:30am) and April pending home sales (10am). Fed speaker slate includes Barkin (8:30am), Goolsbee (10:40am), Kugler (2pm), Daly (4pm) and Logan (8:25pm)

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher with sentiment underpinned following NVIDIA's earnings and after the Manhattan-based Court of International Trade blocked President Trump's Liberation Day tariffs and deemed that the sweeping tariffs under the emergency powers law were unlawful. However, the Trump administration has since filed an appeal and has other tools it could apply to maintain such tariffs. ASX 200 was led higher by outperformance in energy, telecoms and tech although gains were capped with miners, real estate and defensives at the other end of the spectrum. Nikkei 225 outperformed and climbed back above the 38,000 level following the recent currency weakness and blow to Trump's tariff agenda. Hang Seng and Shanghai Comp conformed to the constructive mood although US-China frictions lingered after the Trump administration ordered US chip designers to stop selling to China and US Secretary of State Rubio announced to ‘aggressively’ revoke visas of Chinese students.

Top Asian News

European bourses (STOXX 600 +0.3%) opened with a strong positive bias with sentiment boosted following well received NVIDIA results and after the Manhattan-based Court of International Trade blocked President Trump's Liberation Day tariffs. Sentiment has waned in recent trade, but with indices still broadly in the green. European sectors hold a positive bias, with the more cyclicals sectors topping the pile. Tech takes the top spot, with sentiment in the sector boosted after strong NVIDIA results afterhours; ASML +2.7%.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

As we go to press this morning, there’s been another major development in US tariff policy overnight, as the US Court of International Trade has ruled that the Trump administration did not have the authority to impose most of the tariffs that have been announced. We should say at the outset that this is hardly the end of this story, as the administration are appealing this decision. But already, markets have seen a substantial rally in response, with futures on the S&P 500 up +1.60% overnight, whilst the US dollar index is up +0.37% as well. That’s echoed around the world too, with all the major equity indices advancing in Asia, whilst futures on the German DAX are up +0.96%.

In terms of the court ruling, they said that the administration had exceeded their legal authority, and that the International Emergency Economic Powers Act (IEEPA) “does not authorize the President to impose unbounded tariffs.” So this is a huge development, and the court gave the administration 10 days in order to “effectuate” the judgement. Bear in mind that this ruling covers the 10% baseline tariffs, the 25% tariffs on Canadian and Mexican products, the extra 20% on China, as well as all the reciprocal tariffs that have been paused until July 9. However, there are a few exceptions not covered by the ruling, including the tariffs on steel, aluminum and automobiles.

In response, the Justice Department have filed an appeal with the US Court of Appeals, and it’s possible that this case could go to the Supreme Court. But we haven’t heard directly from President Trump on the matter yet, so it’s unclear how the administration might respond going forward. This could also have broader revenue implications, as they had been hoping to use tariffs as a source of revenue to fund other tax cuts.

If the ruling did remain in place, preventing the use of tariffs under IEEPA, one option for the administration would be to expand the use of other tariff instruments, like the Section 232 on national security grounds, which have been used for autos, steel and aluminium tariffs. But this is clearly a setback for their tariff strategy, and it’s also going to complicate its current attempts to negotiate concessions from trading partners, given the possibility the tariffs might not come into force once the 90-day extension period is over.

The tariff developments have overshadowed the previous day’s news, but sentiment also got a boost from Nvidia’s results after the US close yesterday, as the company delivered upbeat sales guidance. There was only a modest revenue beat for Q1 ($44.1bn vs $43.3bn expected), but the chip giant projected revenue of $45bn for Q2, meeting analyst expectations even as the company projected that restrictions on shipments of AI chips to China would cost it $8bn in sales. Nvidia’s shares rose by nearly 5% in post-market trading after falling -0.51% in the regular session, and futures on the NASDAQ 100 are up +1.92% this morning. However, before Nvidia’s release, tech stocks had lost ground after the FT reported that the Trump administration had ordered US companies that offer chip design software to stop selling to China. Affected companies slumped on the news, including Cadence Design Systems (-10.67%) and Synopsys (-9.64%), while the Magnificent 7 fell -0.53%, having been near flat prior to the reporting.

With all that in hand, markets in Asia are performing very strongly this morning, with gains for the Nikkei (+1.56%), the KOSPI (+1.76%), the Hang Seng (+0.65%), the CSI 300 (+0.68%) and the Shanghai Comp (+0.72%). That outperformance in South Korea also comes after the Bank of Korea delivered a 25bp rate cut overnight, in line with expectations, taking the policy rate down to 2.5%. They also cut their growth forecast for this year to 0.8%.

Before all that, the main story of yesterday had come on the rates side, as bonds came under fresh pressure on both sides of the Atlantic. The main catalyst for that was the weak 40yr auction in Japan we mentioned yesterday, which in turn carried over into the European and US sessions. This saw the 30yr Treasury yield (+2.5bps) move back above 5% intraday, before closing just shy of that at 4.98%. Bonds did reverse some of their initial sell off following a solid 5yr auction that saw primary dealer takeup fall to its lowest in over two years. Still, Treasury yields were higher across the curve, with the 2yr yield up +0.8bps and 10yr yield rising +3.4bps. That move has continued overnight given the risk-on tone, with the 2yr up another +2.5bps to 4.01%, whilst the 10yr is up +2.6bps to 4.50%.

That rise in yields has come as markets continue to dial back their expectations for Fed rate cuts. Indeed, the amount priced in by December is now down to just 44bps, the fewest since February. Moreover, there were no hints of imminent easing in yesterday’s Fed minutes, which re-iterated that “the committee was well positioned to wait for more clarity on the outlooks for inflation and economic activity” and saw an increased focus on the risk of inflation expectations drifting upward. On the downside, the Fed “staff viewed the possibility that the economy would enter a recession to be almost as likely as the baseline forecast”, though one should note that the meeting was on May 7, shortly before the delay in US-China tariffs.

Back in Europe, sovereign bond yields also moved higher yesterday, which came amidst growing concern about inflation. In part, matters weren’t helped by higher oil prices, with Brent crude up +1.26% on the day to $64.90/bbl. But then we also had the ECB’s latest survey of consumer expectations, which found that 1yr inflation expectations were up to +3.1% in April, the highest in 14 months. So that added to fears that inflation could remain sticky above the ECB’s target, particularly with their next policy decision coming up in just a week.

All that meant yields rose across the continent, with those on 10yr bunds (+2.3bps), OATs (+2.0bps) and BTPs (+1.8bps) all moving higher. Yet despite the risk-off tone elsewhere, sovereign bond spreads tightened further, with the 10yr Italian spread over bunds down to just 98bps, the tightest since September 2021. Nevertheless, UK gilts continued to struggle, with the 10yr yield (+6.1bps) seeing a larger increase in yields to 4.73%.

With yields moving higher again, that meant it was a difficult backdrop for equities, which struggled on both sides of the Atlantic. For instance, the S&P 500 (-0.56%) fell back after the previous day’s +2.05% surge. And over in Europe it was much the same story, with the STOXX 600 (-0.61%), the DAX (-0.78%) and the FTSE 100 (-0.59%) all moving lower. However, one relative outperformer was Canada’s S&P/TSX Composite (+0.05%), which just about managed to eke out another record high, having now advanced for 15 of the last 16 sessions.

To the day ahead now, and US data releases include the weekly initial jobless claims, the second estimate of Q1 GDP, and pending home sales for April. Otherwise, Central bank speakers include the Fed’s Barkin, Goolsbee, Kugler, Daly and Logan, along with BoE Governor Bailey.