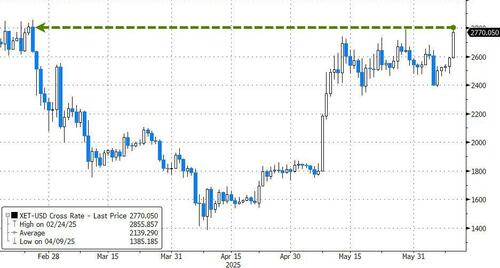

Ethereum surged to a four month high this morning, just shy of $2800 (a key resistance zone) as ETF inflows and Staking have reignited interest in the smart contracts ecosystem.

BlackRock's ETH ETF has become a major focal point in Ethereum investment, and its recent activity is nothing short of impressive. For nine straight trading days, the fund has attracted over $490 million of fresh capital - a streak that has drawn attention from investors and analysts alike.

As themerkele.com's Will Izuchukwu reports, a wider embrace of Ethereum by institutions is reflected in the inflows to Ethereum ETFs, which have notched up a 14-day winning streak— the longest streak yet in 2025.

These inflows are coming when Ethereum is returning to prominence among blockchain networks for fee generation, which is a really important indicator of network activity and demand.

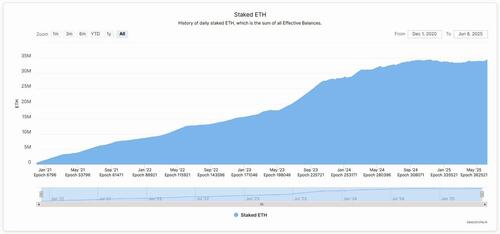

CoinTelegraph's Martin Young notes that staked Ethereum has clocked a new record as the asset’s price reclaimed a 12-day high amid major institutional accumulation.

The amount of Ether staked on the Beacon Chain reached a record high of 34.65 million ETH on Sunday, eclipsing the previous high on Nov. 10, 2024.

The amount of Ether staked has been relatively stable, above 33 million for the past year. However, it started to tick up again in June, according to the network explorer Beaconcha.in.

The higher staking level indicates that more holders are not prepared to sell at current levels, preferring a yield from staking instead.

A Dune Analytics dashboard confirmed the record figure, reporting that 34.8 million ETH was staked as of Monday, while Ultrasound.Money reports 34.7 million staked.

The analytics platform also reports that the current amount staked is equivalent to 28.7% of the current circulating supply of Ether, which is 120.8 million, as issuance returned to inflationary in February.

The milestone also comes as the industry anticipates the approval of spot Ether ETF staking by the US Securities and Exchange Commission.

Analysts have suggested that staked Ether ETFs could debut “within the next few weeks,” following a recent filing by ETF provider REX Shares that used “regulatory workarounds.”

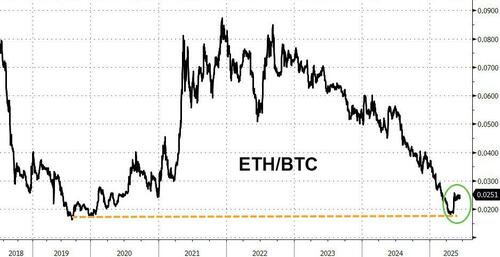

Finally, the last few weeks have seen Ethereum significantly outperform Bitcoin...

...after bouncing off the 2019/2020 ratio low support.