Weak JOLTS?, Poor factory orders, hot EU inflation, surprise RBA rate-hike, a sudden realization of the urgency and seriousness of the debt ceiling debacle, Europe back from vacation, or just pre-FOMC jitters?

Or was it this!?

Who knows to be frank but everything went just a little bit turbo, starting with a total collapse in regional banks...

And despite the Biden admin claiming that FRC was just another 'outlier' business model, PacWest, Western Alliance, and Zions (among others) are in a freefall...

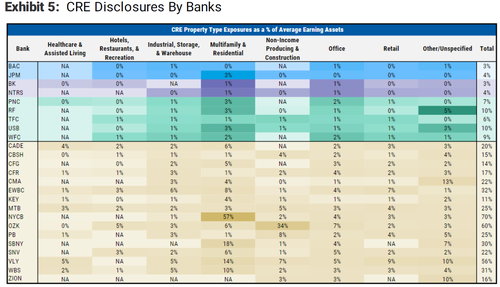

Looks like we are back to "who's next" after yesterday's Milken Conference. Here's a guide...

But the 'big banks' are also getting slammed...

The majors all instantly puked at the US cash open, led by Small Caps (but The Dow and S&P are down over 1%)...

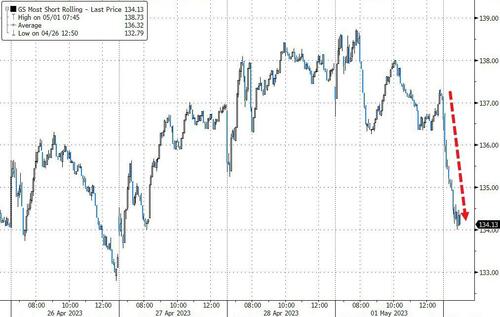

"Most Shorted" stocks are getting monkeyhammered lower...

Notably, 0-DTE traders are fighting this downtrend hard...

But VIX1D is exploding higher...

Just as we warned yesterday, the surge in yields (driven by a heavy corporate calendar and illiquid marke) has reversed entirely with yields collapsing this morning...

The 2Y Yield has puked back to a 4.00% handle...

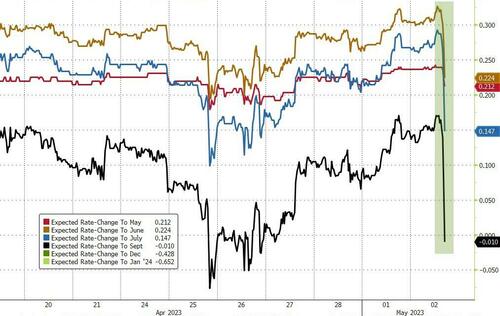

Rate-hike expectations are dovishly puking lower...

Gold has spiked back above $2000...

And Bitcoin is starting to rip again...

And Oil prices are tumbling, with WTI now back well below pre-OPEC+ levels...

Is this a last minute effort to pressure Powell to be 'one and done'?