After two mixed coupon auctions this week (a solid 2Y, a subpar 5Y) moments ago the Treasury concluded the week's final coupon auction when it sold $44 billion in 7Y paper in a well-received sale.

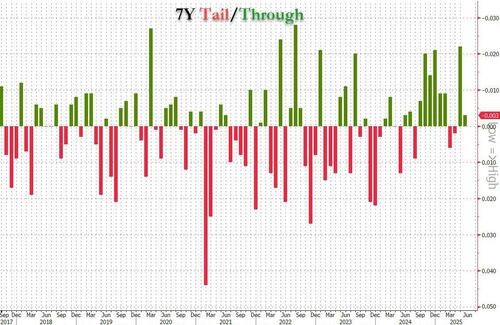

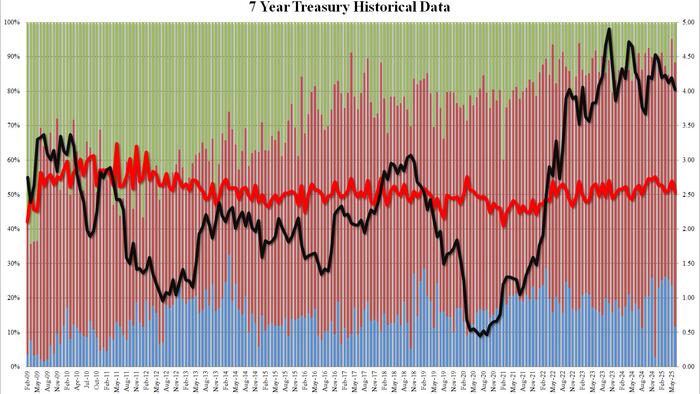

The auction stopped at a high yield of 4.022%, down from 4.194% in May and the lowest since last September. The auction also stopped 2bps thru the 4.024% When Issued, the second consecutive stop through in a row and 8th in the past 10 auctions.

The bid to cover was ugly: it dropped from 2.695 to 2.531, the lowest since August 2024 and obviously well below the six-auction average of 2.637.

The internals were most solid, with Indirects rising to 76.7%, up from 71.5% in May and the highest since December. And with Directs taking just 11.62%, the lowest since December's record low 2.85%, Dealers were left with 11.6%, up from May's record low of 4.85%.

Overall, this was a solid auction, arguably the best of the week, and one which came with yields across the curve already near session lows so there was little movement: the 10Y was down at 4.257% after the auction broke for trading, barely changed from where it was earlier.